Robust health savings are more important than ever, but most employees aren't meeting basic benchmarks. Employers can - and should consider - playing a role in correcting this.

In this post:

- Americans have less than $3,000 saved for healthcare expenses and struggle to pay for emergency medical needs. They're even less prepared for retirement.

- As the sponsor of employee benefits, employers are well-positioned to help their people build better health savings. Doing so leads to less financial stress and greater productivity in the office.

- Smart plan design and access to data-driven insights are two ways employers can improve their benefits package and help employees build savings.

Health savings are more important than ever. With healthcare costs on the rise, Americans will need more funds to cover major medical expenses and manage health in retirement.

Few are practicing the good savings behaviors required to meet these objectives, however. Despite having access to vehicles like the health savings account (HSA), most Americans spend more on healthcare than they save and would struggle to cover unexpected expenses using their savings.

The resulting financial stress can lead to absenteeism at work and leech productivity while employees worry over tending to and paying for their medical needs.

Employers can play a powerful role in reversing these trends. Through thoughtful benefit plan design, strategic use of employee analytics and a commitment to continuous improvement, employers can help employees achieve true health savings success.

<h3>The state of employee health savings</h3>

Americans have an average $2,803 saved for healthcare expenses, according to the most recent HSA data from the Employee Benefit Research Institute (EBRI).

That figure is up from $1,990 in 2011, but for many it isn't enough. In fact, nearly 60 percent of Americans say they wouldn't be able to cover a $1,000 emergency from their savings without turning to other sources, like a credit card.

Employees are even less prepared for the health costs of retirement. Projections by the EBRI suggest a senior couple retiring in 2020 would need $325,000 in savings to have a 90 percent chance of covering medical costs in retirement.

Part of the reason employees are lagging behind in their health savings is how they use the funds they do have. Rather than treat the HSA as a true savings vehicle, many use it the same way they use a flexible spending account (FSA) - spending down the vast majority of their annual contributions on small-dollar expenses like deductibles, coinsurance and copayments.

While there is no one-size-fits-all approach to using health savings funds, it's clear that many could benefit from saving more of these tax-advantaged funds each year.

Why employers should get involved

Most people aren't expert financial planners. Even with access to an HSA, many may not understand or practice appropriate savings behaviors.

As the sponsor of HSA-eligible health plans - and contributor to employee HSAs - employers are in the perfect position to bridge this gap and help their people build health savings.

They also have good incentives to do so. The financial stresses caused by poor health savings behavior can spill out into the workplace, affecting productivity and morale. A survey conducted by Purchasing Power found that more than four in ten (44 percent) of full-time employees worry about personal finances during work hours.

A more effective health benefits package also helps employers attract and retain top talent. More than 75 percent of job seekers say health benefits are very important when considering a job offer, and 60 percent of employees cite health benefits as among the reasons they stay at their current job.

Helping employees build health savings, then, benefits everyone.

How employers can help

The most successful health savings programs have one common denominator: an employer committed to thoughtful planning, analysis and continuous improvement.

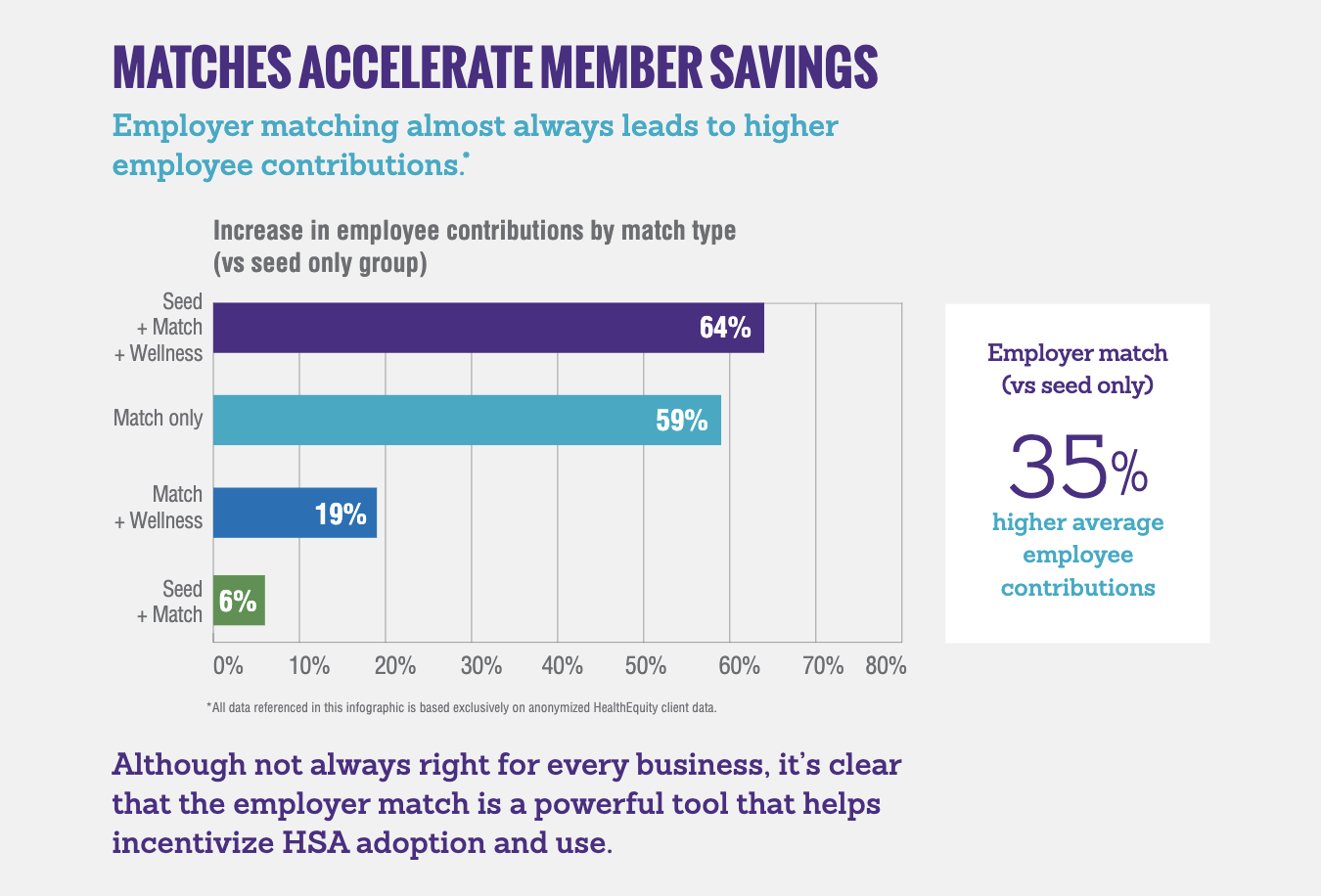

A major component is plan design. When establishing (or revising) an HSA-eligible health plan, employers need to carefully consider their HSA contribution strategy. They may choose to seed employees' HSAs, institute an employer match, combine the HSA with a wellness program or create a strategy that combines these approaches.

While there is no one right answer, internal HealthEquity data shows plans that include an employer match incentivize HSA adoption and use. According to our data, plans with an employer match lead to 22 percent more employee participation and employee contributions that are 35 percent higher than plans without a match.

Source: Building a Winning HSA whitepaper, HealthEquity

Employers should also dedicate time and resources to understanding how employees are using their health benefits. Without insights into HSA utilization, employers are left in the dark on their program's effectiveness.

By contrast, tracking data on whether and how much employees are contributing will give employers insight into how well-positioned their people are to handle major medical expenses and prepare for retirement. Better visibility will also help employers evaluate their program against industry peers and identify opportunities for improvement. Employers can use tools like the new Health Savings Score‚Ñ¢ from HealthEquity to gain access to these insights and improve the way they manage benefits.

Once employers understand what's happening with their health benefits, they can take steps to improve key metrics like engagement and contribution amount. After identifying areas for improvement, employers can tailor their approach to better fit employee needs.

If few employees are contributing, for example, employers may consider revising their plan design to include a match. If many employees are spending down their HSA balances on small items, employers can institute an education campaign to illustrate the benefit of delaying reimbursements and continue to track performance to evaluate the effectiveness of their adjustments.

Employers should also adopt an attitude of continuous improvement. The need for health savings never changes, but employee behaviors do. By regularly monitoring health benefit performance, employers can ensure employees are making the savings progress they need and their benefit program is competitive and valuable.

Conclusion

Most employees could use support in building health savings. With the timely data-based insights and program improvements, employers can help them achieve that goal. That means better health, greater peace of mind and more productivity for everyone.

Let HealthEquity help you optimize your health benefits program. Leverage the power of Health Savings Score to track, measure and improve health savings and make a difference for your people.

HealthEquity does not provide legal, tax or financial advice. Always consult a professional when making life changing decisions.