Enrollment season brings incredible opportunity to engage employees. You have occasions to help them stay informed—and empower them to learn about their benefits. But it’s hard to do on your own. You’ve got so much on your plate. You shouldn’t be expected to figure out how to be a benefits engagement specialist too.

That’s why HealthEquity continues to invest in research and resources to empower our clients to make a bigger impact—with less effort. But, before we dive into the research, let’s cover the good stuff right away.

If you need a library of engagement resources, we got you. Check out the Open Enrollment Toolkit and bookmark it for future reference. It has flyers, articles, webinars, and so much more. All organized by account type. This is your go-to resource during enrollment season—and all year round. (Scroll to the end for a list of our most popular enrollment season articles.)

Want to take engagement to the next level? Explore the BeneFIT education program and sign up. BeneFIT includes several emails, a couple webinars, and customization for all our engagement resources. This is a favorite among clients. It costs nothing. And it makes enrollment season so much easier—and so much smoother. Now, let’s get to it.

New research is making employee engagement easier and more effective than ever

In the past 18 months, we’ve invested significantly in market research to understand employee needs. For example, earlier this year we partnered with 8Acre Research to survey 1,000 employees in the US. We asked them questions about their benefits, concerns, and aspirations.

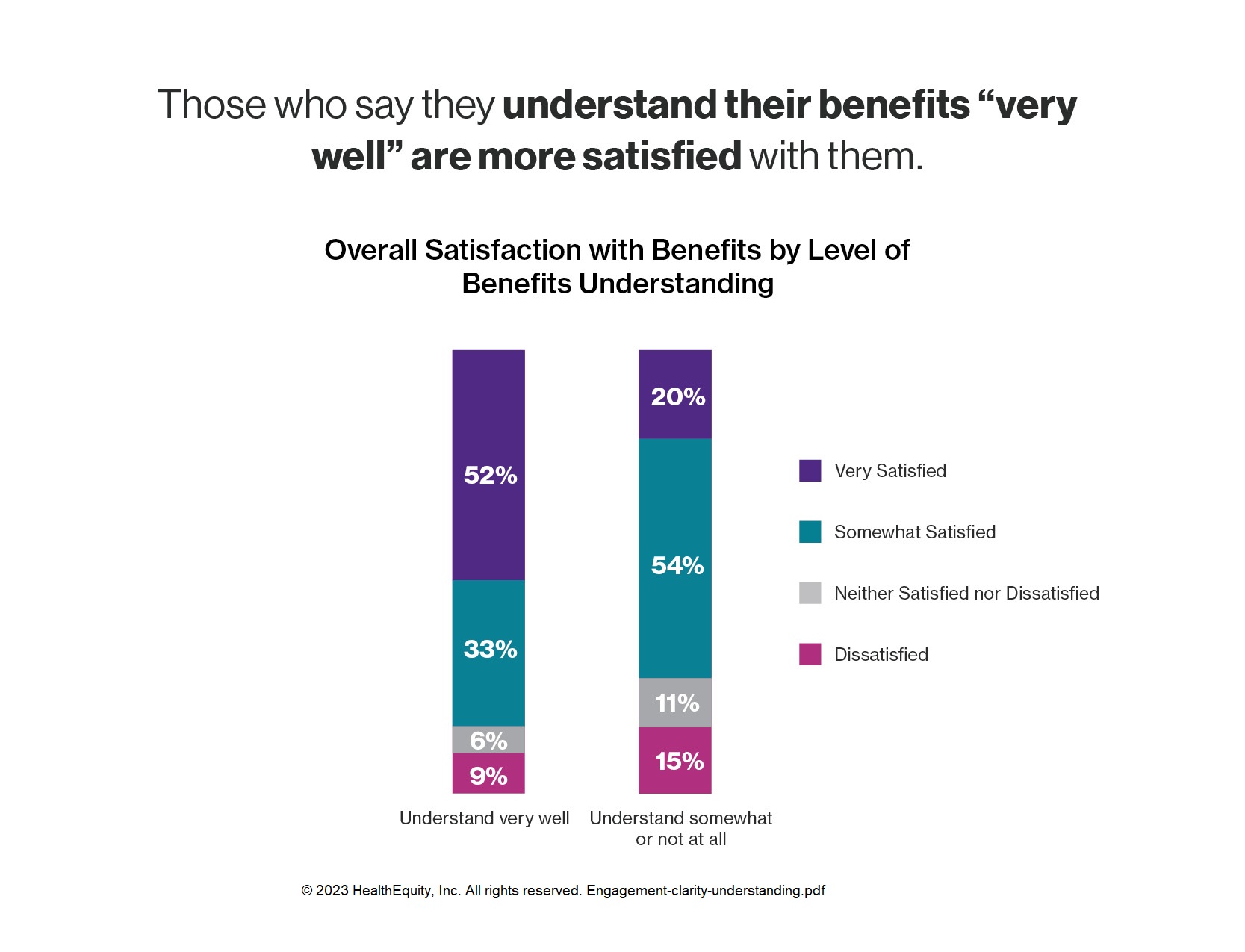

One key finding? Informed employees are happier employees. Those who say they understand their benefits “very well” are also more satisfied with their benefits package. In fact, time and again we found that employers who prioritize engagement end up with happier employees.

In this respect, your benefits communications can make a huge difference. Clear, straightforward communications help drive engagement with benefits materials. This helps promote greater benefits literacy and understanding. Which, in turn, translates into greater confidence during enrollment season.

Confident employees make sounder decisions. And that ultimately leads to higher benefits satisfaction. You can see the all the data in the eBook, Engagement. Clarity. Understanding.

What the research says—developing personas and employee profiles

We know that benefits communications matter. But how do we optimize communications to work for employees from different backgrounds and financial situations? It starts with research.

Partnering with Reve Research, we interviewed 20 consumers, and surveyed 1,000. Based on the data, we identified the key barriers and drivers that influence Health Savings Account (HSA) adoption. In other words, our research uncovered the main factors that influence decision-making during enrollment season. Here’s a high-level summary of what we found on the key barriers and drivers behind choosing HSAs.

Why are employees hesitant to choose HSA?

Let’s discuss key barriers that may make workers pause before choosing the HSA option.

-

Risk perception. Some are very concerned about the high deductibles associated with high-deductible health plans (HDHPs).

-

High healthcare spending. Others believe they may incur high healthcare costs during the year. And worry about the higher out-of-pocket costs related to HDHPs.

-

Status quo bias. Many respondents also say it’s much easier to stick with their current plan. If it isn’t broken, why change?

Why do employees choose HSA?

Now, let’s review the key drivers behind employees ultimately choosing HSA.

-

Lower insurance premiums. Employees love it when less money is taken out of their paycheck!

-

Employer contributions. They also love free money from their employer. Who doesn’t?

-

Triple-tax advantage.1 They also love tax-free contributions, tax-free growth, and tax-free spending for qualified medical expenses—only available with an HSA. (We love this, too).

Next, we crunched the numbers from the survey data to develop personas. Personas are composite fictional representations of segments within a given consumer group (in this case, our study sample). These personas are designed to capture the complexity of motivations and risk profiles likely to distribute across a given population. These are the personas we developed:

The Futurist (29% of avg. population)

• Risk-taker

• Higher income

• Loves personal finance

• Future-focused

• Skews younger, and probably single

The Conductor (24% of avg. population)

• Comfortable with risk

• Prefers the status quo, but open to change

• More emotional

• Wants to save money

• Probably married, and with multiple children

The Strategist (46% of avg. population)

• More risk adverse, cautious

• Careful planner

• Higher medical spend

• Highly values financial security

• Skews older, probably has children

Want to know your health savings personality? Try the HSA Quiz. We designed the quiz based on the research.

Using research to optimize communications

From these personas we revamped the BeneFIT education program. Our emails are now directly focused on the barriers and drivers likely to engage personas. And our enrollment season explainer articles carefully cover the pros and cons of each benefit.

For example, HSA emails now showcase the employer contribution more prominently. Among all personas, the employer HSA contribution is a top reason they select high-deductible health plans. And sometimes employees don’t even know it’s available!

We also emphasize, for example, the potential for HSAs to build a healthcare safety net. Healthcare Flexible Spending Accounts (FSAs) do not let members keep their money year after year. Even where employers offer FSA carryover, eventually unused funds are forfeited.

For these reasons, even risk-adverse employees value how HSAs can build long-term health and financial security. So, our communications are now more deliberate about explaining the power of tax-free account growth, which is only available with an HSA.

Pulling in even more healthcare open enrollment resources

At the same time, we also take more care to do the educational work comparing HSAs and FSAs. The truth is that HDHPs aren’t for everyone.

Ultimately, our goal is to empower employees to make more informed, confident decisions. To that end, we strive to always look at the data. And optimize our communications in light of that data. If you want to see the whole package of emails available with the BeneFIT education program, be sure to contact your account manager.

In the meantime, here’s a quick roundup of our most popular enrollment season articles.

-

HSA vs FSA: Which account is right for me? When it’s time to elect annual benefits, many have the option to choose between HSA and FSA. The two accounts are similar in that both help boost your spending power by allowing pre-tax payroll contributions to spend tax-free money on eligible healthcare expenses. But there are important differences to keep in mind. Discover the pros and cons of each account type.1

-

Should I choose a high-deductible health plan? Among the biggest myths in healthcare is that HDHPs are not great for families that spend a lot of money each year on doctor visits and medications. But there are several other factors to consider as well. Read about four factors to consider, including calculating true costs and long-term healthcare spending.

-

Why you should consider investing your HSA. The retirement savings gap is growing and healthcare in retirement can be expensive. According to recent estimates from Investopedia, the average couple will need $300,000+ to cover out-of-pocket medical expenses in retirement. Find out more about how HSA investing can help build long-term retirement and healthcare savings.2

-

Eight HSA myths, busted. From tax savings to retirement savings to health savings, here’s the truth about HSAs.

-

Comparing FSA options. Learn about the surprising differences between healthcare FSAs, Limited Purpose FSAs, and Dependent Care FSAs.

Confidently approach your benefits open enrollment season

Now you know you’re supported with significant open enrollment resources to help your employees better understand and select benefits packages that best suit their needs. Look out, 2024. You’re ready to play your essential role in helping American workers know how their health benefits work for them.

1HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-deductible with very few exceptions. Please consult a tax advisor regarding your state’s specific rules.

2Investments are subject to risk, including the possible loss of the principal invested, and are not FDIC or NCUA insured, or guaranteed by HealthEquity, Inc. Investing through the HealthEquity investment platform is subject to the terms and conditions of the Health Savings Account Custodial Agreement and any applicable investment supplement. Investing may not be suitable for everyone and before making any investments, review the fund’s prospectus.

HealthEquity does not provide legal, tax or financial advice.