A successful open enrollment season is all about timing. That means reaching your employees at the right time, in the right channel, and with the right message.

But it’s also about your time as a benefits leader. You need a health benefits action plan and a turnkey open enrollment process to help your people know about, understand, and take advantage of your benefits package.

What matters to employees in the open enrollment period?

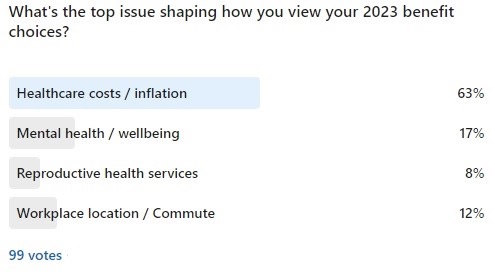

We ran a poll in July on LinkedIn to understand what’s top of mind for people about to make 2023 health benefits elections.

Of nearly 100 responses, 63 percent said healthcare costs and inflation are the top reasons they’re thinking about benefits enrollment differently this year. Messages about cost savings are likely to resonate across age and geographic location this year, perhaps more than ever.

We can’t forget to talk about rising healthcare costs and inflation. It’s no secret that costs of employer-sponsored health insurance are rising. Given that, it’s natural that many employers are looking for ways to offset those costs.

In the past, employers may have used cost shifting—passing on extra costs to employees. Obviously, with the high rate of inflation—reaching 8.5 percent in July—that’s not a viable option this year, especially concerning lower wage earners.

In fact, in a recent webinar on open enrollment, the audience named inflation as a top concern for both their employees and for health benefits costs to the organization. Many indicated they view lower healthcare premium costs and tax savings as ways to help workers keep more money in their paychecks.

What do you want to achieve in the 2023 benefits enrollment season?

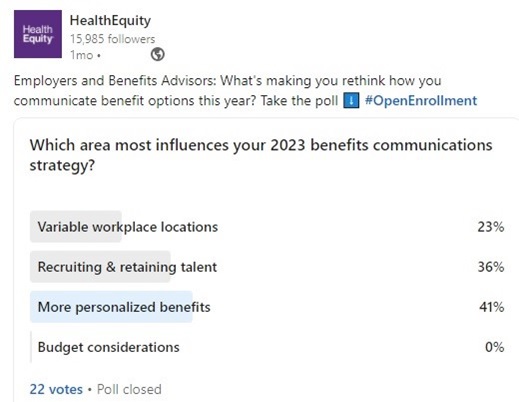

We ran another poll in July asking about what’s influencing plans for 2023 benefits communications. At the top of the list was more personalized benefits (41 percent), closely followed by ways to recruit and retain talent (36 percent) and variable workplace locations (23 percent).

The responses in this poll ring true. Many employers are still working to find the right balance for workplace location—from home to hybrid to in office. And you also need to address equity factors by taking care to ensure that the health benefits you offer are equitable. Add to that the intense competition for talent, and the fact that employees cite inflation as a big factor in their benefits decisions, it’s not surprising that the 2023 benefits enrollment season presents fresh demands.

Is there a benefits communications gap?

Let’s just say our health benefits industry overall has more work to do regarding benefits communications. Consider that 35 percent of employees still don’t fully understand their benefits. And most spend an average of 17 minutes thinking about their benefits during open enrollment season.

We often talk to employers and benefits advisors on what is standing in the way of achieving the desired engagement and utilization. Overwhelmingly, it’s financial literacy.

Put it all together to plan for open enrollment

When we look at all the drivers, it’s clear that, especially with concerns on affordability, benefits engagement and financial literacy programs are paramount. It’s essential to make sure your workforce is empowered to make decisions. Not just those employees with a high degree of financial literacy or are hyper-engaged with employee benefits elections, but all employees.

It’s a tall order and it’s not easy to do on your own, especially if your internal communications resources are stretched thin. That’s why we’re all in to give you what you need for your 2023 open enrollment season.

The good news is the work you do can truly make a difference. And there are ways to encourage employees and ensure your people are aware—and take advantage of—your benefits package. Now it’s time to create your action plan based on open enrollment best practices.

Plan for a successful 2023 open enrollment season

How do you craft this perfect plan? Focus on what matters most in your open enrollment period: awareness, financial literacy, and cost savings. To make progress in these areas, use this proven formula for your 2023 open enrollment process.

1. Use targeted training and resources to engage your workforce.

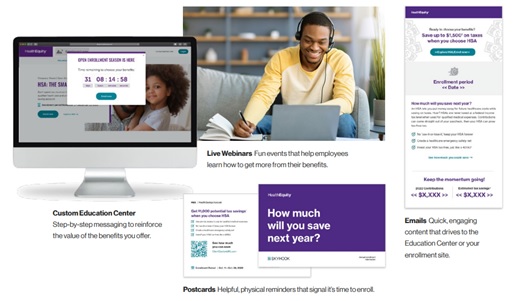

Sending specific, custom communications and open enrollment tips will help you increase engagement and overall benefits awareness.

You can browse our free library of open enrollment materials. You’ll find quick emails you can customize that can drive to your enrollment site. And you can invite employees to webinars—customized with your url, enrollment period, high deductible health plan (HDHP) options, employer contributions—so they can learn how to get more out of your benefits package.

No matter what, make sure your communications reach everyone in your organization, not just engaged employees. Focusing on your entire workforce ensures equity in education and opportunity. Doing so will help ensure every employee can learn about your benefits package.

Be sure to follow these helpful open enrollment best practices. As you craft your benefits communications strategy, consider how you:

- Define your audience. Who do you need to connect with? Start with your entire workforce. And consider creating other categories of employees who might need specialized messaging—like new employees or those nearing retirement age. When you’re looking at your audience, include useful employee data points like demographics, location, age, or even archetypes (busy, apathetic, and so on).

- Know your people. No matter what, it’s important to get to know who you’re talking to. Run internal surveys and interviews with key groups. Ask about their top concerns and gauge their level of understanding about the various terms for benefits enrollment. This will help you understand your audience better and foster trust in your benefits offerings.

- Understand employees’ daily routines. What do their days look like? How much time do they have to read an email or complete enrollment forms? If you see low open and click-through rates on your benefits emails, perhaps consider video channels or webinars they can listen to while they work or accomplish other tasks.

2. Promote financial literacy to help all employees understand their options.

Improving individuals’ financial literacy is an important part of helping all employees understand their health benefits options. And it gets you closer to achieving benefits equity. When it comes down to it, you want to avoid people selecting a benefit choice if they don’t understand it.

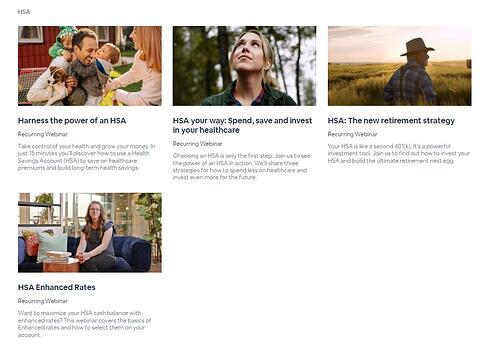

To start, we have several resources to help your people make progress on financial literacy, including the health plan comparison tool and HealthEquity webinars and videos.

To go deeper on financial literacy, HealthEquity clients and partners get access to the Education Center at no cost. It’s simple and effective with videos on benefits selection and ways to reinforce the value of benefits you offer.

3. Concentrate on cost savings.

When you maximize benefits adoption and utilization you can unlock both health plan and FICA tax savings. Talking to your people about cost savings is easy with the materials introduced above in item 1. You’ll have what you need to talk through the benefits and break down any misconceptions about spending accounts. The digital and print documents highlight savings in a simple and effective way. Your people can see common eligible medical expenses, understand when a carryover is available, and explore guides on each product, like flexible spending accounts and health savings accounts.

Overall, the materials are:

- Accessible. You can meet people where they are through email, mobile, and print, like postcards sent to homes.

- Short and simple. Easy-to-understand is the goal, especially with clear actions to take.

- Relevant. Your audience can understand how the savings applies to their situation.

In addition to the available materials for educating employees, our site is packed with ways to see practical ways to save. For example, people can discover medical expenses covered by account in the searchable qualified medical expenses (QME) page. From prescriptions to fitness programs, it’s easy to find details on health benefits coverage and whether letters of medical necessity are needed.

You can Make your 2023 open enrollment season a success

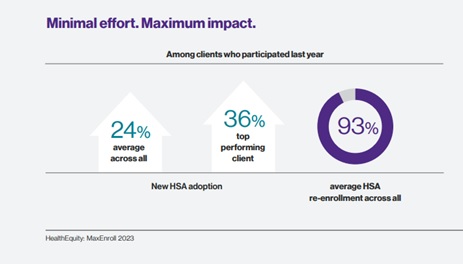

Everything outlined above is a part of the HealthEquity MaxEnroll program. Clients who participated in last year’s MaxEnroll program saw a Health Savings Account (HSA) enrollment boost of 24 percent. Additionally, for those who participated in an HSA, 93 percent have re-enrolled.

Participating in MaxEnroll can help you connect with those members of your workforce that are not currently engaged. Working together, HealthEquity team members can help you drive not just enrollment, but the right kind of open enrollment success where you can see a meaningful difference and employees are choosing to stay in the program. At the end of the day, what matters is that your people can effectively use the benefits you offer to care for kids and aging parents, be well (physically and mentally), and be financially sound.

Our clients have everything to gain using our no-cost enrollment engagement program.

- Targeted, custom communications to increase engagement and benefits awareness.

- Improved financial literacy and benefits equity by helping all employees understand their options.

- Boost benefits adoption and utilization to unlock health plan and FICA tax savings.

- A tailored experience through the Education Center, along with live and on-demand webinars.

It's about quality ingredients going in your open enrollment process

When you need help with your open enrollment employee communication plans, reach out to us. The MaxEnroll program helps address challenges you face when carrying out your open enrollment process. And we’ve seen that increasing open enrollment and health benefits communications can make a difference. We take the work out of helping members make the best decision for wherever they are on their journey to health and wealth.

Wishing you a productive, successful, and efficient 2023 open enrollment season.

HealthEquity does not provide legal, tax or financial advice. Always consult a professional when making life-changing decisions.