Big, bustling cities with people and goods moving from place to place can mean gridlock, plus air pollution and excess carbon emissions. But it doesn’t have to be that way. These days, city planners, transportation experts, and public health professionals are working together to solve tangled traffic problems. One creative solution involves mandated commuter benefits.

Similar to the recent legislation in Philadelphia, Illinois is one of the latest areas to require firms over a certain size to provide commuter benefits to help workers access ways to more sustainably travel for work. The Illinois Transportation Benefits Program Act will require certain employers to allow employees to use pre-tax dollars for the purchase of a transit pass. Ultimately, programs like those required by the new Illinois mandate help people conveniently save money on their commutes.

What are the new Illinois pre-tax commuter benefits requirements?

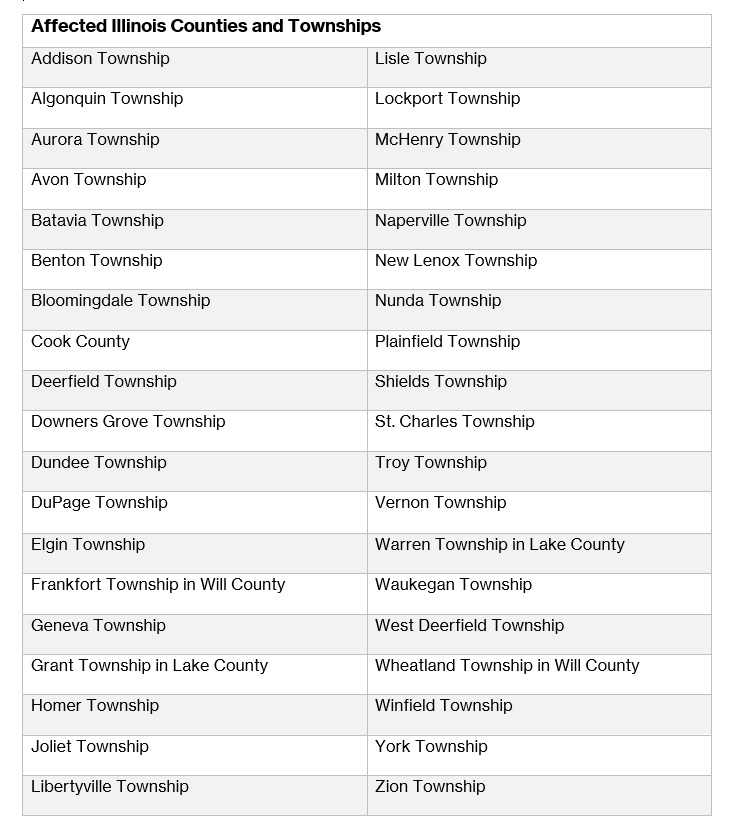

Specifically, the Act requires employers with 50 or more employees located in identified areas (see the full list below) to provide a pre-tax public transit commuter benefit program to their employees that perform at least 35 hours of work per week on a full-time basis. Covered employers are those with an office located within one of 38 named counties/townships in Illinois and that office is within 1 mile of a fixed-route transit service run by the Regional Transit Authority.

What is the timing of the Illinois Transportation Benefit Act?

Starting January 1, 2024, this commuter benefit must be offered beginning on the first full pay period falling 120 days after the start of employment.

What employers are affected by the Illinois Transportation Benefit Act?

This applies to employers with 50 or more full-time “covered employees” at an office located within one mile of a fixed-route transit service location (e.g., Chicago Transit Authority (CTA) Train/Metra Rail stations, CTA/Pace bus stops) in specific geographic areas of Illinois named in the Illinois Transportation Benefit Act (38 counties/townships).

What does the Illinois Transportation Benefit Act mean by a covered employee?

A “covered employee” is defined as any person that works an average of at least 35 hours per week on a full-time basis. This benefit must be offered to all employees starting on the employee’s first full pay period after 120 days of employment.

What is considered a qualified transit program?

Affected employers are required to provide a program which allows employees to use pre-tax dollars up to the amount determined by the Internal Revenue Service under 26 USC 132(f)(1)(B) for the purchase of a transit pass. This includes:

-

Election of a pre-tax, payroll deduction for Mass Transit Expense consistent with the Internal Revenue Code at benefit levels up to the maximum amount that may be deducted for such programs pursuant to the Internal Revenue Code, as amended from time to time.

-

An employer-paid benefit whereby the covered employer supplies a fare instrument for a covered employee’s Mass Transit Expense, at benefit levels up to the maximum amount that may be deducted for such program.

-

A combination of the two program types listed above.

Does the mandate highlight a specific commuting option?

Yes. The pre-tax commuter benefit is all about transit passes for public or mass transit. For this region, that typically means a pass for buses and trains. According to the Act, “public transit” means any transportation system within the authority and jurisdiction of the Regional Transportation Authority. “Transit pass” means any pass, token, fare card, voucher, or similar item entitling a person to transportation on public transit.

How do HealthEquity transit benefits comply with the Illinois commuter requirements?

HealthEquity can support an Illinois-compliant transit benefits program through one of two Commuter packages—both of which can be set up quickly. The two programs are TransitChek, a simple monthly transit order solution, and HealthEquity Commuter, a simplified administration of commuter benefits with a rewarding member experience. With either program, your company will get support to meet your requirements with the law, plus your employees will have options to travel to work in ways that match their needs. To explore the options or to simply learn more, contact HealthEquity.

HealthEquity does not provide legal, tax or financial advice.