Every year when I turn the calendar page to May, I start looking for federal guidance on any updates to Health Savings Account (HSA) index figures. And they just arrived. Fresh from the Internal Revenue Service (IRS) in Revenue Procedure 2023-23, here are the HSA index figures for 2024. Whether you’re an employer, benefits advisor, or a member, this information is helpful as you make your plans and budget for the year ahead. Here’s what you need to know.

Rate increases offer welcome budget relief

The IRS provides this early release to help employers and HSA members budget for the upcoming year. It’s worth noting that these figures represent an increase from 2023, which in turn was an increase from the relatively flat amounts between 2021 to 2022. Last year, the increased amounts accounted for inflation. While inflation may be slowing, the increase in HSA index figures for 2024 will still be welcome for Americans who are watching their household budgets.

Make note of the 2024 HSA index figures

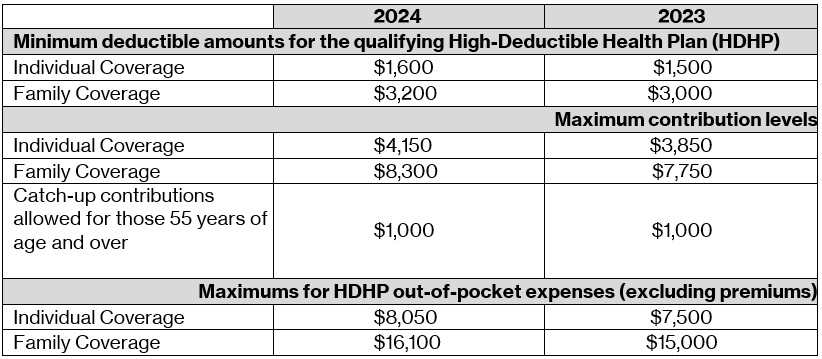

For 2024, the minimum deductible amounts for the qualifying High-Deductible Health Plan (HDHP) will increase a little over six percent—individual coverage will be $1,600 and family coverage will be $3,200. Jumping down to the maximum contribution levels, the roughly seven percent rate increases will boost individual coverage to $4,150 and family coverage to $8,300. See the table below for details on catch-up contributions and the maximums for HDHP out-of-pocket expenses.

Also, for plan years beginning in 2024, Revenue Procedure 2023-23 provides that the maximum amount that may be made newly available for the plan year in an excepted Health Reimbursement Arrangement (HRA) is $2,100.

Your next steps for 2024 planning

Are you a plan sponsor? Now is a good time to prepare for updates to payroll and plan administration systems for the 2024 cost-of-living adjustments. Remember to incorporate the new limits in relevant participant communications, such as open enrollment and communication materials, plan documents, and summary plan descriptions.

While we’re on the topic, here are several resources to help your people make the most of their HSA:

Share this information with your network and subscribe to the Remark Blog to get updates on important benefits topics.

Nothing in this communication is intended as legal, tax, financial or medical advice. We assume no liability whatsoever in connection with its use, nor are these comments directed to specific situations. Readers of this content should consult qualified legal benefits counsel or tax professionals for advice with respect to their circumstances.