Health savings accounts (HSAs) are one of the most tax-advantaged1 accounts that the IRS recognizes. Other retirement accounts are taxed at some point—whether that’s when the funds go into the account or when the funds are taken out—but HSAs have triple-tax advantages (as long as the accountholder follows the rules set up by the IRS) that other programs just don’t have.

Providing your employees with an HSA can help them not only pay for certain medical expenses, but it can also help them realize significant tax savings and save for the future. Here’s how it works:

1. Tax-free contributions into an HSA

Some savings accounts, such as a Roth 401(k) or IRA, are taxed before someone puts funds in. However, the funds are not taxed when money is spent from the account (as long as the accountholder follows the rules set up by the IRS). When someone contributes money to their HSA, the funds are not taxed. This is similar to a traditional 401(k) or IRA.

Because of the significant tax advantages of an HSA, the IRS has put a limit on how much someone can contribute to an HSA each year. For the upcoming tax year of 2019, the maximum contribution limit is $3,500 for an individual and $7,000 for a family. Those accountholders 55 and older can contribute an additional $1,000 annually.

2. Tax-free growth in an HSA

Accountholders can also grow the funds in their account through interest and, potentially, through investing.2 And, unlike other growth options, the increase in funds is not subject to taxes.1 There is also no expiration date on an HSA and no required minimum distribution (like from a 401(k) or IRA. This means that accountholders can potentially spend years growing the funds in their HSA - all tax free.1

3. Tax-free distributions from an HSA

Traditional IRA and 401(k) programs are not taxed when the accountholder puts money in the account, but the money is taxed when it is taken out of the account. This leads to the third tax advantage of HSAs: Funds spent from an HSA are not taxed as long as they are spent on qualified medical expenses. In other words, accountholders can't use their HSA funds to pay for a vacation or buy a new big-screen TV, but they can fund doctors visits, dental and vision care, etc.3 Spending HSA funds on non-qualified medical expenses results in taxes and an additional 20 percent penalty

That said, anyone 65 years and older can use their HSA funds for any reason; the money will be taxed, but they will not be subject to the 20 percent tax penalty. If a retiree uses the funds for qualified medical expenses, it will still be totally tax-free.1

Conclusion

HSAs can save your employees money on taxes because (1) the funds are not taxed when put into an HSA, (2) any earnings through interest and potentially through investing are not taxed, and (3) the money is not taxed when it is spent as long as the funds are used for qualified medical expenses.

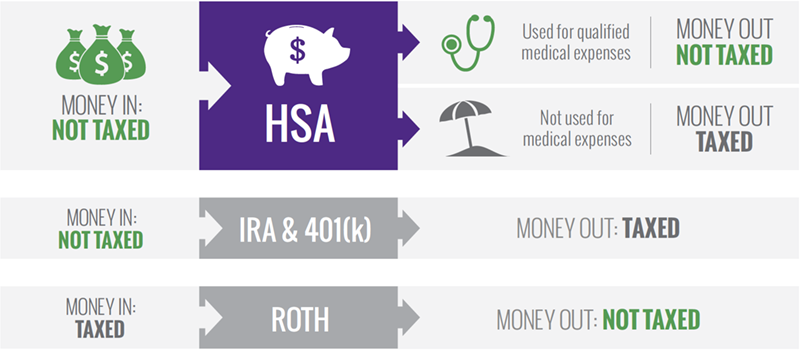

Here's an overview of the accounts we discussed above and how they are treated for tax purposes:

1 HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-free with very few exceptions. Please consult a tax advisor regarding your state's specific rules.

2 Investments available to HSA holders are subject to risk, including the possible loss of the principal invested and are not FDIC insured or guaranteed by HealthEquity, Inc.

3 It is the member's responsibility to ensure eligibility requirements as well as if they are eligible for the plan and expenses submitted. One should consult a tax advisor as individual factors and situations vary.

HealthEquity does not provide legal, tax, financial or medical advice.