HSA. FSA. HRA. HIA.

If you're confused by the acronyms listed above, you're not alone. The healthcare industry throws these around and expects everyone to know what they mean. But many people don't.

For the record, here's what they stand for:

HSA = health savings account

FSA = flexible spending account

HRA = health reimbursement arrangement

HIA = health incentive account

Knowing what the acronyms mean is important, but it's even more important to know what the health accounts actually do so you can provide the best options for you and your employees.

Let's break each down one-by-one.

Health savings account (HSA)

A health savings account provides unique tax savings to pay or reimburse qualified medical expenses. Funds can also be saved for the future, including for retirement.

What you need to know:

- HSAs provide triple-tax savings1 (contribute, grow and spend on qualified medical expenses tax-free)

- Unused HSA funds roll over every year.

- HSA accountholders own their account. Their money stays with them, even if they change jobs or retire.

- HSA funds earn interest and can be invested2

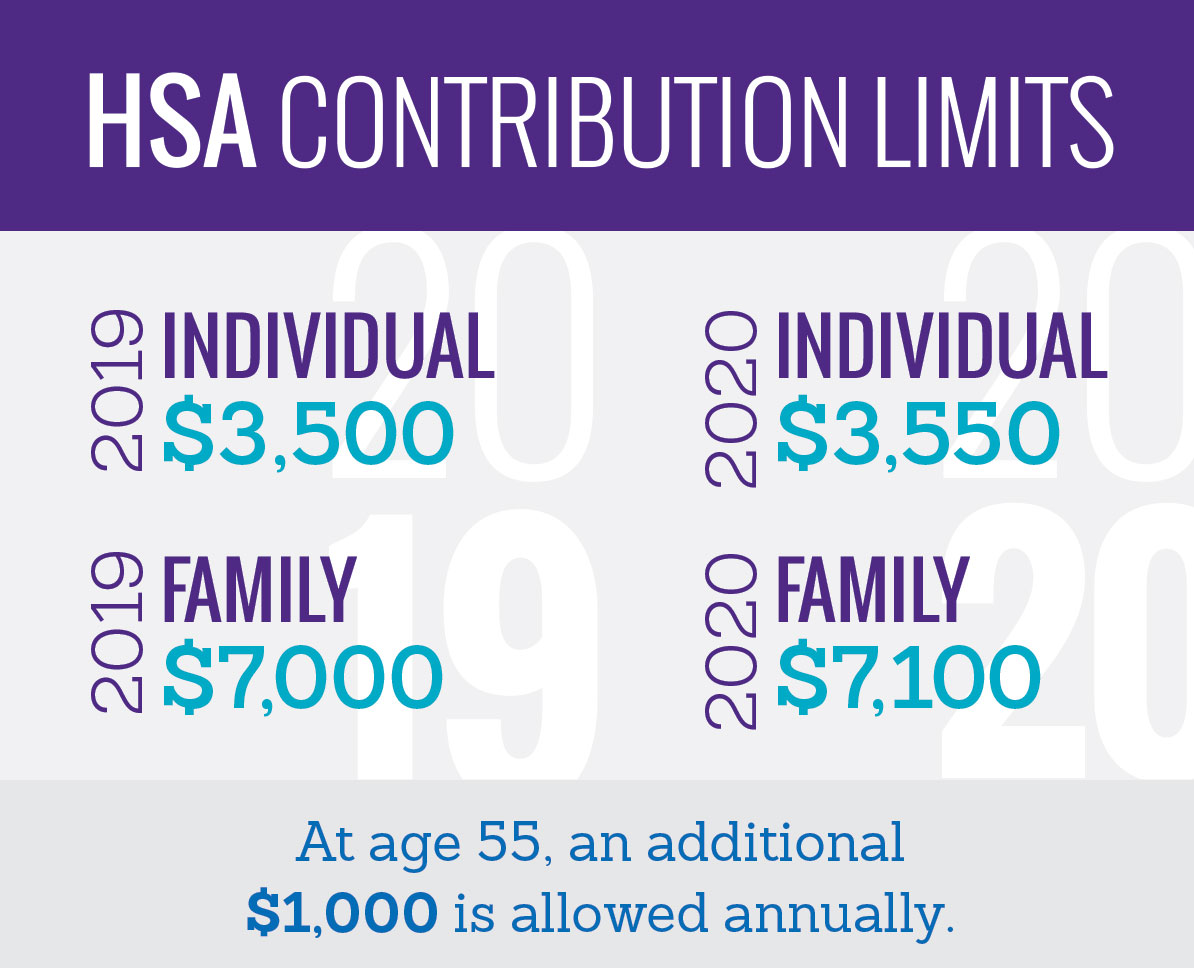

- Contribution limits:

Who is eligible for an HSA?

Accountholders must:

- Be covered by a high deductible health plan

- Have no other health coverage (Medicare, military benefits, medical FSAs, etc.)

- Not be claimed as a dependent on someone else's tax return

Flexible spending account (FSA)

A medical flexible spending account is an employer-sponsored health benefit that allows employees to contribute funds upfront to a health account and then deduct pre-tax dollars from their paychecks each month.

What you need to know:

- The entire FSA balance is available for use on the first day of the plan year.

- FSA funds must be spent each year or they are forfeited.

- Employers may choose to allow a grace period or a carryover up to $500.

- The account is owned the employer. If employee leaves their job, retires or does not spend their entire balance before the end of the plan year, funds are returned to employer.

- Contribution limit: $2,700 per year (spouses may each contribute the full amount to their own FSA)

Who is eligible for an FSA?

- Anyone whose employer offers an FSA.

- Employers may exclude certain employees (part-time, seasonal, temporary, etc.).

- Employees using medical FSAs cannot open or contribute to a health savings account.

Health reimbursement arrangement (HRA)

A health reimbursement arrangement is an employer-sponsored account that can be used by employees for specific medical expenses.

What you need to know:

- Contributions are made solely by employer.

- Funds are expensed by employer when reimbursed to employees.

- The account is owned by the employer. If employee leaves their job, retires or does not spend their entire balance before the end of the plan year, funds are returned to employer.

- Contribution limit: Set by employer. No minimum or maximum

Who is eligible for an HRA?

- Anyone whose employer offers an HRA.

- Employers may exclude certain employees (part-time, seasonal, temporary, etc.).

Health incentive account (HIA)

A health incentive account is an employer-sponsored account created to financially reward employees for completing incentive activities. Funds can be used to reimburse for qualified medical expenses.

What you need to know:

- Only employers contribute to a health incentive account.

- Contributions are not deducted from employee's paycheck.

- Incentive contributions usually deposited directly into employer-funded HRA.

- The account is owned by the employer. If employee leaves their job, incentive funds deposited in their HRA are usually returned to the employer.

- Contribution limit: Set by employer. No minimum or maximum

Who is eligible for an HIA?

- Anyone whose employer offers an HIA.

- Employers may exclude certain employees (part-time, seasonal, temporary, etc.).

Conclusion

Now you know the difference between HSA, FSA, HRA and HIA. All of these health accounts provide benefits to employees and can be a great way to help them save money and pay for their healthcare.

To learn more about HSAs, go to healthequity.com/learn

-

HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-free with very few exceptions. You should consult a tax advisor regarding your specific situation.

-

Investments are subject to risk, including the possible loss of the principal invested, and are not FDIC or NCUA insured, or guaranteed by HealthEquity, Inc. Investing through the HealthEquity investment platform is subject to the terms and conditions of the Health Savings Account Custodial Agreement and any applicable investment supplement. Investing may not be suitable for everyone and before making any investments, review the fund's prospectus.

It is the members' responsibility to ensure eligibility requirements as well as if they are eligible for the expenses submitted.

HealthEquity does not provide legal, tax or financial advice. Always consult a professional when making life changing decisions.