Health insurance and medical costs continue to rise. For working families, the average employee health insurance premium has increased more than 40% over the past decade, reaching $22,463 in 2022.1 It’s no wonder that 60% of benefits leaders told HealthEquity that benefits cost containment is their top concern.

As employers search for coverage options and ways to mitigate climbing healthcare costs, one strategy has remained prevalent: offering a Health Savings Account (HSA)-qualified health plan. These group health plans typically have lower premiums (an average of $21,136 for family coverage in 2022) and afford a way for employees to begin building greater health savings. In fact, 74% of employers surveyed by HealthEquity now offer these health insurance plans to their workers.

Businesses can face barriers to HSA plan adoption

Even with the high number of businesses offering HSA plans to workers, benefits leaders say they’re facing a significant obstacle in realizing the full value of an HSA plan. Just 40% of employees are enrolling, leaving plenty of healthcare cost savings on the table for both employers and employees.

Practical ways to encourage employees to sign up for your HSA

If containing benefits costs and supporting employee financial wellbeing are priorities for your organization, boosting HSA enrollment could be an important way to realize your healthcare benefits goals. Here are three strategies to help you get there.

1. Rename your HSA plan to convey more value to employees

HSAs were created in 2003 through congressional legislation, which requires people to be covered by a “high-deductible health plan” (HDHP) before they can open and contribute to an HSA. The federal government and the Internal Revenue Service (IRS) continue to use HDHP terminology to refer to HSA-qualified plans. The benefits industry has also largely adopted this language in its offerings.

But that language can be off-putting to employees considering signing up for health insurance. High deductibles are rarely seen as a desirable trait in health insurance coverage, and by putting the emphasis on the deductible—rather than the savings potential of the HSA—employers may deter individuals who would be a good fit for the group health plan.

Employers who echo HDHP language also risk conveying incorrect notions about HSA plans.

Many people assume the deductibles associated with these group health plans are significantly higher than those of other health insurance plans, but careful review may reveal only a marginal difference. HSA plans also cover 100% of a person’s preventive care, so deductible figures may not be a concern for those looking to get basic medical needs met.

Many innovative employers are removing this potential barrier by renaming their HSA plans. These names put the focus on access to HSAs rather than the health plan’s deductible. Employers have told HealthEquity this shift helps employees “make the connection” between the health insurance plan choice and their own financial wellbeing, potentially boosting enrollment rates.

Some plan names that have had success include:

• HSA Saver Health Plan

• HSA 1000 Health Plan

• HSA Premium Plan

These value-focused names showcase the HSA benefit as the highlight of the group health plan, with supporting language that conveys savings, health, and quality.

The most successful companies also invest time into employee education, helping their people understand how their HSA plan works and how it can fit into their lifestyle in a positive way. That way, when open enrollment rolls around, employees see and understand the value of an HSA plan—and that value is consistent with the health insurance plan name.

2. Optimize your HSA contribution strategy

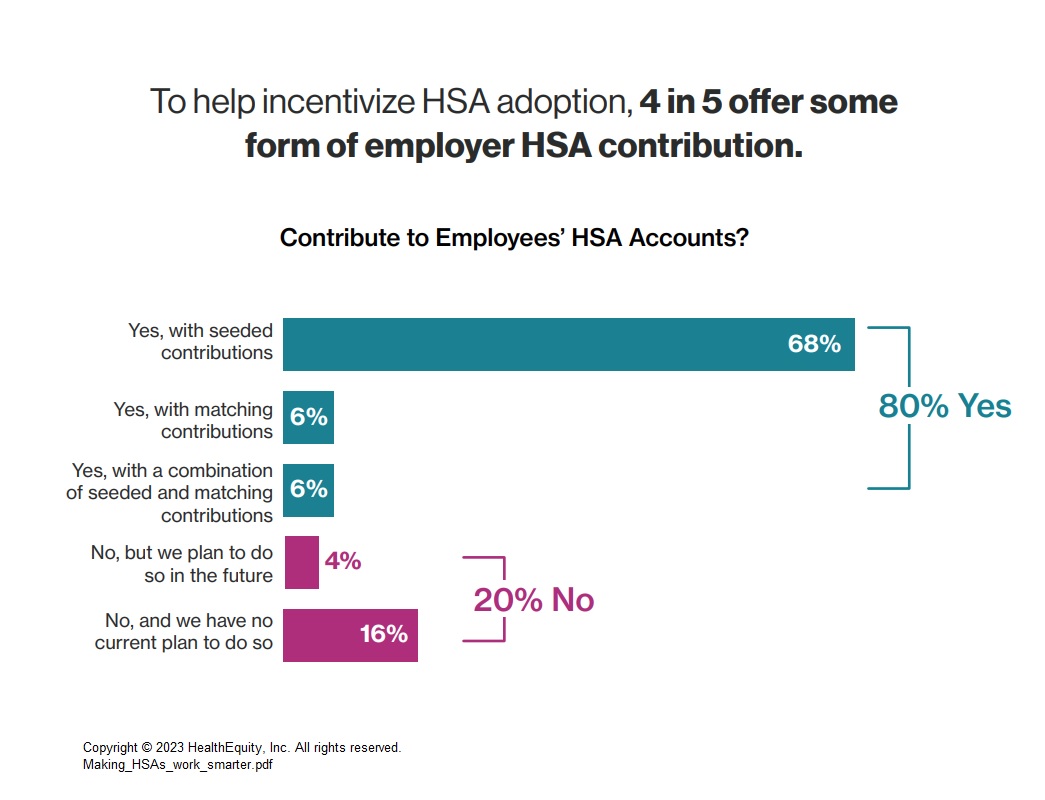

Employers can also boost the value of their HSA benefit by offering contributions. Many companies already do this—in fact, four out of five benefits leaders surveyed by HealthEquity said they contribute to employees’ HSAs in some way.

The vast majority of these employers (68%) offer seeded contributions. Another 12% offer a match, either in combination with a seed or alone. This is a great start, but employers can always level up the value of their benefit by restructuring their HSA contribution strategy.

Given that many employers already seed employees’ HSAs, optimizing this contribution strategy can be a good way to start. Employers can do so by making changes to when they release these funds. Up-front contribution at the beginning of the year is a great way to lessen employee anxiety over signing up for an HSA—that way, they have access to funds immediately for any pre-deductible medical costs. If this isn’t possible, funding on a quarterly or monthly basis can provide some of the same effect.

Another strategy is to offer a match. Similar to a 401(k) contribution plan, a match means you provide a set dollar amount or percentage each time your employee contributes to their HSA. Relatively few employers do so currently, but restructuring to contribute funds alongside employee contributions can be a great way to encourage employees to enroll in the plan and start contributing.

A 2020 HealthEquity data analysis revealed that offering a match was associated with a 22% increase in employee adoption of HSA plans.

Other companies have found unique contribution structures that appeal to employees. HealthEquity client Pfizer designed a tiered HSA that separated colleagues into one of four tiers, based on their annual base pay. Lower-paid colleagues were given the most seed money, with contributions tapering off as base salary increases before zeroing out with the highest tier. This design made the HSA appealing to all Pfizer colleagues, regardless of income. In fact, roughly one in three Pfizer colleagues chose the HSA-qualified plan.

Any of these approaches can be tailored to meet an organization’s unique set of employees and their needs. The more an employer considers its people when offering health insurance, the more appealing the HSA will be.

3. Invest in employee health insurance education

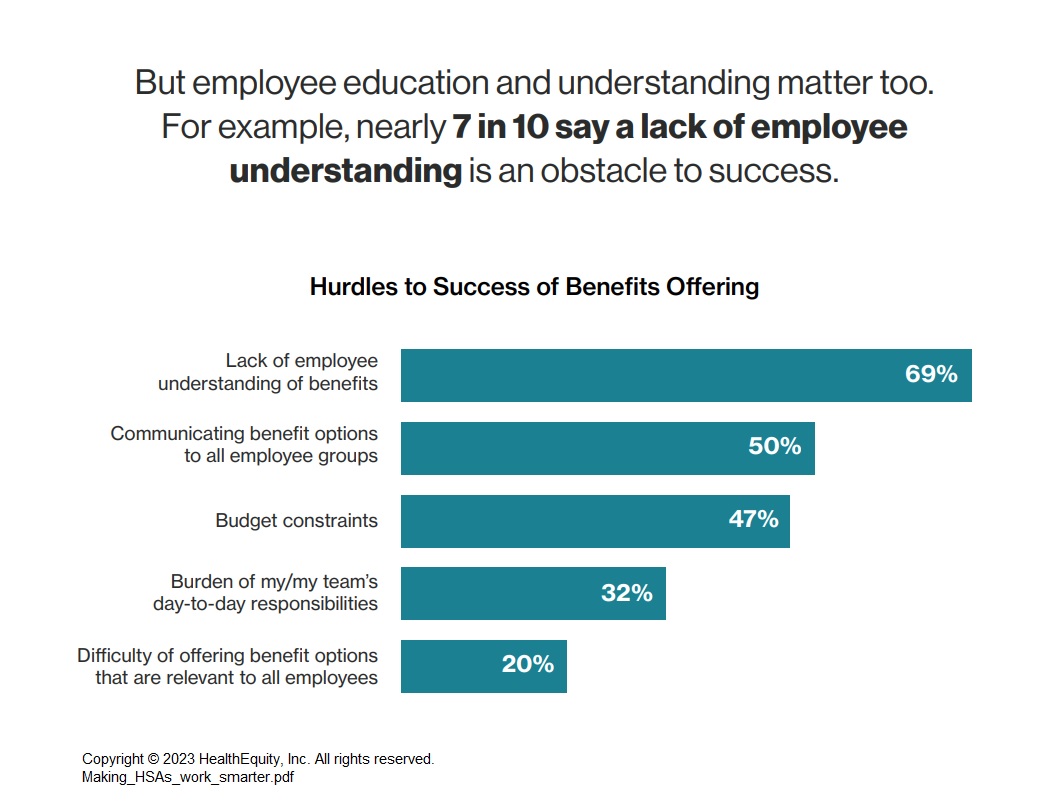

Although HSAs are celebrating their 20th anniversary this year, there is still a large amount of confusion surrounding them. The HealthEquity survey revealed that seven in 10 benefits leaders say a lack of employee understanding of benefits is an obstacle to success.

Employees themselves seem to agree. A 2023 HealthEquity survey found that only 52% of workers understand their benefits “very well”.2 Even those who understand their benefits well say they want better educational materials. In fact, 63% selected the response: “I wish my employer provided better education materials/training about the benefits options available.”

To improve enrollment rates in their HSA plans, employers can heed that call and provide their people with greater education prior to open enrollment season.

Common sticking points on HSA benefits include:

• Who benefits from an HSA, especially with regard to age, health, and income

• How HSAs work, including who owns the account and how funds grow

• The value of using HSAs as a savings vehicle rather than a spending account

Employers who do the best job of educating their employees take multiple approaches through multiple channels. Depending on the location and makeup of the employee population, benefits websites, emails, office flyers, postcards with QR codes, and virtual benefits fairs may all be great ways to reach workers and their families.

Webinars are a particularly effective mode of communication. This gives employers the chance to talk about health plan options, answer employee questions, and dispel any confusion that may exist.

Offering multiple webinars at different times of the day provides flexibility for employees and their family members, including decision makers like spouses. Most webinars are also available on-demand by simply registering for the event, allowing employees to watch at their convenience.

Investing in mid-year health insurance education is also important. Checking in after employees have started to use their HSA plan is an important way to ensure they’re getting value from the healthcare plan and will re-enroll the following year. At this point in the plan year, employers can focus on how to build savings, including potentially investing HSA funds.

Take control of healthcare costs and build financial security

Improving HSA enrollment is an important way to ensure your organization is gleaning the greatest possible savings from your HSA plan option. When employees feel informed, confident, and invested in, it’s easier for them to see the value of HSA plans.

Higher enrollment then benefits not only the employer, but employees as well. Everyone is paying less on health insurance premiums, workers have the opportunity to build savings, and greater health and financial wellness improve outcomes for the future.

As you weigh your options, lean on 20 years of experience from HealthEquity. You can expect our team to work with you to understand your company culture, goals, and cost constraints. From there, teammates will help you design the right plan for your unique business needs.

1Kaiser Family Foundation, 2022: https://www.kff.org/report-section/ehbs-2022-section-1-cost-of-health-insurance/

2HealthEquity research, 2023: Engagement. Clarity. Understanding. Strategies to boost employee confidence and overall benefits satisfaction.