This fall we conducted a survey of 1,155 full-time employees across the United States to understand how they were managing healthcare expenses during COVID-19. We found that many are unaware of how much healthcare services cost, and many more are simply unprepared for unexpected expenses. But there's a lot that benefits teams can do to make a difference. This is part one of a four-part series designed to give employers strategies and resources to help their people save more and spend smarter.

Our most recent survey revealed that over 80 percent signed up for their HSA to capitalize on its unique tax advantages. People clearly see the benefits of an HSA, they just need an extra boost.

The most straightforward way to help your people manage healthcare is to get more tax-advantaged money into their hands. When you include an employer contribution match with your HSA, you help your employees cultivate a savings mindset.

HSA employer matches work. In our most recent survey, eighty-seven percent said that having an employer match their HSA contributions would be a strong motivation for them to put more into their accounts.

Our own study of 50+ client accounts confirms these findings. Among our sample, an employer match correlated with a 22 percent increase in employee adoption and 35 percent higher employee contributions (compared to plans without a match).

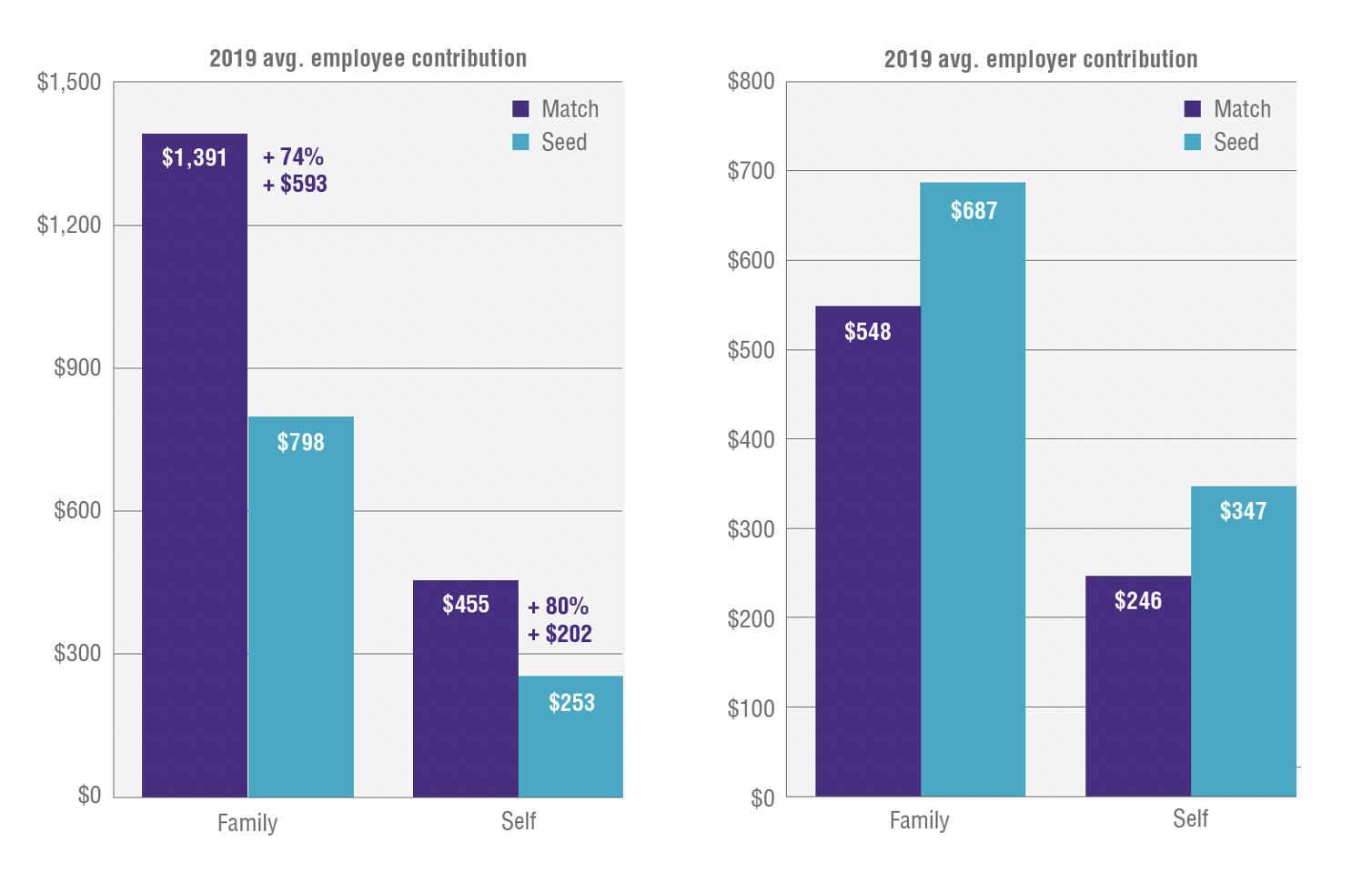

Case in point: HSA seed vs. HSA match

We compared two similarly sized organizations in the hospitality industry - one implemented an employer match and one did not. Both organizations offered $500 for single employees and $1,000 to employees with a family. The company with a match required employee contributions before funds were dispersed, while the seed-only organization dispersed funds regardless of employee activity.

As the charts above illustrate, the organization using a match contributed roughly 25 percent less than the organization using the seed-only option. In addition, employee contributions at the organization using the match were 80 percent higher among single employees and 74 percent higher among employees with a family.

Beyond the charts, our analysis also uncovered several additional advantages. Nearly 90 percent of employees at the organization using a match contributed funds to their HSA, compared to just 37 percent of employees at the seed-only organization. At the same time, total HSA account balances were on average 24 percent higher at the organization using a match.

Conclusion

Although not always right for every business, it's clear that the employer match is a powerful tool that helps incentivize HSA adoption and use. According to our data, matches drive greater employee participation, higher employee contributions and higher account balances.

Not only can this can help alleviate the stress that comes from being unprepared for the unexpected, but it also serves as a tool to help your employees become savvier healthcare consumers. It puts them in control, empowering them to save more and spend smarter.

Stay tuned for part two of our four-part series.

HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-deductible with very few exceptions. Please consult a tax advisor regarding your state's specific rules.

HealthEquity does not provide legal, tax or financial advice. Always consult a professional when making life-changing decisions.