Smile, it’s National Tooth Fairy Day! Whether you have little ones who expect payment under their pillows or not, you’re likely invested in some way in your dental health or your family’s—from orthodontia and sealants to cavities and root canals (ouch!).

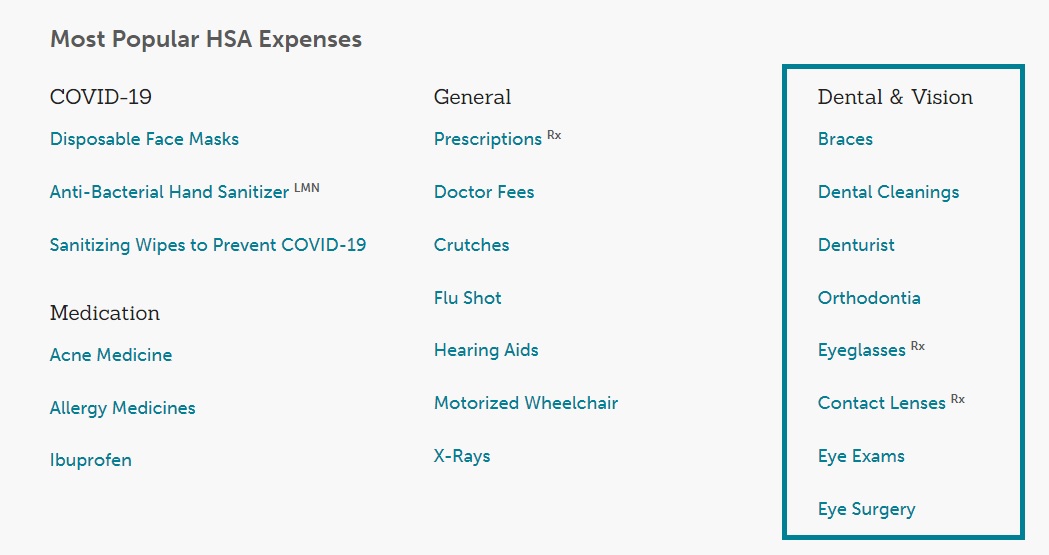

As we celebrate all things whimsical and toothy, it’s a great opportunity to talk about practical dental care, dental insurance, and your Health Savings Account (HSA) or Flexible Spending Account (FSA). If you’ve ever wondered, “What dental expenses are HSA-eligible” or “does my FSA pay for dental crowns” this information is for you. Read on to understand your HSA and FSA coverage for dental services and how yours can help with out-of-pocket dental expenses.

HSA and FSA coverage for dental services

Because HSAs and FSAs are both tax-exempt accounts used to offset the cost of healthcare, every penny you put into these accounts can pay for eligible dental expenses, tax-free.1 And since some dental-related expenses are not covered by insurance, you can save money by using your HSA or FSA to cover those costs.

Looking at our data, from spend made via card transactions, around 25 percent of dollars spent from HealthEquity HSAs and Health Reimbursement Arrangements (HRAs) are for dental and vision expenses.

What are the HSA and FSA rules for dental services and dental procedures?

You may already know that your HSA or FSA can be used for things like dental visits and crowns—but did you also know they can be used toward braces and other orthodontic work? It’s true. FSAs and HSAs can help you get reimbursed for a wide variety of dental treatments for you and your family.

If you’ve ever had a root canal or a child in braces, you know that dental expenses can quickly add up to the thousands. Luckily, your FSA or HSA can help remedy that. Here’s what the accounts typically cover:

- X-rays

- Sealants

- Dental implants (not cosmetics like veneers)

- Dental crowns

- Dentures

- Extractions

- Cavity fillings

- Gum cleaning

- Dental reconstruction

- Periodontal surgery

- Orthodontia (such as braces or Invisalign)

- Root canals

- Dental cleaning

- Wisdom-teeth removal

In some cases, you can even use an FSA or HSA for travel expenses as long as it is for an eligible dental procedure at a dentist office.

What dental items or services are not HSA or FSA eligible?

While it seems like they would fit under the dental care umbrella, general self-care items like toothpaste, toothbrushes, and floss are not FSA or HSA eligible. Same goes for specialized or medicated toothpastes. Here’s a short (and not exhaustive list) of items that are not eligible for reimbursement:

- Braces wax

- Denture adhesives or creams

- Mouthwash

- Picks

- Teeth-whitening

If you have any questions about certain items and dental treatments, look up eligible dental expenses here. Or reach out to your dentist office; they should be able to tell you whether a service is eligible or not as well as help you plan how to pay for your dental care.

How to use my FSA and HSA on eligible dental expenses?

Paying for eligible services or items is easier than you think. In most places, you can use your HSA or FSA card like you would a credit card.2 If you don’t have a card available, you can submit a reimbursement form to your health insurance provider along with the receipt.

What if I have an LPFSA?

Just like HSAs and FSAs, a Limited Purpose Flexible Spending Account (LPFSA) is a tax-advantaged account that you can use on eligible dental and vision expenses. But unlike HSAs which carryover, you typically only have one year to spend your LPFSA money before it goes away.

HSA and LPFSA for a winning combo

Often, you can participate in both an HSA and LPFSA in order to maximize your tax savings. A good practice in this case is to use your LPFSA to pay for current eligible dental expenses and save your HSA funds for later.

Save more, smile more

As you take care of you and your family’s dental health, feel free to lean on our HSA or FSA tools to help you plan for and cover any eligible expenses. If you know you or a family member will be needing a dental treatment or dental procedure soon, such as braces or oral surgery, be sure to contribute to your spending accounts ahead of time to get the most tax-free savings possible.

1HSAs and FSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-deductible with very few exceptions. Please consult a tax advisor regarding your state’s specific rules.

2This card is issued by The Bancorp Bank; Member FDIC, pursuant to a license from Visa U.S.A. Inc. Your card can be used everywhere Visa debit cards are accepted for qualified expenses. This card cannot be used at ATMs and you cannot get cash back, and cannot be used at gas stations, restaurants, or other establishments not health related. See Cardholder Agreement for complete usage restrictions.

HealthEquity does not provide legal, tax or financial advice. Always consult a professional when making life-changing decisions.