Employers and employees alike search for the best way to manage the high cost of healthcare. Both groups often consider a Health Savings Account (HSA) qualified high deductible health plan (HDHP) to be a win-win. As an employer, you likely appreciate the ability to lower both tax obligations and premiums while providing a framework to help your people thrive. HSA-qualified plans are also attractive to individuals due to lower premiums, plus the ability to maximize tax savings1 and accelerate long-term savings.

With all the benefits, it's no wonder more organizations choose the HDHP + HSA path. Once you've selected this path, where does your organization start to make the transition? And how do you help your employees along the journey?

1. Start smart in the HSA transition

Education is the key to getting started and ensuring a smooth transition. First, it's important to know the terms. A high-deductible health plan (HDHP) has lower premiums each month, but an overall higher employee-paid deductible than a traditional insurance plan. With some exceptions for preventative care and Covid-19 testing, an HDHP generally involves consumers paying for all medical expenses before the deductible is met. When an HDHP is paired with a health savings account (HSA) it's possible to offset costs with the resulting lower monthly premiums. As an added benefit, employees are then able to pay for qualified medical expenses tax-free.

After you know the basics, it's helpful to get familiar with member education materials, such as:

- Information on how to make a bigger impact with less effort-The engagement imperative: Thinking beyond employee education to maximize HSA program success

- Detailed steps on how to become a savvy healthcare consumer with the HSA Guide

- Explanations on tax savings connected to HSAs

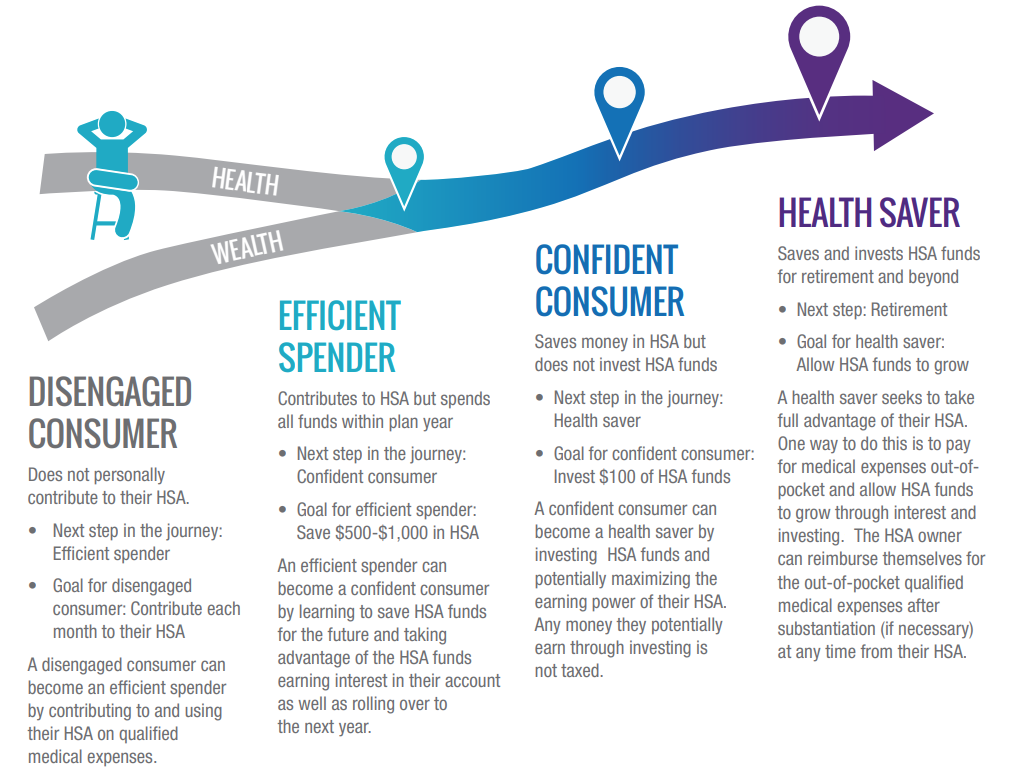

When it comes to helping employees access healthcare, it's a good idea to think about four types of healthcare consumers you may encounter-disengaged, efficient spenders, confident consumers, and health savers.

2. Show consumers how to evolve their HSA spending

At one end of the spectrum are disengaged consumers-individuals who are unlikely to contribute personally to their HSA. You can help them get to the next stage just by showing them how to contribute to an HSA and use those funds on qualified medical expenses. For this group, driving adoption will be key. Be sure to reach out to new hires in an onboarding process designed to get direct feedback on specific needs and interests-from younger employees focused on employer contributions to older employees needing retirement planning resources. Likewise, tap into employees experiencing qualifying life events and, of course, events within your annual open enrollment process.

Speaking of open enrollment, implementing an active open enrollment will help mitigate any issues of disengagement. Active enrollment can help inspire your people to enroll in the HSA and give you ample time to cover potentially murky terms-from copays to deductibles-and demystify concepts with webinars and microsites with searchable content.

3. Level up with HSA goal-setting

Another subset of consumers are efficient spenders, consumers who contribute to their HSA and spend all their funds within the plan year. Perhaps they associate an HSA with a Flexible Spending Account (FSA) and believe they risk losing any remaining funds. If this is the case, sharing a resource on busting HSA myths may prove effective. You can facilitate learning opportunities to help them understand the full capabilities of an HSA and promote positive habits. For example, this group may respond well to a suggestion of setting a goal to save $500 to $1,000 within their HSA. And if you can highlight their ability to earn interest in their account, the initial saving experience could inspire them to set additional stretch goals.

4. Next step, growth

Farther along the path are confident consumers. Individuals in this group consistently save money in their HSAs and may be looking for ways to increase their financial acumen. Their next step would be investing.2 Along the vein of promoting positive habits, this group would likely be receptive to taking the first step toward potentially maximizing their earning power by investing $100 of their HSA funds. A key message for this population is that any money they may earn through investing is not taxed.

One more group of consumers you may encounter are the health savers-well-practiced at both saving and investing HSA funds for retirement and beyond. For these individuals, you can leverage more advanced materials. For instance, health savers may be interested in how to use delayed reimbursement-consumers pay for qualified medical expenses out-of-pocket while allowing HSA funds to potentially grow and reimbursing themselves later through the HSA.

Never stop learning about health savings

No matter the mix of healthcare consumers in your organization, HealthEquity resources cover the full range of your needs. Dive into Engage360 to explore engagement packages and best practices. As you transition to an HDHP + HSA, you'll have plenty of educational tools, training, and support to help maximize your success.

1HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-deductible with very few exceptions. Please consult a tax advisor regarding your state's specific rules.

2Investments are subject to risk, including the possible loss of the principal invested, and are not FDIC or NCUA insured, or guaranteed by HealthEquity, Inc. Investing through the HealthEquity investment platform is subject to the terms and conditions of the Health Savings Account Custodial Agreement and any applicable investment supplement. Investing may not be suitable for everyone and before making any investments, review the fund's prospectus.

HealthEquity does not provide legal, tax, financial or medical advice. Always consult a professional when making life-changing decisions.