This fall we conducted a survey of 1,155 full-time employees across the United States to understand how they were managing healthcare expenses during COVID-19. We found that many are unaware of how much healthcare services cost, and many more are simply unprepared for unexpected expenses. But there's a lot that benefits teams can do to make a difference. This is part two of a four-part series designed to give employers strategies and resources to help their people save more and spend smarter.

Being a savvy healthcare consumer isn't just about managing today's expenses. Saving for the future is equally important. The latest estimates suggest the average American couple will need over $300,00 to cover healthcare expenses in retirement. That's why helping members build long-term health savings is critical.

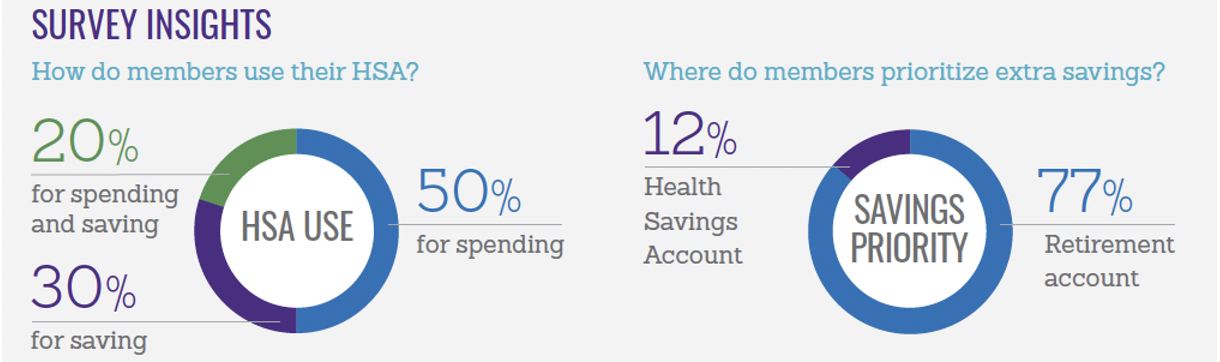

Unfortunately, many people don't use their HSA primarily as a savings account. Half of the respondents said they primarily use their HSA to pay for healthcare expenses in the current year. Only 30 percent use their HSA to save for future healthcare expenses, and 20 percent say they use it for an equal mix of both spending and saving.

With 77 percent saying a retirement plan would be their first choice to save extra funds, it's clear members view the HSA primarily as a spending account. Only 12 percent of respondents said they would put the extra funds toward their HSA.

Because respondents do not view their HSA as a retirement savings account, they prioritize other options like the 401(k) or IRA. That points to a real opportunity to help members understand the power of the HSA and how to better use it for retirement.

That's where education comes in. For example, many HSA members don't know that HSA investing2 is even an option. They aren't aware of the triple-tax advantage3, which includes pre-tax contributions, tax-free earnings and tax-free distribution for qualified medical expenses. And they don't understand that HSAs deliver greater spending power (versus the 401k) in retirement healthcare spending.

But teaching about the HSA is only one part of the equation.

Conclusion

You've also got to promote the habits that propel members on the journey to long-term retirement savings. It's one thing to know that HSAs make powerful retirement savings accounts. But it's another thing to use it. Having a partner who can maximize participation and account utilization through data-driven, targeted engagement campaigns can make a difference. At HealthEquity, for example, we use Engage360, which is our proven approach to member engagement. By focusing on trigger-based communications, we respond directly to member account behavior. The key is to engage members with the right message at the right time to shape savings habits that set members on the path to retirement readiness.

For more strategies to help your employees become wiser healthcare consumers, follow the rest of our series.

After age 65, if you withdraw funds for any purpose other than qualified medical expenses, you will be subject to income taxes. Funds withdrawn for qualified medical expenses will remain tax-free.

Investments are subject to risk, including the possible loss of the principal invested, and are not FDIC or NCUA insured, or guaranteed by HealthEquity, Inc. Investing through the HealthEquity investment platform is subject to the terms and conditions of the Health Savings Account Custodial Agreement and any applicable investment supplement. Investing may not be suitable for everyone and before making any investments, review the fund's prospectus.

HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-deductible with very few exceptions. Please consult a tax advisor regarding your state's specific rules.

HealthEquity does not provide legal, tax or financial advice. Always consult a professional when making life-changing decisions.