Fresh news of updated Health Savings Account (HSA) contribution limits comes against a backdrop of rising consumer prices. Inflation is in the news lately, and indeed, as of March 2022 the Consumer Price Index is up 8.5 percent. Drilling down, Americans are seeing food prices at 8.8 percent higher and energy prices up 32 percent. It's in this context of overall inflation that we share the new contribution limits.

On April 29, 2022, the IRS announced updated amounts adjusted for inflation. The 2023 maximum contribution that may be made for calendar year 2023 by an individual with self-only coverage will be $3,850, representing a $200 increase from 2022. For an individual with family coverage, the maximum contribution will be $7,750, which is $450 higher than the current limit of $7,300. Unchanged is the $1,000 "catch-up" additional contribution that may be made by individuals who are age 55 or older before the end of the tax year.

Updated limits

| Tax year | Individual coverage limit | Family coverage limit |

| 2021 | $3,600 | $7,200 |

| 2022 | $3,650 | $7,300 |

| 2023 | $3,850 | $7,750 |

| At age 55, members can contribute an additional $1,000 beyond IRS limits. | ||

New opportunities

The new limits represent a relatively big increase and is important information to help your people make plans for the year. More than numbers to memorize, this update could present your team members with more opportunities to save-whether those savings will be used for current qualified expenses, saved for future qualified expenses, or for retirement.

Who maxes out?

Speaking of maximum contribution rates, how many members contribute the maximum amount to their HSA? Looking at internal data, roughly 12 percent of HealthEquity members fund their HSAs to the maximum allowed amount (95 percent of the contribution limit). Interestingly, the extent to which members max their HSA depends on account longevity-for accounts older than three years 18 percent are max contributors, whereas only nine percent of accounts younger than three years fund their accounts to the limit.

As an employer, you're uniquely positioned to help encourage HSA adoption and incentivize contributions. This article outlines how plan design can influence employee behavior and help them be better prepared to handle major medical expenses as well as prepare for retirement.

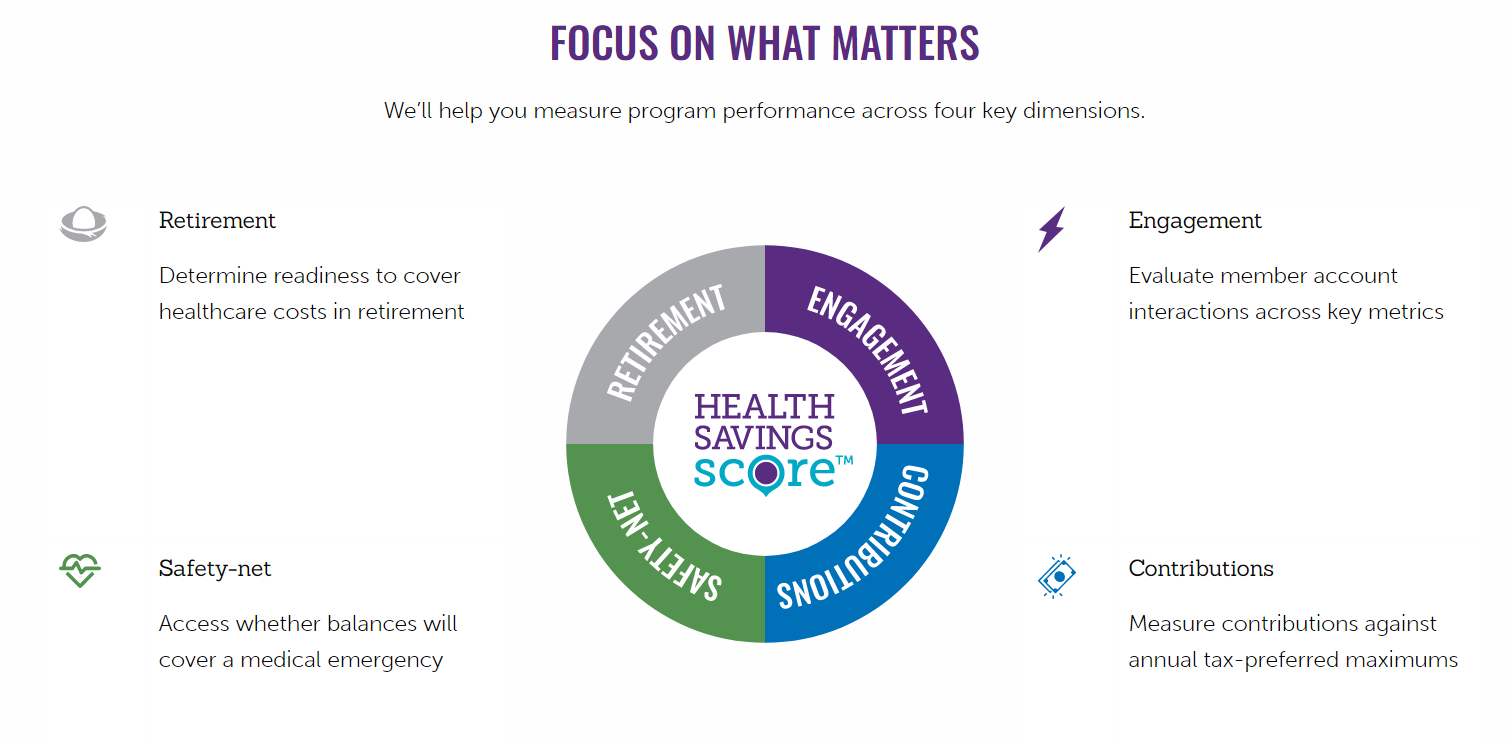

To get visibility into how much your employees are contributing and the extent to which they maximize their HSA contributions, use our Health Savings Score tool. This tool can help you better understand the rate at which your employees are contributing to their HSA, identify areas for improvement, and tailor your approach to suit your employees' needs. Remember, the need for health savings never changes, but employee behaviors do. So regularly monitoring your health benefit performance will help ensure employees are making the savings progress they need and that your benefit program is both competitive and valuable.

Room to grow

When communicating the updated contribution limits to your people, you can help them on their way with useful resources, including:

- HSA Guide with key points on HSA basics

- Extensive engagement materials in the Engage360 Hub

- Comparison tools in the Open Enrollment Center

HealthEquity does not provide legal, tax or financial advice. Always consult a professional when making life-changing decisions.