The benefits landscape has seen a lot of changes in the last several years, all of which have the potential to affect benefits engagement rates—how many employees actually use a specific benefit offering. To keep pace with the changes, employers are starting to evaluate their offerings to alleviate the external pressures employees face.

If you find that you’re in the same boat, you’re perfectly positioned to help make a difference for employees and their families by looking at how your benefits offerings—and especially your Health Savings Account (HSA) qualified plans—are designed. It can be hard to know how to begin the evaluation process, so here’s a recording of our latest webinar, 5 strategies for designing an HSA plan your employees love that lays out actionable tips on how to make the most of your HSA plan structure.

Be sure to check out the webinar, but first, let’s look at factors that have led many employers to re-evaluate their benefits plan design. Follow along to learn more about rising healthcare costs, the latest insights on employee healthcare concerns, how Health Payment Accounts (HPAs) can work alongside your existing benefits offerings, and more.

Contributing factor: Healthcare costs are on the rise

One of the biggest changes we’ve seen in the benefits world is the rising cost of healthcare. And healthcare costs may only continue to rise at rates that outpace inflation. This prompts employees to evaluate what types of plans will meet their needs as they feel the financial strain.

According to the KFF 2023 Employer Health Benefits Survey, average premiums for family coverage rose to $23,938. This increase outpaced the increase in workers’ wages and overall inflation.

Employees are starting to feel the strain associated with these rising costs. According to a recent Kaiser Family Foundation poll, unexpected medical bills and healthcare costs top the list of expenses that adults say they worry about affording, with three in four adults saying they are “very” or “somewhat worried” about being able to afford unexpected medical bills (74%).

To put a finer point on it, to cope with the financial burden of healthcare, people have withdrawn funds from their 401(k)s. In 2023, 12.6% of 401(k) holders borrowed funds or took hardship withdraws, and 32% of hardship withdrawals were made to pay for medical expenses. Early distributions from retirement funds come at a price, including paying income tax on the money and a potential withdrawal fee. Then there’s the long-term price people pay for reducing their retirement funds growth.

How can you overcome the high healthcare cost hurdle?

As an employer, you can influence just how much financial strain your employees feel. Through your plan design, you’re able to help your employees combat rising healthcare costs, making it easier to seek care.

Pairing HSAs with new ways to pay medical bills over time

The webinar covered another way to help bridge the affordability gap—pairing your HSA-qualified plans with HPAs that provide your workforce with more options to afford care without having to pay upfront costs out of pocket. HPAs provide an interest-free line of credit that employees can use for a variety of medical expenses. They pair well with HSAs because they encourage employees to continue contributing to their accounts while also affording the care they need when they need it. Payments then come directly out of an employee’s paycheck with no interest or fees added.

Contributing factor: HSA-qualified plans may not be optimally designed

According to our own HealthEquity survey, almost 3 out of 4 employers offer a High Deductible Health Plan (HDHP) with an HSA, but they only see 40% of their employees adopt the plan. This could be for a variety of reasons. In the webinar, our speakers went into detail on underlying factors, including employers’ current seed or matching strategy not appealing to employees. Or perhaps, during open enrollment, there isn’t an incentive for employees to consider switching plans because their benefits automatically roll over.

In 2023, HealthEquity surveyed and spoke to over 1,000 healthcare consumers, uncovering the largest barriers to HDHP and HSA adoption. Unsurprisingly, one of the biggest barriers employees have when considering enrolling in an HDHP is the fear of a higher deductible and having to cover out-of-pocket (OOP) costs— medical expenses incurred before the deductible is hit or not covered by a health insurance plan. Additionally, this research also revealed that the top barrier to HSA adoption is that staying with an existing plan is easier than switching.

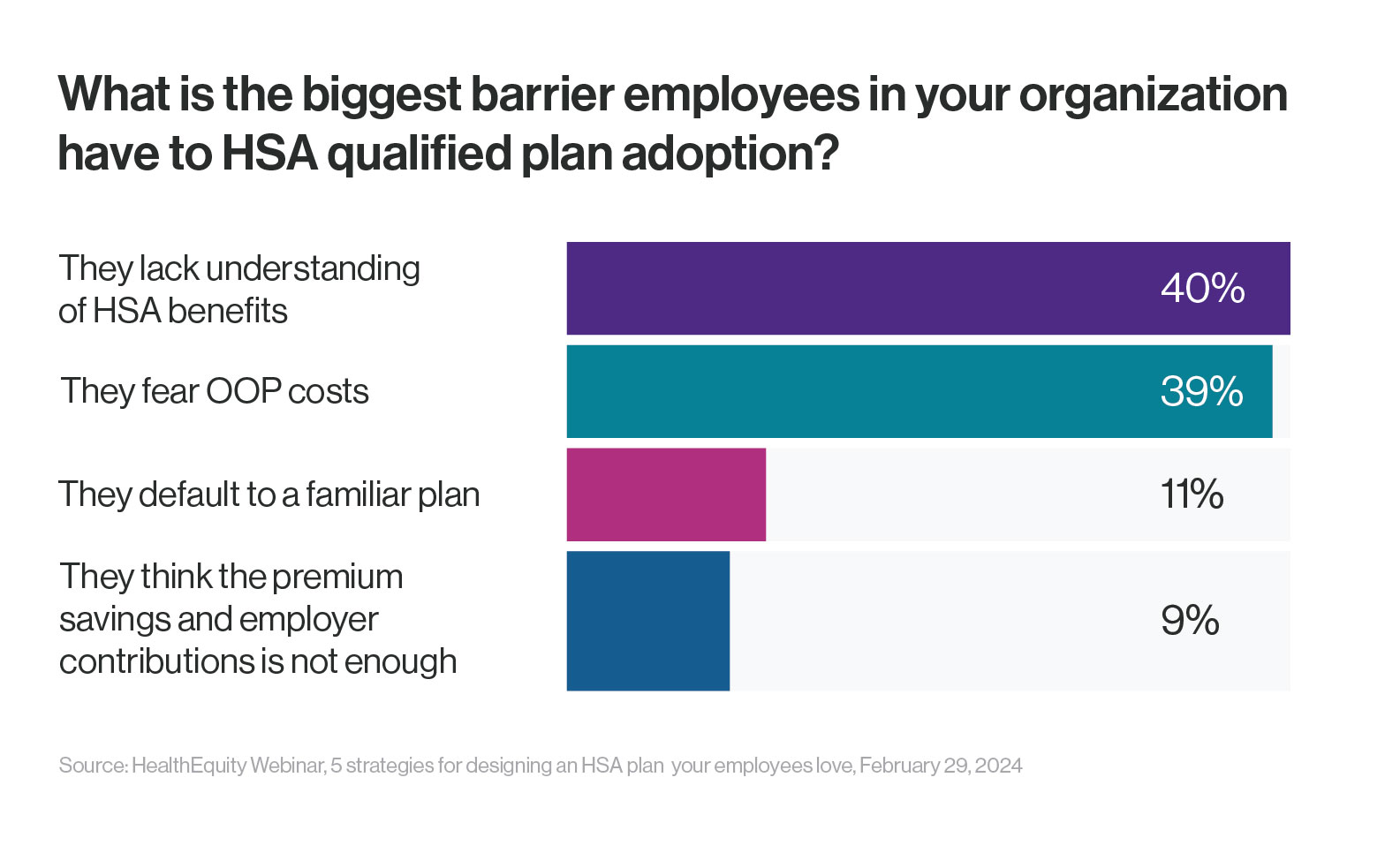

A poll during the webinar backed up the 2023 research. While 40% of audience members selected “they lack understanding of HSA benefits,” a close second at 39% was “they fear OOP costs”.

When your HSA-qualified plan is optimally designed with a compelling employer contribution, lower premium costs, and reasonable deductible costs, you’ll start to see the adoption rates you want. But, if any of those levers aren’t aligned with each other, it can be hard for employees to switch plans, especially if they are comfortable with their existing coverage.

How can you overcome the sub-optimal HSA plan design hurdle?

Re-evaluating your HSA plan design, particularly around how you as an employer contribute funds and how you encourage employees to fund their HSAs, can help you reach your goals. One way to make progress is to require employees to review and select benefit choices every year. Also known as active open enrollment, this can put a stop to default bias.

Default bias or status quo bias can be a serious hurdle. It’s the tendency to automatically favor or accept a situation simply because it exists right now. When people are in the default bias mode alternatives seem unthinkable, impossible, or requiring too much energy to change. Those who might otherwise elect lower cost options remain in more expensive plans.

Strategy: Increase HSA adoption with active open enrollment

Overcoming the above factors can feel daunting, but with a few key adjustments, you’ll start to see the benefits participation rates you’re looking for. One of the top strategies covered in the webinar is switching to active enrollment when it’s time for your employees to make elections.

Keep in mind, employees may feel as though it is easier to stay on their current plan than to switch to a new one. You’ll need to be prepared to give an extra push and offer educational resources to help employees evaluate their options. As Amanda Riley, SVP Enterprise Client Relationships, outlined in the session, the extra effort is worth it because active open enrollment creates amazing opportunities to highlight your benefit offering’s value and encourage positive behaviors.

Active open enrollment can also encourage people to reflect on their options. The process can introduce people who would otherwise stay with an expensive plan that doesn’t fit into their financial and wellness goals to another plan that is more aligned with their needs.

Although active open enrollment requires greater investment of time and resources, it can result in more HSA adoption and higher contributions, which can pay real dividends throughout the plan year.

Additionally, it’s important to prioritize education and provide comparison tools to help employees easily navigate their options. Sharing online tools and offering detailed webinars with Q&A sessions can give employees insight into their options and help them make the best choice.

Pro-tip: If you don’t want to eliminate default elections entirely, consider defaulting current HSA members into their current plan and defaulting eligible or new employees into the HSA plan.

More ways to improve your HSA plan design

There are several more strategies—from education to renaming plans—to explore as you consider adjusting your plan design to reach your benefits adoption goals. To get the complete information, you can watch the on-demand webinar replay at your convenience.

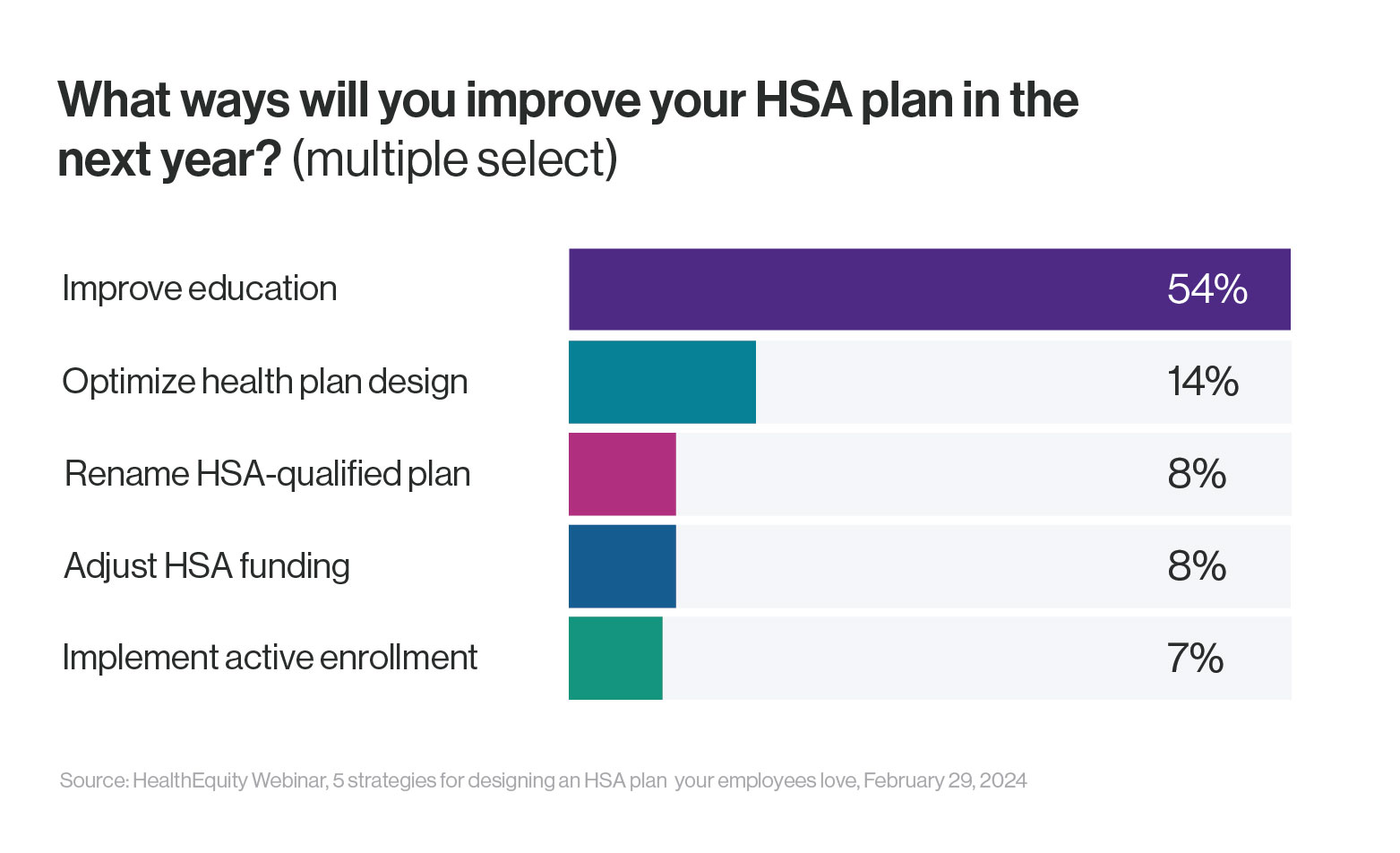

Here’s a sneak peek of the major topics covered in the session. As the webinar wrapped up, the audience selected improving education (54%) as the top way to fine tune their HSA plan.

No matter what strategies you choose to implement to help your employees better manage healthcare expenses, know that your benefits work is important. With your thoughtful approach to removing barriers to accessing and affording healthcare, your employees and their families will be better positioned to weather changing economic patterns.

HealthEquity does not provide legal, tax or financial advice.