It’s time for the benefits compliance year in review to help you stay informed and organized for next year. On one end, there’s a lot of business-as-usual core benefit items to cover, and on the other end, there’s the whopping change as COVID-19 provisions ended. I’m up to the task to run through all the notable compliance events.

Evolving landscape of benefits compliance in 2023

For many employers and plan sponsors offering benefits to employees, it’s the perfect time to review some end-of-year action items and reminders. As 2023 comes to a close, and before the onset of 2024, let’s also go over the residual impact of the COVID-19 pandemic on benefit plans and its related relief.

In addition, I’ll include some general refreshers regarding general compliance requirements of Internal Revenue Code § 125 cafeteria plans, nondiscrimination testing, Form 5500 filing obligations, San Francisco Health Care Expenditure Rates, and updated Patient-Centered Outcome Research Institute or Clinical Effectiveness Research (PCORI) fees.

What happened with the expiration of the Public Health and National Emergency Periods?

At the beginning of 2023, the White House announced a plan to sunset the COVID-19 Public Health Emergency (PHE) and National Emergency periods. That action marked the end of an era. And it created the need to reverse some areas that were suspended as the nation grappled with the pandemic. For example, during that time the government suspended certain ERISA health and welfare plan benefit deadlines. And there were several requirements to cover the cost of COVID-19 tests and testing-related services without cost-sharing or prior authorization or other medical management requirements. This even included coverage for over-the-counter (OTC) home COVID-19 tests.

From January through May 2023, our teams worked to review the actions, understand the guidance, and report back to you. Here’s the full list of blog posts that cover, in order, the COVID-19-related actions.

• What you need to know about the upcoming COVID-19 National Emergency expiration

• Unwinding of COVID-19 plan deadline relief: New federal guidance and a potential earlier end?

• Timeframe set for expiration of COVID-19 emergency measures

• Answers to your top 10 questions about the COVID-19 emergency mandates

If you want to learn more about the COVID-19 actions and are short on time, I recommend watching this webinar recording—Everything old is new again: How to navigate the end of COVID-19 benefits regulations.

What should employers and plan sponsors do to address the end of COVID-19 relief?

Plan sponsors should review their plan documents and associated member materials to ensure any prior amendments addressing the deadline extensions reflect the end of the PHE and National Emergency periods correctly.

What happened with telehealth and remote care in 2023?

Now, I’ll cover the telehealth and remote care service relief extensions under the Consolidated Appropriations Act, 2023 (CAA, 2023). CAA, 2023 was enacted at the very end of 2022. It introduced a number of changes potentially impacting plan sponsors, notably including an extension of telehealth relief with respect to Health Savings Accounts (HSAs).

Read this analysis for a summary of the telemedicine benefit extension. Essentially, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) of 2020 included a telehealth or telemedicine provision. The action allowed HSA-qualified high-deductible health plans (HDHPs) to cover telemedicine and other remote care service expenses before the deductible was met. And the regulation included no effect to a participant’s ability to continue to contribute to their HSA for plan years beginning on or before December 31, 2021. This was renewed in 2022.

CAA, 2023 further extended these exceptions. The extension allows plan sponsors offering HSA-qualified high-deductible health plans (HDHPs) to pay for these telemedicine and remote care service expenses before the deductible is met for plan years beginning after December 31, 2022, and before January 1, 2025. And such services will continue to be disregarded coverage during those plan years (meaning payment for such services will not cause a loss of eligibility to contribute to an HSA).

What should employers and plan sponsors communicate about telemedicine services?

Sponsors of HDHPs that cover reimbursement for telemedicine services who adopt this deductible relief for its HSA-qualified HDHP should communicate the specifics of this relief to their participants. It’s also a good idea to send a communication near the end of 2023 to remind participants about the upcoming relief provision. For calendar-year plans, this telemedicine and remote care service relief will expire December 31, 2024.

What happened with COVID-19-related testing and treatment expenses in 2023?

While many COVID-era regulations were reversed, some received extensions. In June of 2023, the Internal Revenue Service (IRS) provided guidance on how HDHPs can cover COVID-19-related expenses before the minimum deductible is satisfied. It’s important to note it only pertained to plan years ending on or before December 31, 2024.

Background on COVID-19-related testing and treatment expenses

To be eligible to make contributions to an HSA, an individual must be covered by an HDHP and cannot be provided benefits under the HDHP until the minimum deductible for that plan year has been satisfied; an exception to this is for coverage for preventive care services.

In response to the COVID-19 National Health Emergency, the IRS issued Notice 2020-15 allowing HDHPs to provide benefits associated with testing for and treatment of COVID-19 either without a deductible or with one that is below the otherwise required minimum annual deductible. Therefore, an HDHP providing such care on a no- or low-cost basis would not fail to qualify as an HDHP. Consequently, employees’ eligibility to make contributions to their HSAs was not jeopardized, even if medical expenses related to COVID-19 testing or treatment were paid by the HDHP.

On March 29, 2023, the Department of Labor (DOL) Employee Benefits Security Administration (EBSA) released guidance in the form of Frequently Asked Questions (FAQs) addressing, in part, how the end of the PHE on May 11, 2023 would impact requirements to cover COVID-19 diagnostic testing and vaccines. The FAQs affirmed that the relief provided in Notice 2020-15 would continue to apply following the end of the PHE until further guidance is issued.

Notice 2023-37 provided that, due to the end of the PHE, the relief described in Notice 2020-15 will apply only for plan years ending on or before December 31, 2024. As of the subsequent plan year, the HDHP is not permitted to cover testing and treatment expenses related to COVID-19 without a deductible or with a deductible below the minimum deductible (for individual or family coverage) for an HDHP as of the end of 2024.

What should employers and plan sponsors share about COVID-19-related services?

Sponsors of HSA-qualified HDHPs should communicate to their participants about the expiration of this relief provision (for calendar-year plans, this COVID-19-related testing and treatment relief will expire December 31, 2024).

Learn about new indexed PCORI fees issued

Under the Affordable Care Act (ACA), a fund for a nonprofit corporation to assist in clinical effectiveness research was created. The fund is called the Patient-Centered Outcomes Research Institute (PCORI). To aid in the financial support for this endeavor, certain health insurance carriers and health plan sponsors are required to pay fees to this organization based on the average number of lives covered by welfare benefits plans.

PCORI fees increased

On October 18, 2023, the IRS published Notice 2023-70 updating the amount of the PCORI fees that must be paid by self-insured health plans for plan years ending on or after October 1, 2023 and before October 1, 2024. For plan years ending on or after October 1, 2023 and before is increased to $3.22, up from $3.00.

Fees are reported and paid annually through IRS Form 720 (Quarterly Federal Excise Tax Return). These fees are due by July 31 of the year following the end of the plan year along with IRS Form 720.

Indexed each year, the fee amount is determined by the value of national health expenditures. The fee phases out for plan years ending after September 30, 2029.

What do employers and plan sponsors need to know about PCORI fees for HRAs?

As a reminder, fees are required for all group health plans including Health Reimbursement Arrangements (HRAs) but are not required for Health Flexible Spending Accounts (FSAs) that are considered excepted benefits. To be an excepted benefit, Health FSA participants must be eligible for their employer’s group health insurance plan and may include employer contributions in addition to employee salary reductions. However, the employer contributions may only be $500 per participant or up to a dollar-for-dollar match of each participant’s election.

HRAs exempt from other regulations would be subject to the PCORI fee. For instance, an HRA that only covered retirees would be subject to this fee, but those covering dental or vision expenses only would not be, nor would Employee Assistance Programs (EAPs), disease management programs and wellness programs be required to pay PCORI fees.

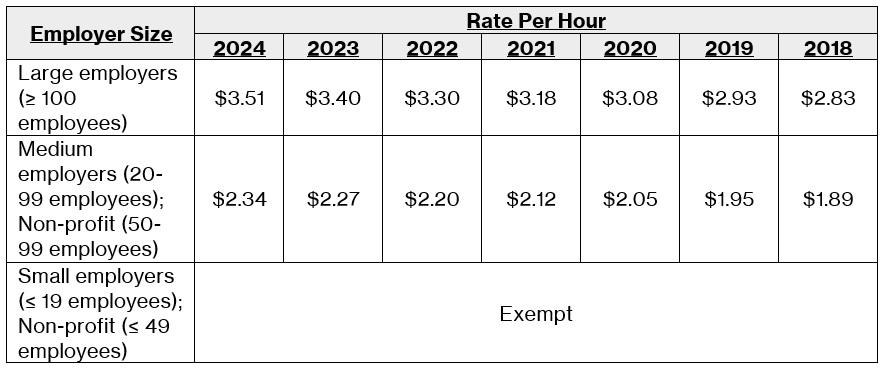

Get an update on the 2024 San Francisco healthcare expenditure rates

The San Francisco Office of Labor Standards Enforcement recently released updated Health Care Security Ordinance (HCSO) required health expenditure rates for 2024.

The 2024 healthcare expenditure rates–and previous years’ rate history–are as follows:

Remember to complete requirements for nondiscrimination testing

All employers, irrespective of business type or size, that offer a cafeteria plan are required by the IRS to perform various nondiscrimination tests on a cafeteria plan that includes benefits like a Health FSA or a Dependent Care FSA (DCFSA) to ensure the plan is not offered in a discriminatory fashion (i.e., unduly favoring highly-compensated and/or “key employees”). Read this for a full rundown on everything you need to know about nondiscrimination testing rules, like the overall “25% Concentration” test, and important Form 5500 obligations for welfare benefit plans.

Important information about 2024 index figures

The last topics to discuss are the updated contribution limits for HSAs and FSAs. It’s important to note that HSA figures are released in May, while many other limits are announced in late fall. While it would be helpful for the limits for the next year to be announced at the same time—and early enough to be prepared before many open enrollment periods begin—we have to work within the existing system of getting the information in two batches.

In May, the IRS gave HSA rates a big boost. For 2024, the minimum deductible amounts for qualifying HDHPs will increase a little over 6%. Individual coverage will be $1,600 and family coverage will be $3,200. For maximum contribution levels, the roughly 7% rate increases will boost individual coverage to $4,150 and family coverage to $8,300.

Then, in November the IRS issued 2024 annual inflation adjustments for many tax provisions of the Internal Revenue Code, including FSAs. For 2024, the FSA annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2023. These adjusted amounts will be used to prepare tax year 2023 returns in 2024. Also, on November 1, 2023, the IRS released the dollar limitations for qualified retirement plans for tax year 2024, including 401(k) plans.

For everything you need to prepare for 2024, here’s a comprehensive list of index figures and contribution limits for you to reference.

Your sneak peek at 2024 trends

Before I close, consider making time to learn about what employee benefits topics you might encounter in 2024. Listen to a panel of expert health and benefits professionals on this Society for Human Resource Management (SHRM) webinar to get insights on vital topics like:

• Controlling rising healthcare costs

• Embracing the role of artificial intelligence (AI) in benefits

• Improving benefits literacy across a diverse workforce

• Addressing employee needs for wellbeing and flexibility

Ensuring compliance excellence in 2024

These are but a few of the specific year-end deadlines and requirements that were required to have been completed or are quickly approaching.

Compliance becomes clearer for employers through knowledge. It’s as easy as contacting HealthEquity for more information about its services, and your own accounting or legal sources for additional guidance. Thank you for reading. I wish you a wonderful end to 2023 and a happy New Year.

The preceding general summary is intended to educate employers and plan sponsors on the potential effects of government guidance on employee benefit plans. This summary is not and should not be construed as legal or tax advice. As always, we strongly encourage employers and plan sponsors to consult competent legal or benefits counsel for all guidance on how the actions apply in their specific circumstances.

HealthEquity does not provide legal, tax or financial advice.