The COVID-19 pandemic has been challenging for everyone, but it's been especially difficult for working families, according to a new national omnibus survey from HealthEquity.

Conducted in the fall of 2020, the survey asked more than 1,100 full-time workers with employer-based healthcare coverage about their attitudes and behaviors on a variety of healthcare topics, including COVID-19, healthcare spending and their use of health savings accounts (HSAs).

The study found that nearly half of full-time workers had to make financial sacrifices in the past six months due to healthcare costs. The strain on workers with children at home is even greater - a full 63 percent of these respondents say they have gone without healthcare or cut spending in other areas to afford healthcare.

Results also indicate that while HSAs are an important way working families and other employees manage these issues, many still encounter roadblocks and potential misunderstandings that limit their progress.

Organizations have an opportunity to help change that. And in an environment where individuals are increasingly looking to their employers for support, these actions can make a crucial difference for all working Americans and their families.

Employees are handling healthcare costs by making tradeoffs

It's no secret that healthcare costs are a major stressor for many Americans. In a 2018 survey from the American Psychological Association, two-thirds of U.S. adults said that the cost of health insurance alone was a significant cause of stress.

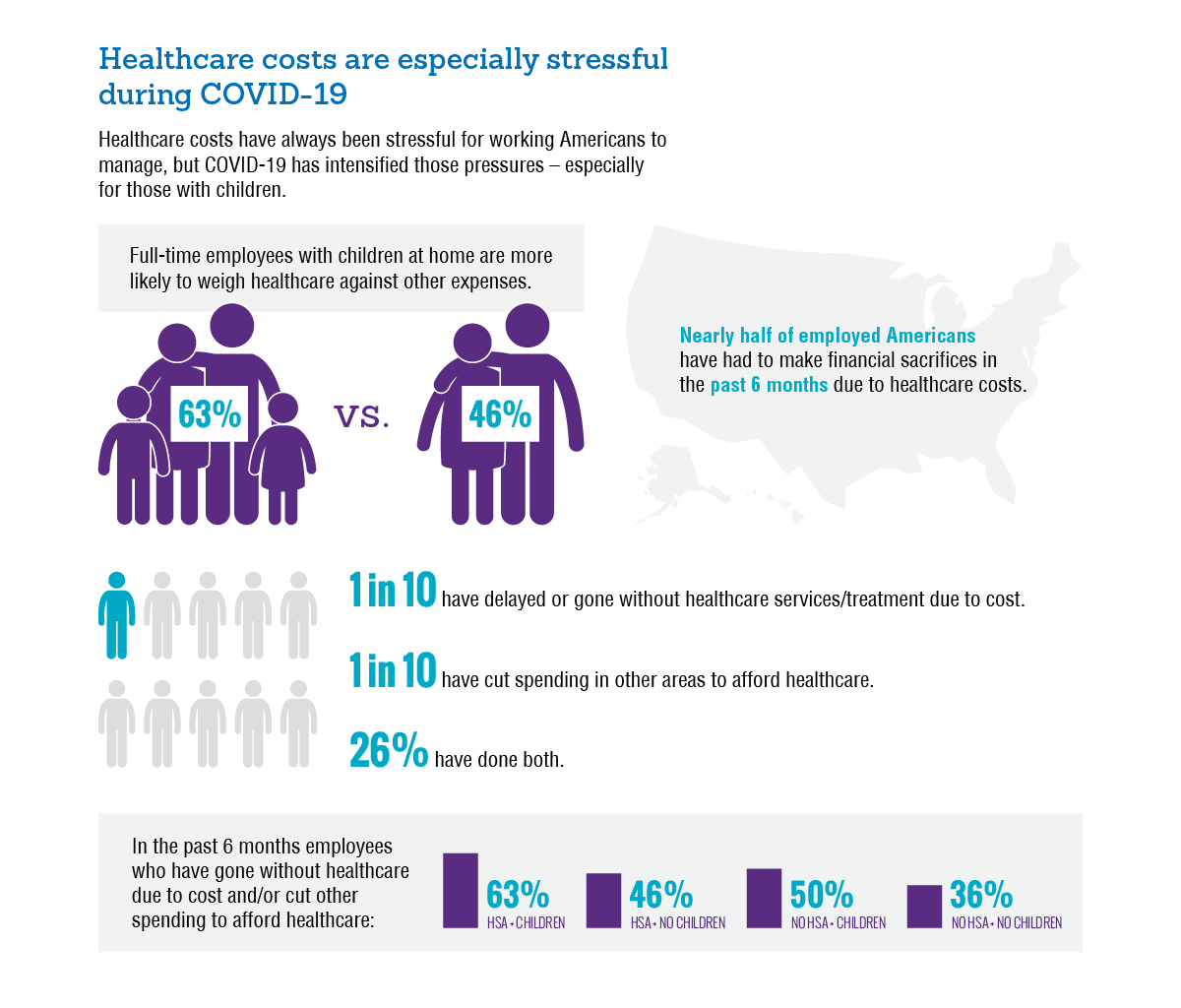

The continued rise of those costs and the advent of COVID-19 has only amplified those feelings. To handle the cost of healthcare in 2020, nearly half of respondents to the HealthEquity survey say they're making financial sacrifices.

According to the survey, 46 percent of full-time employees have had to make tradeoffs between healthcare and other expenses in the last six months. That represents 10 percent of employees who say they've gone without healthcare services due to cost, another 10 percent who say they've cut their spending in other areas to afford healthcare costs and 26 percent who say they've done both.

Those numbers are particularly outstanding for working families. A full 63 percent of full-time employees with children at home say they've both gone without healthcare services due to cost and cut spending to afford healthcare in the past six months.

Taken together, these numbers suggest that while many employees are feeling the strain of healthcare costs, working families are feeling especially vulnerable.

HSAs are encouraging positive consumer behaviors

One important way working families are managing healthcare cost pressures is by contributing to and utilizing their HSAs.

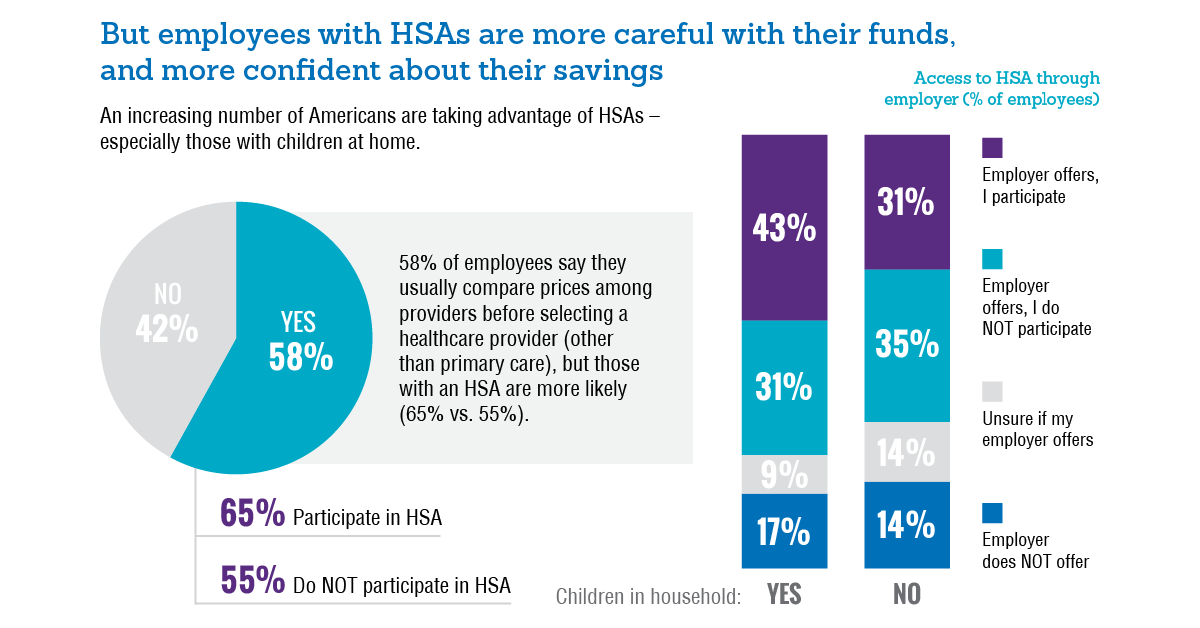

HSAs are a widely popular benefit, now used by more than 29 million Americans. Roughly a third of those surveyed say they participate in an HSA through their employer, and more than 80 percent with an HSA say they were motivated to sign up due to the HSA's tax advantages1.

HSAs are particularly popular with employees with children. Forty-three percent of these employees chose to participate in their employer's HSA benefit compared with just 31 percent of employees without children. They're also twice as likely to put extra funds toward their HSA as are employees without children.

There is convincing evidence that in addition to facilitating health savings, HSAs are encouraging other positive consumer behaviors that could ease cost-related stress.

One of these behaviors is price shopping. Comparing prices among healthcare providers can lead to significant savings, potentially reducing up to seven percent of overall healthcare spend, according to a Modern Healthcare report.

Price shopping has become more common among consumers, with 58 percent of survey respondents telling HealthEquity they usually compare prices before selecting a healthcare provider. But those with an HSA are far more likely to price shop, with 65 percent of respondents who participate in an HSA saying they do so compared to just 55 percent of respondents who don't participate.

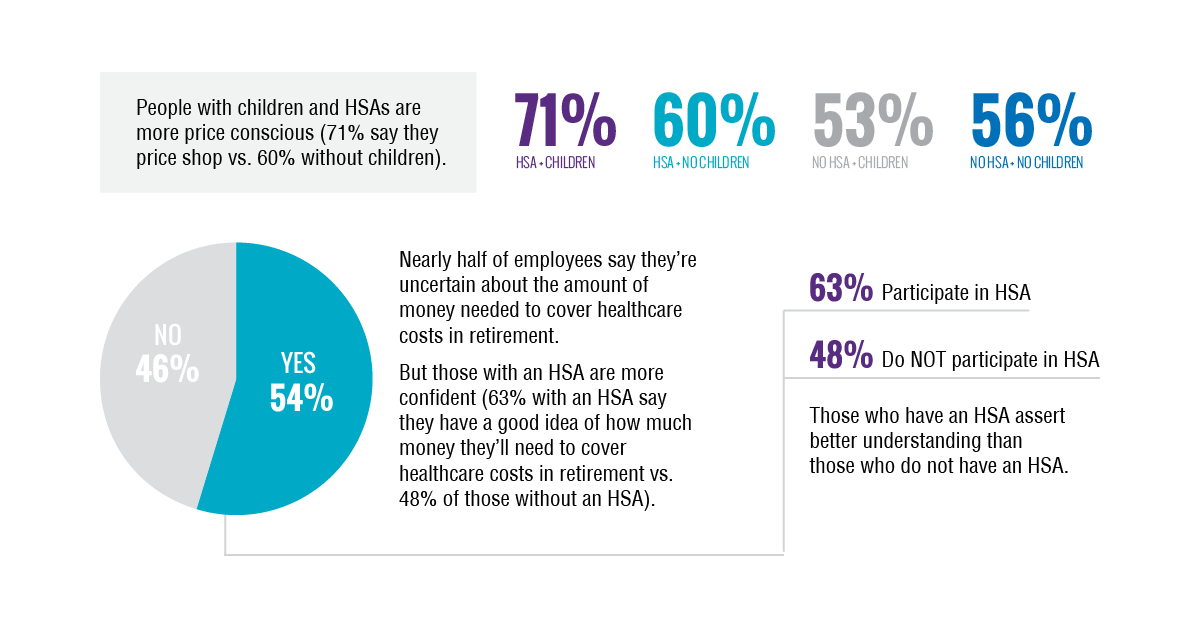

Once again, employees with children display the most price sensitivity. Among HSA participants with children, 71 percent say they compare prices before selecting providers; only 60 percent of HSA participants without children do.

HSA participants are also much more confident about their financial planning. Though nearly half of survey respondents (48 percent) say they're uncertain about the amount of money needed to cover healthcare costs in retirement, HSA participants are more self-assured - 63 percent of them say they have a good idea of how much money they'll need.

This data underscores what proponents of consumer-directed health benefits like HSAs have long argued - that giving consumers more up-front access to healthcare decisions and the ability to budget leads to better savings behavior and better outcomes throughout life.

Organizations can do more to support employees through HSAs

Given the stresses felt by working families and the solutions offered by HSAs, one of the most meaningful ways organizations can provide support is by strengthening their HSA benefits.

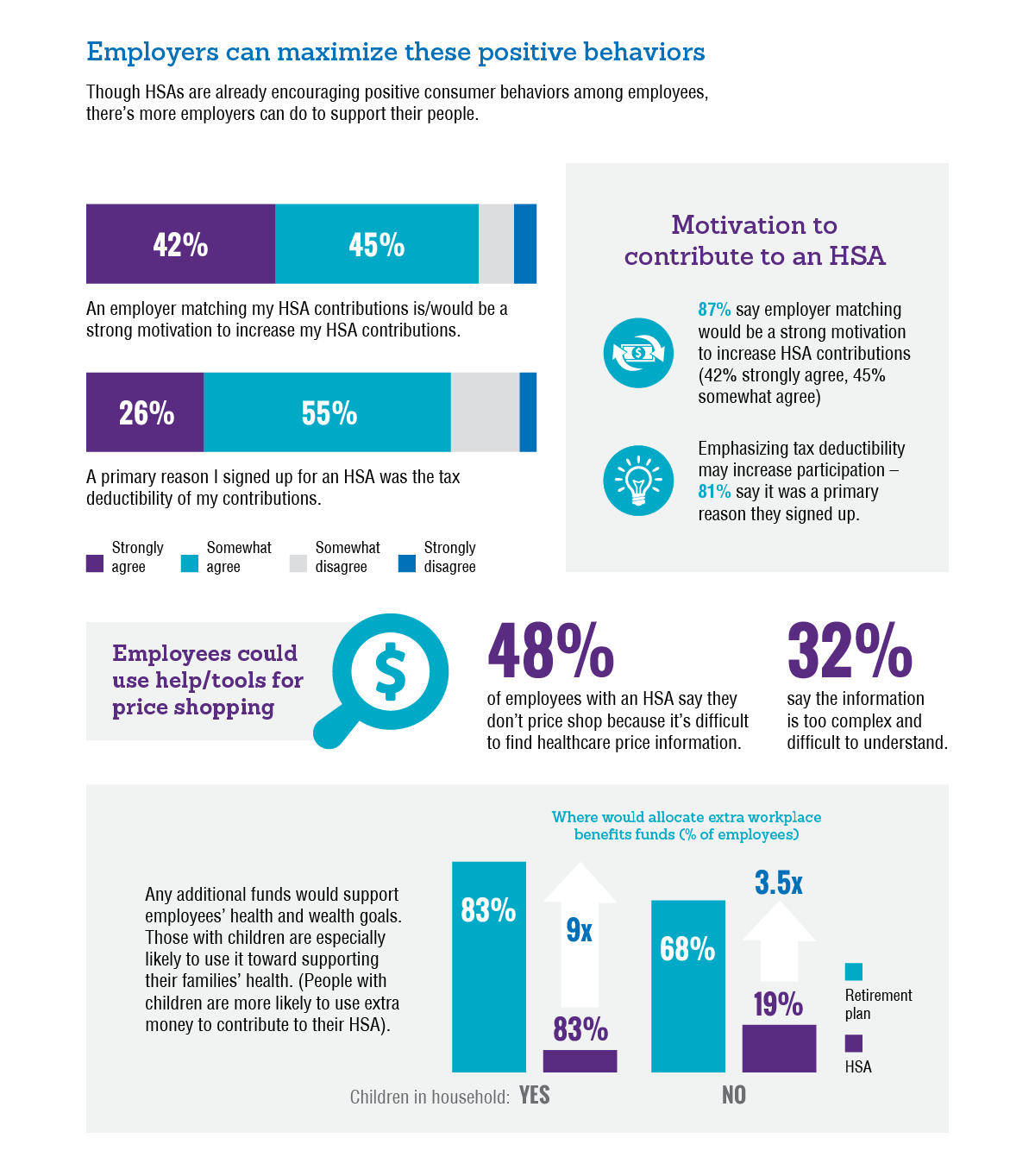

A simple way to do that is to help build savings. More than a quarter of survey respondents with an HSA say they're concerned they aren't contributing enough to their account - but 87 percent also say they would be motivated to increase their contributions if their employer offered a match.

This sentiment is backed up by internal HealthEquity data, which shows plans that include an employer match lead to 22 percent more participation and employee contributions that are 35 percent higher than plans without a match. For organizations that have not already done so, amending their HSA benefits to include a matching contribution could promote better outcomes for employees.

Organizations can also bolster their education efforts with regard to HSAs. Despite being designed as a savings tool, HSAs aren't often seen or used that way. Just 30 percent of survey respondents with an HSA say they view their account primarily as a tool to save for future healthcare expenses. Half instead say they use their account primarily to pay for current-year health expenses, and 20 percent say they use it both to save and spend.

Respondents with children at home are even more likely to view their HSAs as spending rather than savings tools - 63 percent of these employees say they see their HSA mostly as a way to finance current expenses versus 40 percent of employees without children who say the same. Better education can help make employees aware of the savings power of the HSA and perhaps unlock financial peace-of-mind and future preparedness.

Finally, organizations can help employees overcome roadblocks in the healthcare system itself. Although price shopping has become more common - especially, as previously discussed, among HSA participants - there remain some obstacles that prevent more people from researching and comparing healthcare prices.

Among HSA participants who don't price shop, 48 percent say a prominent reason is because it's difficult to find healthcare price information. Another 32 percent say that healthcare pricing information is too complex and difficult to understand.

By providing price transparency tools and amplifying their education programs, employers can help their people comparison shop more easily and make more informed decisions about their healthcare.

Learn more about HSAs, healthcare consumerism and how to support your employees

Working families are under significant stress, but data from the new HealthEquity survey points to several ways organizations can offer support.

It's also just one narrative thread from a survey that reveals many insights into how working Americans are thinking about healthcare and practicing healthcare consumerism in 2020. For the next several weeks, we'll be sharing top takeaways from the survey that will help guide both employers and individuals as they navigate the new realities of the healthcare system.

Subscribe to our blog for updates.

Survey methodology

Quantitative survey fielded in September 2020, among a national sample of 1155 full-time employees who have healthcare coverage through their employers.

Survey topic categories:

- Attitudes about health savings accounts (HSAs)

- Attitudes and behaviors regarding healthcare price shopping and saving for healthcare

- Attitudes and behaviors regarding the use of telehealth

HealthEquity does not provide legal, medical or financial advice. Always consult a professional when making life-changing decisions.

1 HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-deductible with very few exceptions. Please consult a tax advisor regarding your state's specific rules.