We all know the world is changing, and as it does, so is the benefits landscape. Increased prices, more demand for personalized benefits, and additional considerations for generation-specific needs continue to keep the benefits industry on its toes.

As we’re trying to make sense of rapidly changing trends, there’s a temptation to think the solutions must be as complicated as the challenges. But, I think some of the benefits industry’s most effective solutions are the simplest—help people understand their existing benefits. Yep, I think many of our answers are grounded in benefits literacy.

Why is benefits literacy important for employees’ understanding of healthcare?

When I talk about benefits literacy, I describe it as employees having a solid understanding of their healthcare and wellness benefits. When employees really understand what their benefits offer and pay for, they can be empowered to make budget-smart choices. This was a topic we just covered in a recent webinar, Connecting benefits literacy with employee wellbeing. Here’s a link to watch the replay.

Key steps to take for clarity in covered services, treatments, and preventative care

Today, I’ll talk about four simple ways you can help ensure your teams understand and appreciate the full value of their benefits. The effort is worth it because when employees have a practical, working knowledge of what their benefits cover, you’ll make progress in enhancing employee satisfaction and engagement.

1. Simplify benefits communication

Clear and accessible communication can be the foundation for improving benefits literacy. Complex jargon and legal terminology can obscure the true value of benefits packages, leaving employees confused and disengaged.

Here are some examples of ways to provide easy and quick access to simplified information.

-

Use plain language. Explain benefits in straightforward terms. Avoid industry jargon where possible so employees know what plans are available and what they cover.

-

Develop a glossary. Use it to further demystify plan terms and acronyms.

-

Create visual aids. Infographics and videos can help distill complex information into easy-to-understand bites, making it more accessible.

-

Clarify preventative care. Share real life examples about what is (and what isn’t) classified as preventive care for coverage purposes. Plus, explain any differences in out-of-pocket (OOP) expenses for each classification.

-

Provide regular updates. Provide consistent updates about benefits and any changes to ensure current information is always available. Lean on your benefits providers to help you distill the updates into plain language.

2. Personalize benefits education with helpful tools

A one-size-fits-all approach to benefits education is unlikely to meet the diverse needs of your workforce. Personalization can bridge this gap by tailoring the information to fit individual circumstances. This way employees will have the information they need to better understand their benefits and make choices that best suit their needs.

-

Allow time for individual consultations. Offer one-to-one meetings with HR or benefits specialists to discuss personal situations and needs.

-

Create customized materials. Use technology to create personalized guides for employees, reflecting their specific benefits package and how it can best serve them.

-

Make cost calculators available. Prioritize developing ways to add up and estimate OOP costs.

-

Give quick answers. Supplement the in-person support from benefits staff well-versed in your offerings with an easy-to-understand FAQ page for a succinct source of truth.

-

Help employees compare options. Promote a side-by-side comparison tool to show the differences between High Deductible Health Plans (HDHPs), Health Maintenance Organizations (HMOs), and Preferred-Provider Organizations (PPOs).

-

Provide access to emergency funds. Offer an employee assistance fund to help employees cope with unexpected financial hardship.

3. Emphasize the benefits of an HSA beyond just “paying for healthcare”

Sometimes it’s easy to get lost in the small details. That’s when it’s important to show the big picture of how a Health Savings Account (HSA) can help your employees in multiple situations. Ways to reinforce this may include:

-

Give visual examples. Help employees see their HSAs as investment tools. Dashboards help show the longer term financial impact. Eye-catching visuals help too.

-

Make it easy to distinguish between accounts. Show how an HSA differs from a Flexible Spending Account (FSA). Emphasize the triple tax savings, investment options, ability to roll over, portability, and ease of use.1

-

Buddy up with the 401(k). Highlight how HSAs can complement their 401(k) by essentially being the medical arm to their long-term investment strategy. With an HSA, they can use the funds they invest now to pay for their medical care later, without having to dip into their 401(k)s. Plus, HSAs have better tax savings with the ability to invest2, the ability to be used right away and long-term, doesn’t have required minimum deductions, and has a wide variety of uses beyond doctor visits.

-

Offer incentives to encourage new behaviors. Especially if you’re trying to foster new habits, offering financial incentives helps encourage people to open an HSA. If you go this route, communicate how the HSA and the incentive are employer-sponsored contributions. Or, shorter still, make it clear how this is “free money”. If you’re able, provide incentives that don’t require matching to help ensure more people are able to open an account.

-

Get creative to inspire new connections. We’re all digital these days, so meet people where they’re at with online quizzes. Quizzes are fun to take and give space to help people learn about themselves and find ways to connect with others.

4. Offer benefits education throughout the year

Staying connected to your employees after the enrollment period is over is the key to helping people build up their benefits knowledge. Here are some simple, but important ways to keep the benefits literacy conversation going.

-

Send frequent reminders. Continue to provide a variety of materials and low-stress educational opportunities through seasonal benefits reminders through your organization’s intranet or employee blog.

-

Provide incremental education. Build communications around a step-by-step journey so employees can stack their successes.

-

Offer round-the-clock service. Ensure your benefits providers can provide 24/7 access to customer service support so employees can easily ask direct questions—and get timely, clear answers.

-

Give employees more time to decide. Whenever possible, give employees more time to evaluate their benefits options.

Connect your benefits literacy efforts by encouraging feedback and questions

When you implement those steps above, you’ll create an environment where employees feel comfortable asking questions and providing feedback on your benefits. This two-way communication can highlight areas where benefits literacy is lacking and identify opportunities for improvement.

-

Schedule Q&A sessions. Hold regular sessions where employees can ask questions directly to HR or benefits specialists.

-

Conduct surveys and polls. Use anonymous surveys to gather feedback on the effectiveness of your benefits literacy initiatives, and tailor your strategies accordingly.

Tap into the HealthEquity BeneFIT Enrollment Program to enhance benefits engagement

If you want more support, consider the HealthEquity BeneFIT Enrollment Program—a pivotal support system for organizations striving to elevate their benefits literacy and engagement. With an emphasis on inclusivity and comprehensive education, the program offers free enrollment marketing support at any point throughout the year. It’s designed to ensure your employees have the knowledge and resources they need to make informed decisions about their benefits.

Off-the-shelf educational resources: Our suite of resources is designed to simplify benefits education, making it accessible and engaging for all employees. This includes a variety of formats to suit different learning styles and preferences, such as:

- Webinars: Interactive sessions that provide detailed insights into how each benefit works.

- Flyers: Quick, easy-to-read guides available in multiple languages, including Spanish, ensuring that language barriers do not hinder benefits understanding.

- Articles and videos: Deep-dive content that explains the nuances of different plans, including HSA, FSA, Dependent Care Flexible Spending Account (DCFSA), Limited Purpose Flexible Spending Account (LPFSA), Health Reimbursement Arrangement (HRA), and Commuter benefits.

By partnering with the HealthEquity BeneFIT Enrollment Program, organizations can streamline their benefits enrollment process while improving the quality and effectiveness of their benefits education. This, in turn, fosters a more informed, engaged, and satisfied workforce, contributing to the overall success and wellbeing of both employees and the organization as a whole.

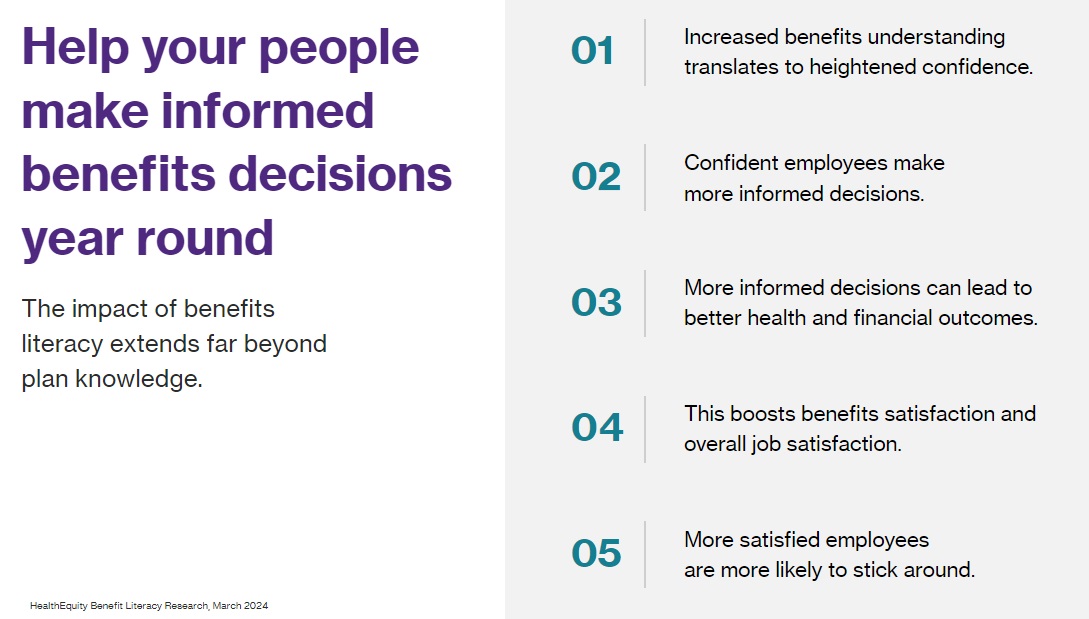

Benefits literacy helps people make informed benefits decisions year round

Enhancing benefits literacy is not a one-time effort. It’s a continuous process of communication, education, and feedback. At the end of the day, the key is to provide easy and quick access to simplified information. When combined with tools and resources to help employees personalize their experience, they will be better able to see the bigger picture. Empowering your team with the knowledge they need to make informed decisions about their benefits is an investment in the future - theirs and yours.

HealthEquity does not provide legal, tax or financial advice.

1HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-deductible with very few exceptions. Please consult a tax advisor regarding your state’s specific rules.

2Investments are subject to risk, including the possible loss of the principal invested, and are not FDIC or NCUA insured, or guaranteed by HealthEquity, Inc. Investing through the HealthEquity investment platform is subject to the terms and conditions of the Health Savings Account Custodial Agreement and any applicable investment supplement. Investing may not be suitable for everyone and before making any investments, review the fund’s prospectus.