If you’re like me, you’ve been refreshing the Internal Revenue Service (IRS) website multiple times daily to find out the new 2024 contribution limits for healthcare Flexible Spending Accounts (FSA), Commuter, and other areas. Good news! The updated figures are here and, as many expected, the benefit limits in many categories are roughly 5% higher than 2023 levels.

I’ll run through the limits for FSA. Plus, I’ll cover the 2024 annual inflation adjustments for compensation levels, 401(k) plans, dependent care, Commuter, adoption assistance, Health Reimbursement Arrangements (HRA), Archer Medical Savings Accounts (MSA), and more. That’s a lot, so let’s get going.

Even though my colleague, Fran Scott, already covered the updated Health Savings Account (HSA) contribution limits in May, I’ll review them here, too. That way, you’ll have all the 2024 IRS contribution limits in one place.

What are the IRS index figures for 2024?

On November 9, 2023, the IRS issued the 2024 annual inflation adjustments for many tax provisions of the IRS Code. These adjusted amounts will be used to prepare tax year 2024 returns in 2025. The IRS also released the dollar limitations for qualified retirement plans for tax year 2024, including 401(k) plans.

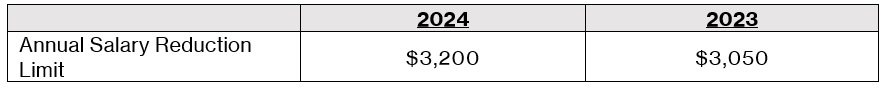

Among the many categories, there’s a high interest in FSA figures. It’s open enrollment season for many organizations and knowing the updated FSA limits will help individuals better plan amounts to set aside. For 2024, the FSA annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2023. Keep reading for the updated limits in each category.

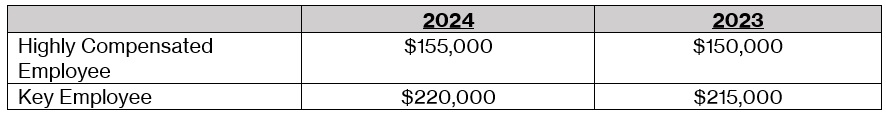

What are the 2024 indexed compensation levels?

Here’s what you need to know about the 2024 indexed compensation levels for highly compensated and key employees. As a reminder, a highly compensated employee is an individual who passes the IRS 5% ownership or compensation test, while Investopedia states that a key employee is defined as someone who is an officer or meets the ownership criteria.

Indexed Compensation Levels

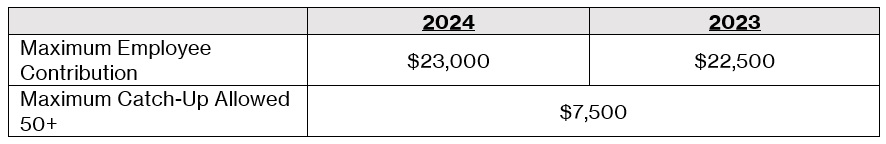

What are the 2024 maximum contributions for retirement savings plans?

401(k), 403(b), and 457 plans are all types of retirement savings plans. Workers can save money from their paycheck to help fund retirement. Here are the 2024 limits for these plans.

401(k), 403(b), or 457 Plans

What are the 2024 limits for Health Flexible Spending Account (FSA)?

As a reminder, Healthcare FSAs that permit the carryover of unused amounts, the maximum carryover amount is increased to an amount equal to 20 percent of the maximum health FSA salary reduction contribution for that plan year (that is, $640 (= $3,200 * .2)). As I mentioned earlier, 2024 FSA rates got a bump of almost 5% over 2023 levels.

Healthcare Flexible Spending Account (FSA)

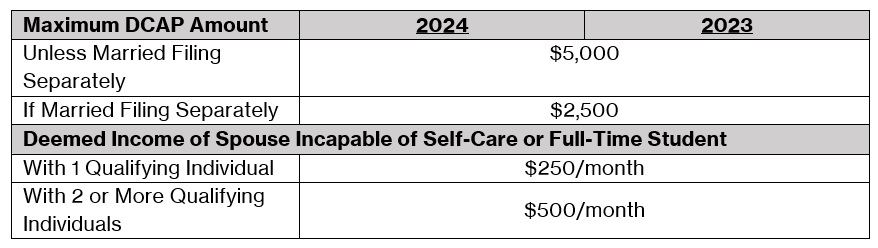

What are the 2024 allowable amounts for the Dependent Care Assistance Program (DCAP)?

DCAP, also known as a Dependent Care Flexible Spending Account (DCFSA), is an employer-sponsored benefit plan. Employees can set aside pre-tax money from every paycheck to help pay for care for children under age 13, a disabled spouse, or an older parent in eldercare.

Dependent Care Assistance Program (DCAP)

There are adjustments to some of the general tax limits that are relevant to the federal income tax savings under a DCAP. These include the 2024 tax rate tables, earned income credit amounts, and standard deduction amounts. The child tax credit limits are also relevant when calculating the federal income tax savings from claiming the dependent care tax credit (DCTC) versus participating in a DCAP.

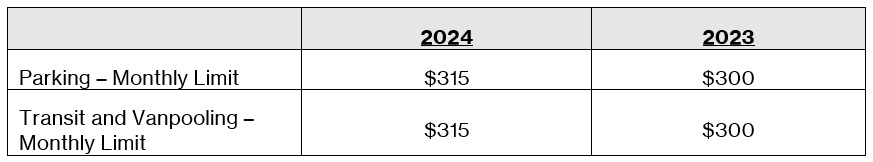

What are the 2024 monthly limits for Commuter accounts?

Commuter or transportation benefits allow employees to set aside their pre-tax earnings to pay for their commutes. Commuting by public transit, ridesharing, or cycling may qualify commuters for the program. Parking costs may also be eligible when they are used for a carpool.

Commuter accounts

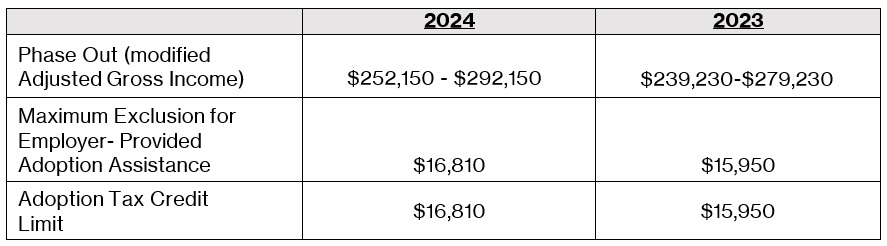

What is the 2024 adoption assistance exclusion and adoption credit?

This section covers tax benefits for adoption, the Adoption Assistance Exclusion and Adoption Credit. These include an exclusion from income for employer-provided adoption assistance and a tax credit for qualified adoption expenses to adopt a child.

Adoption Assistance Exclusion and Adoption Credit

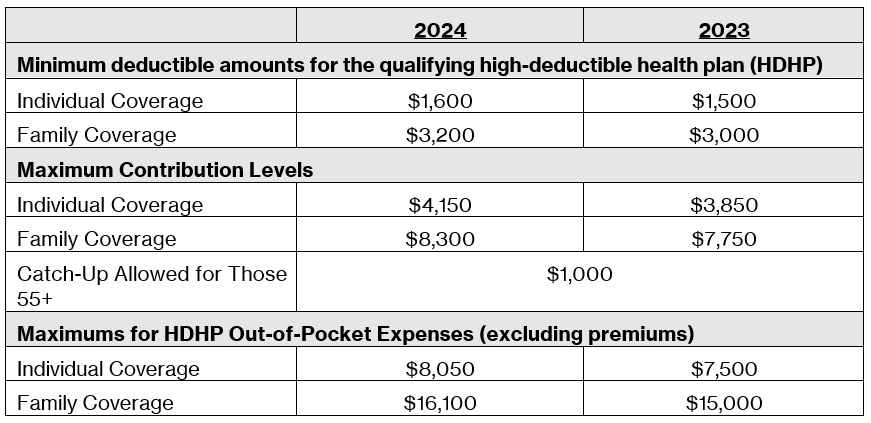

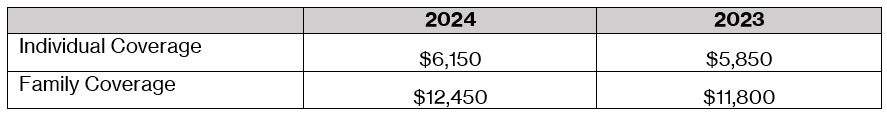

What are the 2024 HSA deductible amounts and maximums?

The 2024 HSA figures represent a significant increase from 2023. For a deeper explanation of 2024 HSA limits, read Fran Scott’s summary from May of 2023.

Health Savings Account (HSA)

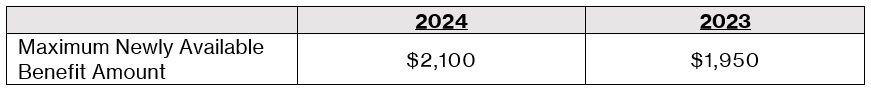

What are the 2024 Excepted Benefit Health Reimbursement Arrangement (EBHRA) amounts?

The Excepted Benefit Health Reimbursement Arrangement (EBHRA) is yet another tax-advantaged health reimbursement arrangement that pays premiums and qualified medical expenses for excepted benefits like dental and vision coverage.

Excepted Benefit Health Reimbursement Arrangement (EBHRA)

What are the 2024 Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) amounts?

Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is a way to help small employers decide what they will contribute to employees’ healthcare costs. This includes an annual maximum set by the IRS.

Qualified Small Employer Health Reimbursement Arrangement (QSEHRA)

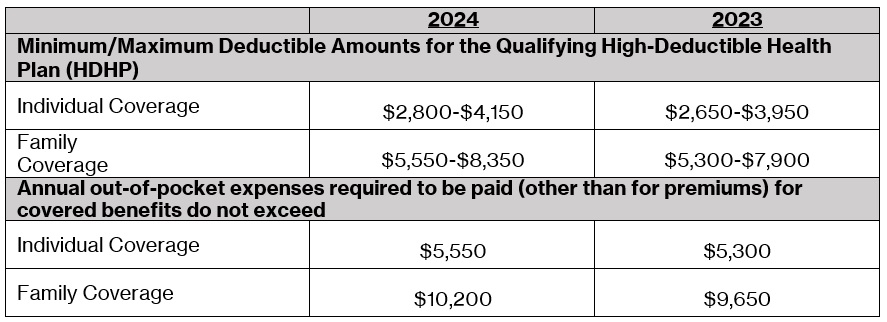

What are the 2024 Archer Medical Savings Account (MSA) minimum and maximum amounts?

An Archer Medical Savings Account (MSA) is a medical savings account, which provides a way to save funds to cover medical expenses.

Archer Medical Savings Account (MSA)

Understanding what the latest 2024 IRS figures mean

I hope you reference this employee benefits information as you plan for 2024. Whether you’re an employer, a plan sponsor, a benefits advisor, or an interested member, you now have the key employee benefit limits for 2024. This will help you and others determine how much you want to set aside to help pay for expected—and surprise—expenses.

It’s important to stress that this general summary helps you understand the potential effects of recent government guidance on employee benefit plans. This summary is not and should not be construed as legal or tax advice. As you’re likely aware, the government’s guidance is complex and very fact specific. As always, HealthEquity strongly encourages employers and plan sponsors to consult competent legal or benefits counsel for all guidance on how the actions apply in their circumstances.

HealthEquity does not provide legal, tax or financial advice.