While organizations vary, chances are you’re gearing up for your company’s benefits open enrollment season. As you prepare, it’s a good time to look at how your organization stacks up with your employees’ financial literacy levels and benefits satisfaction.

Introducing HSA Week to provide you with helpful healthcare education resources

To help you kickstart your open enrollment season, you’re invited to participate in HSA Week. Starting on August 14, HSA Week coincides with National Financial Awareness Day—a timely reminder to plan for a more financially secure future.

Throughout the week you can expect insightful resources, original research, and a data-informed, HSA personality quiz. All combined, you’ll have plenty of ways to empower individuals to make the most of their HSA health plans. Let’s get started with what you need to know about the connection between benefits knowledge and benefits satisfaction.

Employee benefits education leads to greater benefits happiness

It turns out, the level of satisfaction employees experience with their benefits is closely tied to their overall understanding of the specifics—from health insurance to wellness programs. When employees understand their benefits, they make informed choices that result in higher satisfaction levels and lead to increased retention rates with their current employer.

Reach your talent recruitment and retention goals with targeted benefits literacy efforts

In today’s competitive job market, recruitment and retention are critical areas of focus for most organizations. A recent HealthEquity study highlighted that 74% of benefits leaders saw higher turnover in the past two years.

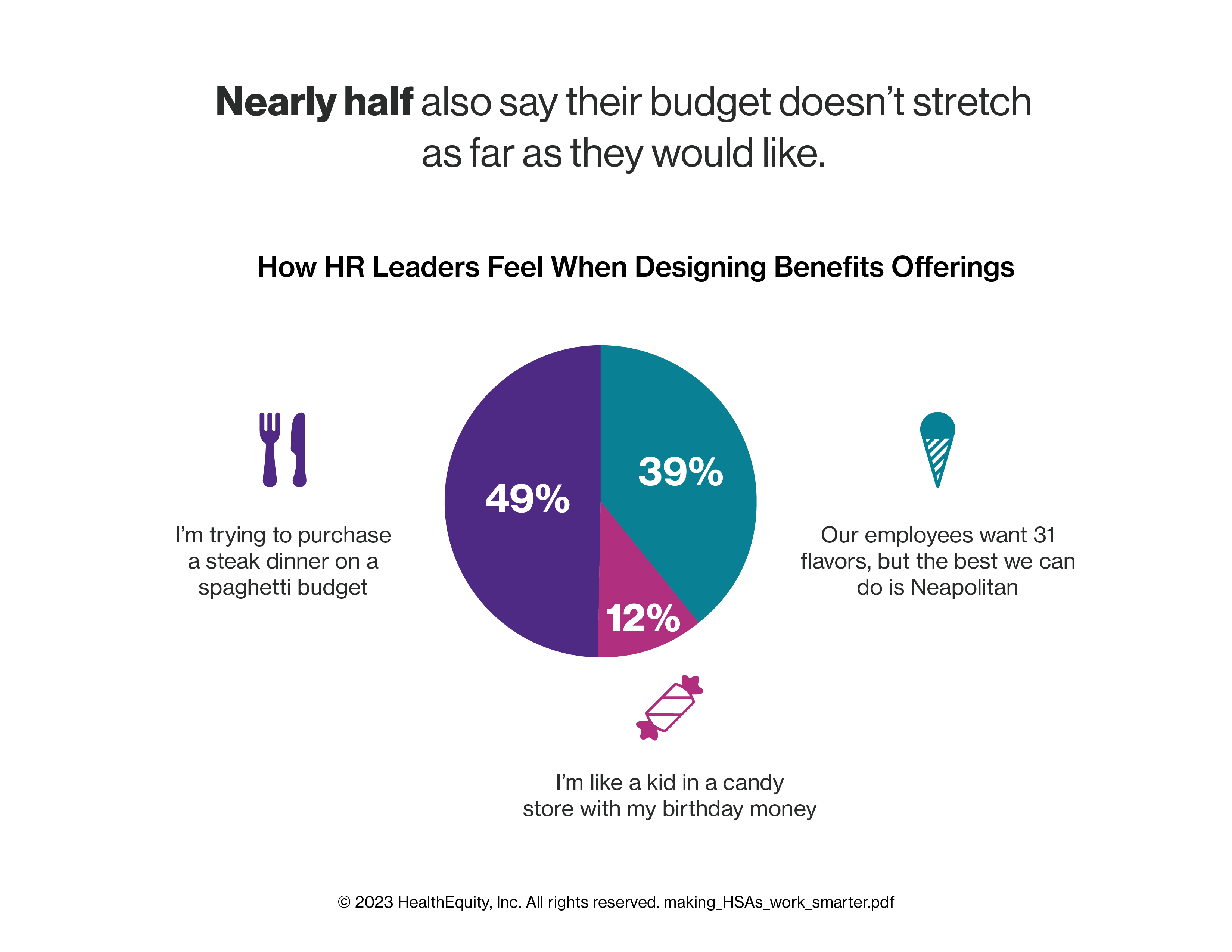

It’s encouraging to see that benefits leaders recognize the impact of benefits on overall job satisfaction. In fact, our recent research shows the vast majority of benefits leaders acknowledge the importance of benefits in talent acquisition and retention. However, budget constraints pose a challenge for nearly half of them when designing benefits offerings.

To address the growing cost concerns, 74% of employers surveyed by HealthEquity now offer Health Savings Account (HSA) health plans to their employees.

HSAs and other consumer-driven benefits can deliver huge savings, lower healthcare costs, and foster financial security for employees.

HSAs on the rise, but benefits understanding lags behind

Despite the numerous benefits of HSA plans and a notable 9% year-over-year growth in HSAs in 2022, HSA health plans are still misunderstood and underused. The good news is there are many ways to bridge that gap in benefits understanding. Organizations have a unique opportunity to enhance their employees’ understanding of HSA basics. By doing so, they can potentially boost benefits satisfaction and talent retention.

Find valuable information during HSA Week

The goal of HSA Week is to boost HSA literacy, help people discover the value of an HSA health plan, and ultimately, help elevate benefits satisfaction among employees. As we dive into HSA Week, we invite you to immerse yourself in a wealth of knowledge and insights. Seize the opportunity to empower yourself and others.

Maximize benefits understanding to increase employee confidence

Achieving benefits satisfaction starts with effective communications that boost employees’ understanding of their benefits. Unfortunately, nearly 7 in 10 benefits leaders say that a lack of employee understanding poses an obstacle to the success of their benefits offering.

During enrollment season, time constraints also worsen the challenge of understanding the intricacies of benefits, including HSA basics. But those who have higher benefits literacy reap significant rewards. Employees who claim to understand their benefits “very well” express increased confidence in selecting their benefits during enrollment season.

And an impressive 71% of respondents who find their employer’s benefits communications very easy to understand report higher levels of satisfaction with their benefits.

Bust HSA myths to improve health benefits understanding

On top of comprehension challenges are the many misconceptions around HSA health plans. For example, a common myth is that an HSA is too expensive and only caters to the wealthy.

In truth, HSAs are a powerful tool that empower people across all income levels. HSA health plans often offer substantial premium savings, helping to reduce the financial burden on individuals.

Plus, any unspent funds from annual health insurance premiums can be set aside for future healthcare emergencies, providing a safety net for unforeseen medical expenses.

When armed with the right information, employees can confidently navigate their benefits options, empowering them to make well-informed choices that lead to greater satisfaction.

Unlock the potential of HSA Week for maximum impact

We want to set you up for success during HSA Week. Here are three impactful ways you can participate and make the most of HSA Week and National Financial Awareness Day.

1. Tap into The Complete HSA Guidebook

Benefits leaders need to have the expertise to help their employees understand their benefits, including HSA health plans. The good news is that The Complete HSA Guidebook is a great resource to support your workforce in maximizing their HSA benefits.

This comprehensive guidebook covers everything you and your employees need to know about HSAs. Whether it’s navigating HSA spending or optimizing HSA contributions, the guidebook has all the answers to help people get the most out of their HSA experience.

2. Learn your health savings personality

Discovering your unique health savings style not only benefits you but also allows you to support others in preparing for their own health plan selection and journey. Experience the fun and insightful Health Savings Personality Quiz, designed to unveil your distinct approach to health savings.

Take the quiz now and share it with your peers. You’ll gain valuable insights and learn how you can support employees to make informed decisions about their HSA health plans.

3. Get ahead of open enrollment season

Let HSA Week serve as your motivation to engage with your benefits administrators. As trusted partners, these valuable allies can support you in maximizing employee engagement with relevant content that encourages better benefits decisions during annual enrollment.

When employees understand their benefits options, they choose benefits that fit their needs. The BeneFIT Education Program is designed to simplify enrollment season for organizations, offering a research-driven and no-cost solution to boost benefits understanding and empower more informed decisions.

If you’re looking for more enrollment season resources to engage your workers, check out the open enrollment toolkit. Take advantage of free digital content and resources, including flyers, articles, presentations, and more.

Did you know? The HealthEquity member engagement resources deliver proven outcomes that make a meaningful impact. Compared to industry benchmarks, HealthEquity members see 13% higher HSA balances and 33% higher investing rates.

Pave the way for benefits satisfaction

HSA Week presents a great opportunity for benefits professionals to make a lasting impact on benefits engagement and satisfaction.

Clear benefits communications enable employees to navigate benefits confidently, resulting in higher satisfaction levels and improved employee retention.

Leverage HealthEquity resources during HSA Week and beyond to empower employees to make educated benefits decisions, maximize their HSA benefits, and achieve greater financial security.

Investments are subject to risk, including the possible loss of the principal invested, and are not FDIC or NCUA insured, or guaranteed by HealthEquity, Inc. Investing through the HealthEquity investment platform is subject to the terms and conditions of the Health Savings Account Custodial Agreement and any applicable investment supplement. Investing may not be suitable for everyone and before making any investments, review the fund’s prospectus.

HealthEquity does not provide legal, tax or financial advice.