FIRE (Financial Independence, Retire Early) is quickly becoming a new mantra for young workers and it just may be a solution to retiring early. It has piqued the interest and been reported in major news outlets like the New York Times, Marketwatch, Yahoo Finance and US News and World Report, and others.

The idea behind FIRE is that people are finding ways to live on less, save and invest smarter and then retiring years before the prescribed "retirement age." FIRE is setting the established view of retirement ablaze.

The changing landscape

Thanks to a change in generational views and shifts in the American business landscape, retirement is taking on a new definition for younger generations. The mindset of "go to school, get a job, work for 40 years and let the company's pension pay for retirement" is no longer cutting it.

The new retirement view

Very few companies still offer a defined benefit pension plan meaning the main cog in the antiquated retirement machine is becoming a thing of the past. Most companies now offer a defined contribution plan like a 401(k). This shift has altered the workplace dynamic and employees no longer view their employment with a company as a lifelong relationship.

If a retirement plan is portable, then, so are the employees. The portability has opened the door to new ideas about retirement and how younger generations view their "golden years."

The FIRE model

Becoming financially independent and retiring early is just the ticket individuals looking for a way out of the stressful day-to-day of the corporate workforce have been looking for.

The FIRE model looks different for each participant, but generally, it can be broken down into these two areas:

- Frugality is defined simply as living well below your means. It includes a range of strategies from deep household budgetary cuts on everything from cable tv to couponing at the grocery store.

- Saving and investing takes proceeds from living frugally and redirects it. This could include implementing those savings into savvy investment behaviors like maxing out 401(k) and individual retirement accounts (IRA) contributions to maximize compound growth and accelerate the retirement timeline.

FIRE pros leverage just about every opportunity to boost savings. They compound investment growth and fast track their financial independence, but there is one savings vehicle that is typically left out of the discussion, and it is perhaps the best tax advantaged1 hidden gem available. A health savings account (HSA).

The HSA hidden gem

Saving money by cutting frivolous spending and maxing out 401(k) contributions are great steps to retire early, but when it comes to tax savings, they pale in comparison to the triple tax advantages of an HSA. HSA is a savings vehicle that must be paired with a qualified healthcare plan, and allows for tax free contributions and tax-free distributions when used for qualified medical expenses. These funds can be invested2 in stock market instruments and the earnings are also tax free.

According to EBRI, the average couple will need roughly $296,000 in retirement for a 90% chance of having enough to cover healthcare expenses. Frugal behavior with an HSA can make a sizeable impact in long-term healthcare savings and retirement plans.

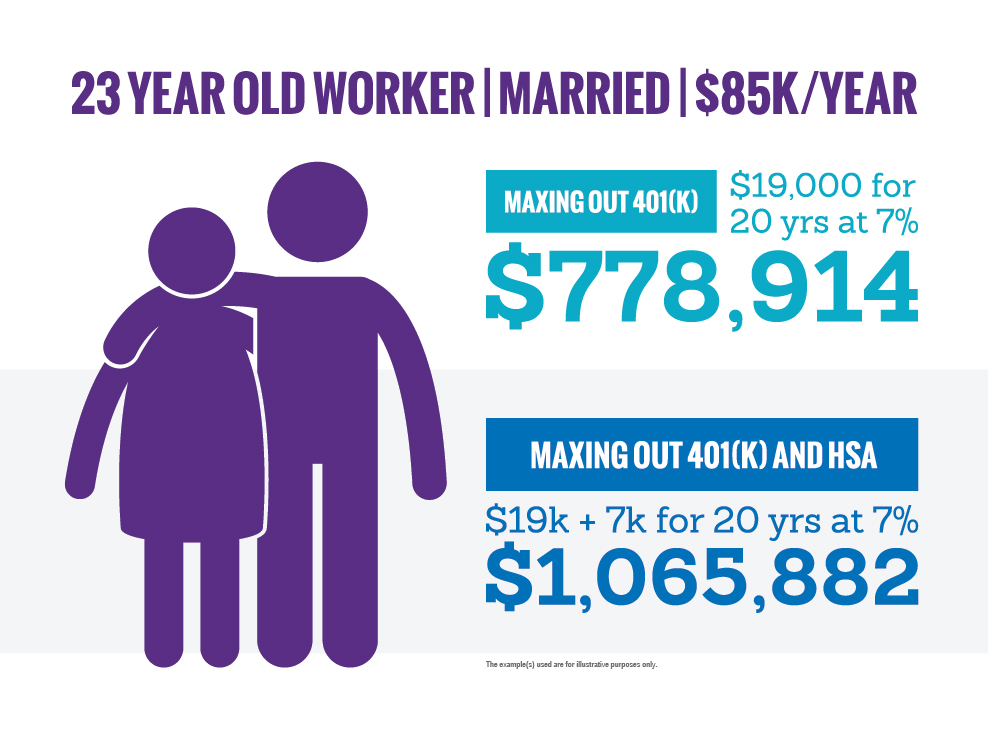

By utilizing an HSA to its maximum capacity as a retirement savings vehicle, FIRE practitioners could shave a couple years off their retirement timeline and retire even sooner. Just by adding an HSA and maxing it out every year for 20 years could add an additional $286,968 to the retirement picture3, tax-free.

Conclusion

The FIRE approach to frugality and investments may be a solution to early retirement, but HSAs, HSA investments and their inherent tax savings may be the secret to even earlier retirement.

Learn more about everything you can do with an HSA.

1HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-free with very few exceptions. Please consult a tax advisor regarding your state's specific rules.

2Investments are subject to risk, including the possible loss of the principal invested and may not be eligible for federal depository insurance by the FDIC or NCUA or guaranteed by HealthEquity. Investing may not be suitable for everyone and before making any investments, review the fund's prospectus.

3The example assumes the accountholder is: (1) maxing out the family contribution limit of $7000 (2) saving the money and not spending the contributions and (3) achieving a 7% rate of return