As the healthcare cost scene keeps shifting, employers and benefits professionals are looking for creative ways to tackle rising expenses while still providing a top-notch benefits package.

Healthcare benefits play an important role in ensuring employees’ health and financial wellbeing. They’re also a bit of a puzzle for employers who are trying to strike a balance between offering a competitive benefits lineup and keeping costs in check.

Exploring employee benefits contribution strategies

One solution that has gained popularity is pairing a High Deductible Health Plan (HDHP) with a Health Savings Account (HSA), not just as a tax-advantaged saving tool for employees, but also as a clever way for employers to trim premium costs without sacrificing quality.1 In particular, adding an HSA contribution match is a great way to motivate employees to save more and reduce their overall healthcare expenses by paying with tax-free HSA funds.

The rising tide of healthcare costs

Every year, the premiums increase for employer-sponsored health coverage. This year, they even surpassed the typical inflation rates.

In 2023, the average premium for family health coverage went up by 7% from the year before. That’s way more than the 1% increase from 2021 to 2022. It even outpaced the growth in workers’ wages (5.2%) and overall inflation (5.8%).

Specialty drugs, in particular, have become a major driver of healthcare spending. Their costs keep shooting up every year, and it’s becoming a real challenge for employer health plan budgets. It’s no surprise that a whopping 80% of employers feel it’s very important to get a grip on prescription costs when setting up benefits.

Why employers need to act to rein in benefits costs

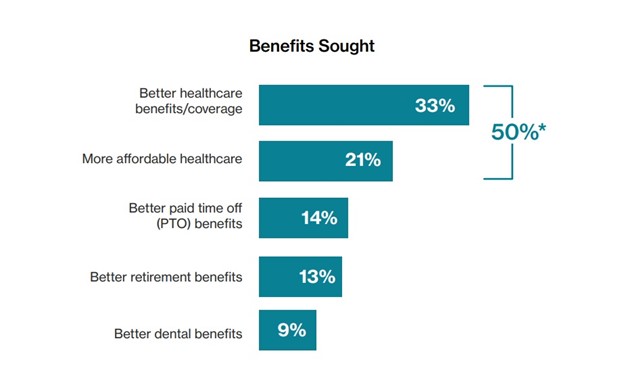

There are many reasons for employers to tackle rising healthcare benefits costs. A competitive benefits package can make a big difference in employee job satisfaction and retention. Employees who are satisfied with their benefits are more likely to stick around, which is a huge win in today’s tight labor market. And research shows that when it comes to benefits, the majority of employees say they want better, more affordable healthcare.

Plus, when employees have access to useful benefits and wellness programs, they’re more likely to take positive steps for better health and financial security.

What’s more, employers are also looking for benefits that work well for all their employees and don’t cost a fortune. That’s where benefits plan design comes in handy.

The power of savvy benefits plan design

When it comes to battling healthcare costs, one of the most effective strategies is smart health plan design. Plans like HDHPs paired with HSAs are one way to hand more control to employees while also cutting costs for employers.

In 2022, HSA plan premiums were about 11% lower than traditional PPO plans. Plus, HSA plan premiums tend to go up less each year – only 5.7% from 2022 to 2023, compared to 7.7% for PPO plans.

HSAs also help employees make savvy choices about healthcare spending, like prescription medications. And by encouraging employees to use their HSA for preventive care, you can cut down the need for costly medications to treat serious illnesses.

But here’s the trick: simply offering an HSA-qualified plan isn’t enough. Employers find that adding a well-thought-out HSA contribution match program boosts employee engagement, encourages plan use, and increases savings.

Instead of employees treating an HSA like a savings account (albeit a tax-advantaged one), it becomes a tool that employees are motivated to use. And when more employees contribute to and use their HSA, that benefits both the employer and the employee.

The HSA contribution match strategy

An HSA contribution match is a simple concept. You add money to an employee’s HSA based on how much they put in, similar to a 401(k) match. For instance, you may match 50% of the employee’s HSA contribution up to a certain percentage of their salary or you can commit to a dollar amount up to a pre-set threshold. If you offer a dollar-for-dollar match, you’d contribute at the same rate as your employee (example: $1 for every $1 an employee contributes, up to $500).

An HSA match not only encourages employees to save for medical expenses but also gives them extra cash from the get-go. It’s also a proven way to get employees to contribute in the first place.

In addition, an HSA contribution match program can help bridge the gap for lower-earning employees who might find it tough to save for an HSA. It’s an inclusive strategy that encourages a healthier workplace, both financially and physically.

Making an HSA match that counts: Seed then match

When implementing an HSA contribution plan, it’s helpful to structure the program in a way that is not only cost-effective but also encourages adoption. Seed options are a good way to encourage HSA use because they directly help employees with healthcare costs. You can make seed contributions in several ways, such as:

-

A lump sum

-

Smaller amounts throughout the year

-

Or a combination of both tactics

To boost adoption, consider offering an HSA-qualified plan with lower premiums than your regular plan. This way, the choices cost about the same. For instance, you could offer a PPO plan with a $400 monthly premium or an HSA-qualified plan with a $200 monthly premium and an extra $200 monthly employer seed.

It’s not uncommon for organizations to seed the first year of an employee’s HSA to help them transition into the plan, but few make the important switch to a match system to continue encouraging contributions.

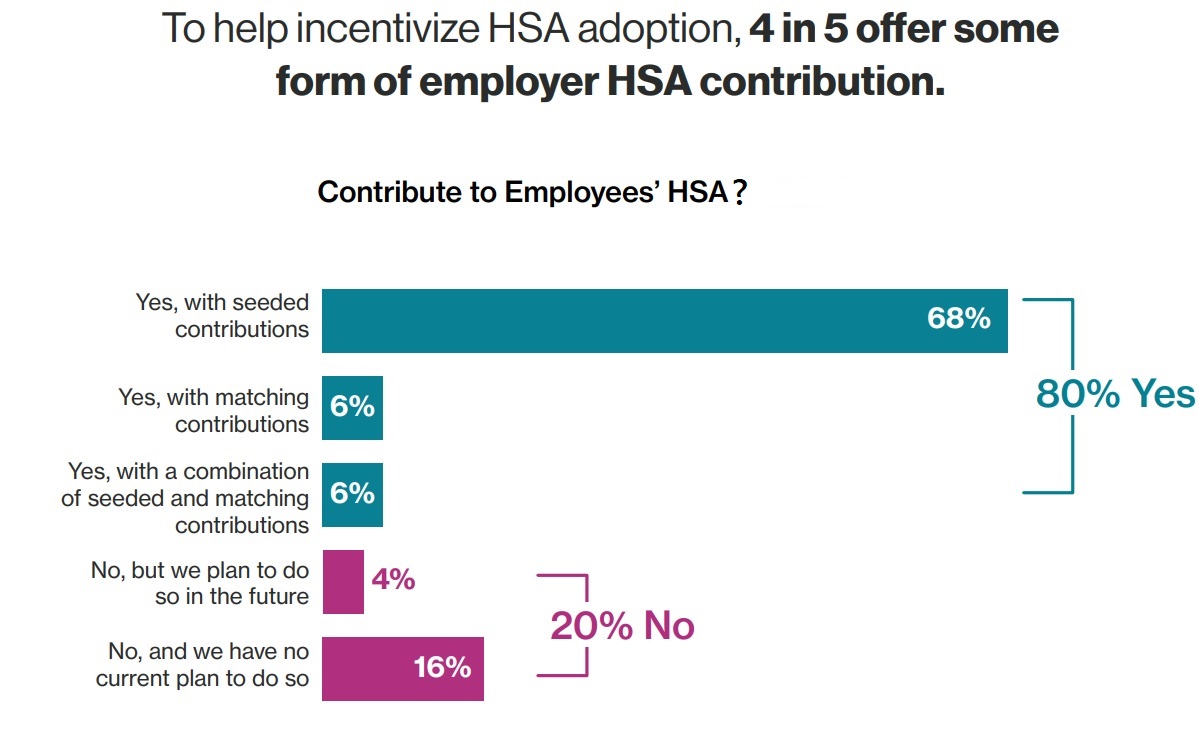

According to HealthEquity research, only 12% of employers provide a contribution match compared to 68% who offer a seed.

A smart contribution plan is not just a great cost-cutting strategy, it can also help employees build a financial safety net.

The real-world impact of HSA contribution matching

Let’s take a look at two similarly-sized organizations in the hospitality industry in the HealthEquity book of business who offered their employees an HSA—one providing a seed and the other a contribution match of roughly the same amount.

Employees who got a matching contribution not only showed a higher likelihood of putting money into their HSA, but they also contributed significantly more compared to those who only received a seed.2

Notably, the match approach also saved the organization money, with the employer contributing 42% less compared to the seed-only employer. And because the contribution match encouraged employees to add extra funds to their HSA, they had 24% higher HSA balances than those only getting a seed contribution. The additional HSA funds allow employees to build a safety net for unexpected medical expenses and start investing for their future healthcare needs.

Elevating HSA plans with an employer contribution match is a win for all. It motivates employees to contribute to their HSA, while the employer sees a positive impact on their bottom line.

Putting the strategy into practice

For HSA contribution matches to work well, employers need to integrate them smoothly into their benefits package. This means tying them into your overall wellbeing and financial education efforts. Ongoing education is also important, ensuring employees feel supported as they navigate the world of HSAs.

Making a difference with cost-effective health benefits strategies

In a world where healthcare costs keep rising, you need strategies that work but don’t hurt your bottom line. The HSA contribution match is more than a financial perk – it’s a reflection of an employer’s dedication to their employees’ health and financial wellbeing.

By combining the power of an HSA-qualified plan with a contribution match, you have the potential to cut costs, boost employee participation, and create a benefit program that truly stands out. It’s a step toward a more cost-effective future for healthcare benefits, and one that can set your organization apart in a crowded field.

HealthEquity does not provide legal, tax or financial advice.

1HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-deductible with very few exceptions. Please consult a tax advisor regarding your state’s specific rules.

2HealthEquity data, current as of February 2024.