Whether you are a baby boomer nearing retirement, a Generation X'er in the middle of your career or a millennial just starting out, you have at least one thing in common with your co-workers:

You need to prepare for retirement.

Yes, baby boomers and Generation X'ers, we hear your shouts of protest that you are already preparing for retirement and have been for years. And you, millennials, stop laughing and hear us out.

A recent report from Employee Benefit Research Institute found that a couple could need as much as $363,000 to cover health expenses in retirement. That's a lot of money.

The good news is that a health savings account (HSA) can help you prepare for retirement, no matter what stage of planning you are in. Below are three benefits HSAs offer that can make preparing for retirement easier.

HSA funds never expire

HSAs provide triple tax savings by allowing you to contribute, grow your money and pay for qualified medical expenses tax free.1 Unlike a flexible spending account, unused HSA funds automatically roll over to the next year, and there is no expiration date on when you have to spend the funds. This is a benefit for HSA owners of any age, but it could be particularly helpful for millennials.

Catch-up contributions

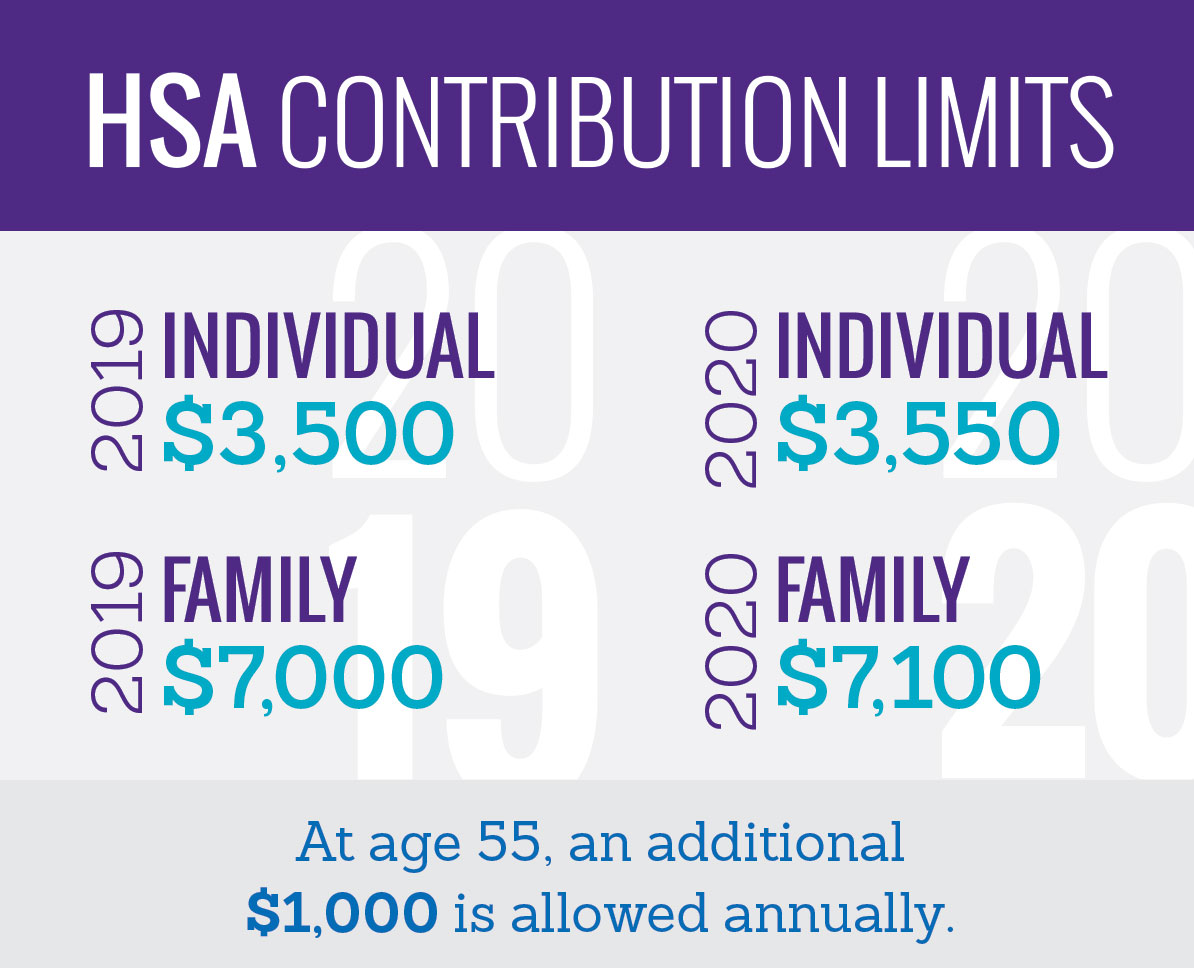

The IRS typically increases the maximum amount that can be contributed to an HSA each year. Here are the amounts for 2019 and 2020.

HSA owners 55 and older can contribute an additional $1,000 over the normal contribution limits each year. These catch-up contributions could allow baby boomers and some Generation X'ers to save up to $10,000 extra by the time they reach age 65, or potentially more if they decide to invest2 the funds.

HSA funds during retirement

HSA owners under age 65 can only spend HSA funds on qualified medical expenses or face income taxes and tax penalties. HSA owners 65 and older can spend HSA funds on any expense.3 If they use funds on qualified medical expenses (remember the EBRI estimate mentioned above?), the distribution is tax-free. If used for any other purpose, the expense is subject to income tax but tax penalties do not apply.

Conclusion

No matter your age, you should be preparing for retirement. An HSA offers benefits for every generation, including rolling over unused funds, making catch-up contributions and spending HSA funds similar to a 401(k) in retirement.3

To learn more about how to take advantage of the many other benefits that HSAs provide, visit www.healthequity.com/HSAlearn.

1HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-free with very few exceptions. Please consult a tax advisor regarding your state's specific rules.

2Investments are subject to risk, including the possible loss of the principal invested, and are not FDIC or NCUA insured, or guaranteed by HealthEquity, Inc. Investing through the HealthEquity investment platform is subject to the terms and conditions of the Health Savings Account Custodial Agreement and any applicable investment supplement. Investing may not be suitable for everyone and before making any investments, review the fund's prospectus.

3After age 65, if you withdraw funds for any purpose other than qualified medical expenses, you will be subject to income taxes. Funds withdrawn for qualified medical expenses will remain tax-free.

HealthEquity does not provide legal, tax or financial advice. Always consult a professional when making life changing decisions.