Looking for ways to grow and thrive? Me too. Personal growth is important to me. Not just for my own development, but in my role as a Chief People Officer. I’m also trying to help lots of people fuel their personal, professional and company growth.

Times have changed. Since the pandemic, people are more interested in building skills that increase their earning power and the flexibility to work when and where they choose.

That’s why I talk about training and development a lot. In fact, earlier this year I spoke with HRO Today on internal HR policies and benefits packages. Have a listen.

How your benefits can help inflation-proof paychecks

If you’re also in the HR and benefits administration space, the number of opportunities to pursue can be overwhelming. So, let’s cut through clutter and focus on one topic—ways your benefits packages can lighten the financial load for employees.

First, let’s set the stage. You’re not managing your organization’s employee benefits in a vacuum. Over the past year, inflation raised costs of essential goods and services—from gas and eggs to healthcare services. While inflation may be cooling now in some areas, our research shows employees across the country are struggling to manage their household budgets. That prompted many employees to ask for raises.

And that can make sense, right? Someone might think, huh, my paycheck doesn’t get me as far as it used to, so the obvious solution is I need a higher salary. But employees aren’t the only ones feeling the sting of inflation.

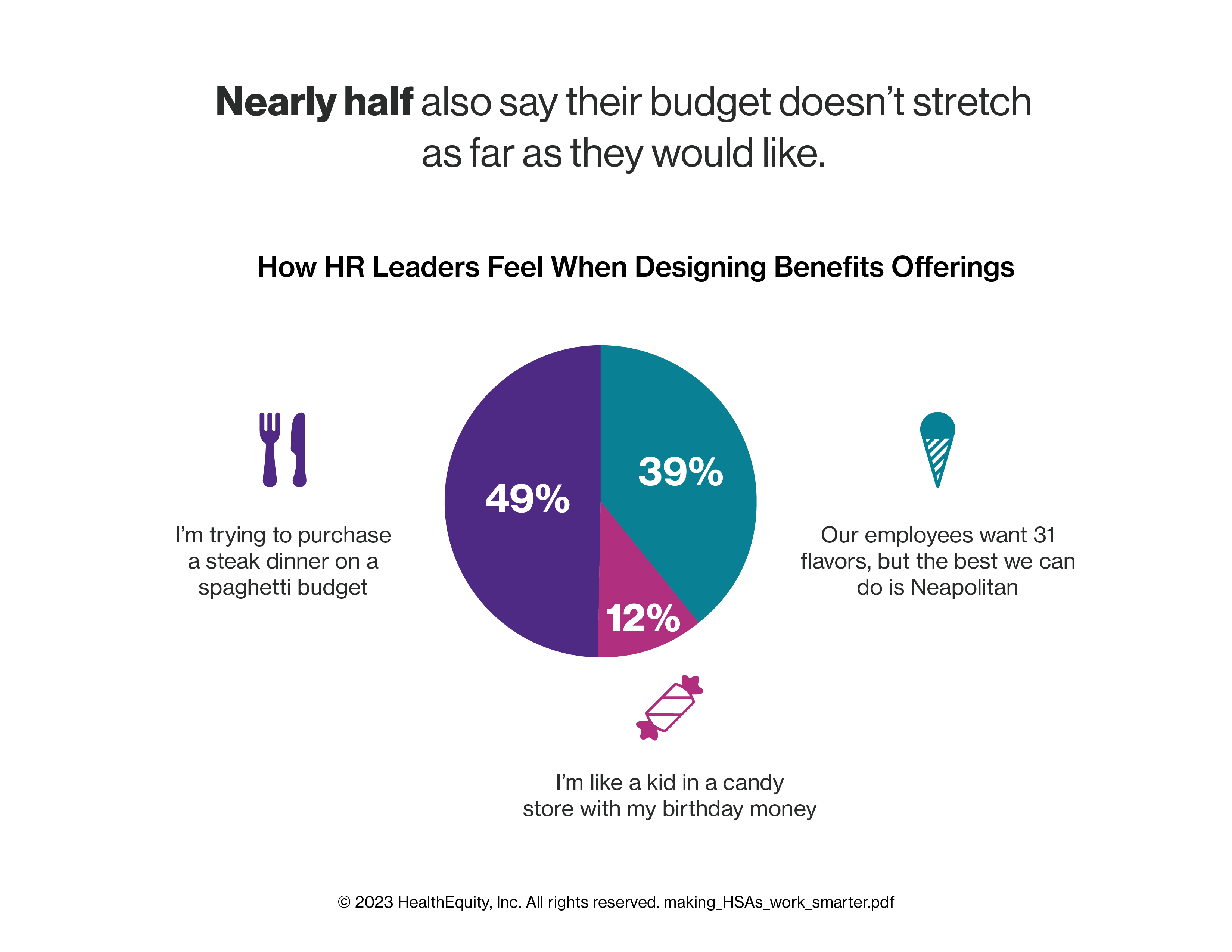

We found that businesses face rising costs too. In fact, 60% of benefits leaders are worried about cost. And nearly half say their budget doesn’t stretch as far as they would like.

Tune into your people through engagement surveys and more

Use engagement surveys and other tools to understand the challenges your people are feeling. Find out more about the benefits that already mean the most to them. Ask specific questions to understand their financial needs as they relate to family, educational expenses, and other areas they care about. Yes, engagement surveys cost money, but from where I’m sitting the expense is always worth the effort—a better understanding of your audience is priceless.

When you know more about your demographic you can tailor your programs to fit your people and demographics. For example, if your organization trends younger, student loan repayment programs may be high on the wish lists. On the flip side, if your population is more mature, investing in benefits to support retirement savings may be appealing.

Mine your existing benefits package to delight employees

Today’s inflation-stressed landscape means it’s time to get creative. You and I know there are many other ways beyond a salary increase to help employees stretch household budgets.

Yes, you need to crack into your internal HR policies. But good news: you’re likely already in possession of five key ways you can help your people stretch budgets, protect savings, and add flexibility to their spending.

At a minimum, look at these five common, but potentially overlooked items to include in your benefits packages.

-

Student loan repayment support: A program to help employees reduce their outstanding student loan debt can be magical. Whether you help employees negotiate lower monthly payments or contribute money toward loan repayment, they can pay down their principal balance, pay the whole loan off faster, and avoid extra interest. Now, their income can go to housing, groceries, transportation, and other essentials. But that’s not all. Knowing they don’t have a huge financial burden weighing them down, your employees may be less stressed and feel happier overall.

-

Financial planning: When you offer money management training and development, you’re building skills. And at the end of the day, you’re really giving them lifetime-long knowledge and tools to apply in any number of situations. This category can include everything from budgeting and expense management to salary negotiation and retirement planning. These skills will pay dividends and help employees reduce their risk of financial setbacks caused by inflation-related emergencies.

-

Consumer-directed benefits (CDBs): This is my bread and butter, as it were. When you offer savings vehicles for medical expenses, you help employees tackle a major area of concern—healthcare expenses. This is a huge topic, but I’ll keep it short by saying that Health Savings Accounts (HSAs), healthcare Flexible Spending Accounts (FSAs), and other accounts can help employees pay for emergency healthcare expenses, reduce their out-of-pocket costs, create long-term savings and more. Read here to learn even more.

-

Benefits literacy: Investing in year-round benefits education can boost your employees’ understanding of their finances and money management. Again, it’s another massive topic, but one that I’m happy to go into. Recent research we conducted with 8Acre revealed employees who say they understand their benefits very well are significantly more likely to be satisfied with them. More than that, though, employees who understand their benefits very well also have more confidence in their ability to select the best options for themselves during open enrollment. Offering multiple ways to help employees make informed choices about their workplace benefits and take full advantage of the programs is crucial. When they know enough to select benefits that match their needs and circumstances, they can potentially save money in the long run.

-

Lifestyle Spending Accounts (LSAs): As an employer, you can create customized reimbursement accounts to target specific interests. For example, if you know your employees are highly interested in fitness, you can create a fund just to reimburse wellness activities, like gym memberships. LSAs are post-tax accounts funded by you, the employer, to focus on employee wellbeing—financial, social, emotional, physical. You can decide participation rules, what qualifies as an eligible expense, the allowance amount, and what documentation will be required for reimbursement. More than anything, LSAs are a flexible account type to help retain employees.

You have the power to make a difference

I hope the five ideas above got you fired up. And that’s just the start. When you select a benefit to roll out, there are ways to truly make the juice worth the squeeze.

Your current benefits offering may solve the challenges they are facing. If so, remember to lean on your benefits partners to help you adjust your plan design to provide more support in areas your team members need it most. If you have some gaps, tell partners about your specific items of concern and they may be able to offer up new things to try. Who knows, they may even be ready to roll out a new feature that would wow your workers. You have to ask to find out.

And don’t forget to engage smarter. This last step is essential. When you announce your new benefit, remind everyone in your organization about how you heard their concerns. They spoke and you listened, but if you don’t remind them you may not get the credit you’re due. Meet them where they’re at and tell them how you found specific ways to support them—even if it’s not the raise they hoped for. Use tactics like these:

-

Show them the math and how the benefit creates real financial support

-

Highlight the big ideas and how they can use the benefits

-

Use a multi-channeled approach—company newsletter, postcards, lunch-and-learns—to blast out your messages

-

Engage year-round with plenty of opportunities in townhalls or team meetings to listen to concerns and demonstrate actions

You’re now equipped with several tangible ways to help people fight back against reduced purchasing power. By using some of the benefits mentioned above, you’ll be helping the stretch a paycheck and save for the future. Your thriving organization awaits.

Need some extra help with implementing these programs in your organization?

HealthEquity can help with the expertise and proven best practices to help you empower your employees. You’ll get side-by-side help from knowledgeable people so you can provide meaningful support for employees at any income level or from any background.

HealthEquity does not provide legal, tax or financial advice.