It’s tax season and a good time to plan ahead. Did you know you can potentially uncover new ways to realize tax savings? It’s true and it starts with your Health Savings Account (HSA). To get right to the point, when you contribute to your HSA now you can save on your 2022 tax bill. It’s a smart, practical way to save on taxes today while also setting aside funds for future qualified medical expenses.

Have a healthcare Flexible Spending Account (FSA)? Good news: you do not report your FSA contributions on your taxes and you will not get a tax form.

Keep reading to find out more about how your HSA works, the Internal Revenue Service (IRS) allowable maximum contribution limits, how to max out your 2022 HSA contributions, how to find your tax forms, and more.

Tell me more about how an HSA works

An HSA is a special kind of savings account that can result in significant tax savings. HSAs are available to individuals enrolled in HSA-qualified health plans and can be used (tax-free) to pay for qualified medical expenses (QMEs) like doctor visits, prescription medications, dental services, and much more. Money you contribute to your HSA is tax-deductible and the funds earn interest tax-free.1 You can also invest HSA funds in mutual funds to further increase potential tax-free earnings.2

What’s important to emphasize here is: HSAs never expire. Unlike an FSA, your funds carry over year after year. The money in your HSA remains yours even after changing jobs or retiring. This is why HSAs can be a great strategy for retirement. Once you reach 65, your HSA behaves much like a 401(k) with one bonus—you don’t pay taxes on money used for QMEs. For non-qualified expenses after age 65, you just pay income taxes with no additional penalty.3 Medical expenses will only increase as we get older, so setting funds aside now makes sense.

To summarize:

• Your HSA helps you pay for qualified out-of-pocket medical costs

• Funds added to your HSA aren’t subject to federal income tax

• Money earned in your HSA grows tax-free

• Your HSA is yours to keep

• Funds in your HSA don’t expire—no “use-it-or-lose-it”

• Your HSA can help you save for retirement

Let’s talk about benefits of contributing to your HSA

If you did not contribute the maximum allowed to your HSA in 2022, you can still add funds to your HSA, right up to the IRS allowable maximum. In fact, you can make 2022 tax year HSA contributions right up to the time you file your 2022 taxes (the tax filing deadline in 2023 is April 18th).

Making an extra contribution to your HSA before filing your previous year’s tax returns is a smart move because it can reduce your taxable income. This move alone can potentially lower the amount of taxes you owe or increase your refund. And as we covered above, contributions to your HSA can help to increase the amount of money you have saved for future health care costs and are tax deductible, providing additional tax savings.

How does an HSA help me save on taxes?

Every dollar you add to your HSA reduces your taxable income by one dollar. So, if your effective tax rate is 25 percent, you’ll save a quarter for every dollar you set aside.4 Those quarters can add up fast! Plus, the dollars your save in your HSA will be there if you need them for qualified medical expenses (or long-term retirement savings).

How much can I contribute to my HSA?

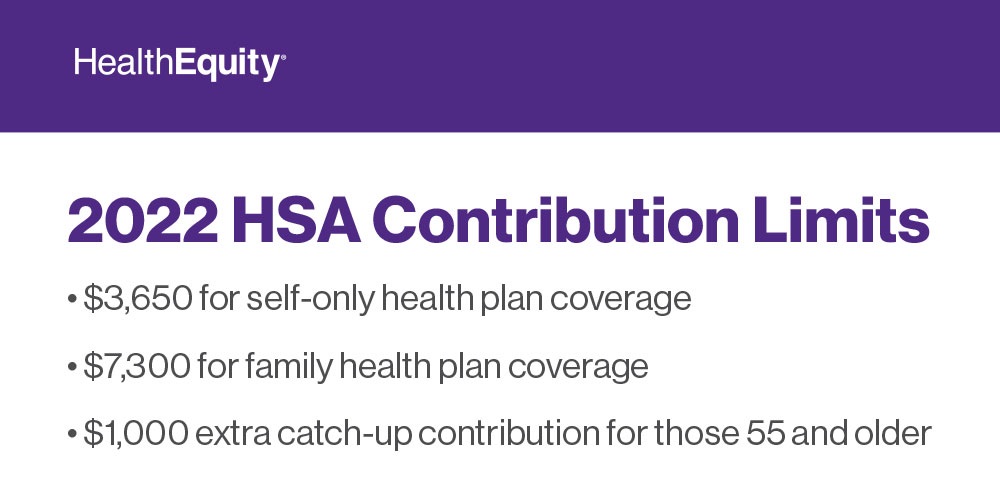

The IRS sets annual HSA contributions limits. Contributions can be made until the tax filing deadline (without extension) of the prior tax year. This year, the tax filing deadline for your 2022 taxes is April 18, 2023. Note that if you are age 55 and older, you can contribute an extra $1,000 to your HSA. This opportunity to contribute an extra $1,000 applies the same regardless of whether you’re enrolled in a family plan or individual plan.

As an example, if you’re enrolled in a family high-deductible health plan, and contribute the maximum allowed, you could claim up to a $7,300 tax deduction.

There are just a few things to keep in mind:

• Be sure your 2022 health plan counts as an HSA-qualified health plan under IRS rules. Otherwise, contributions could be subject to a tax penalty.

• Don’t over-contribute. Contributions beyond IRS limits (outlined above) could also incur tax penalties.

Here’s how you contribute to your HSA

To make an additional contribution to your HSA, log into your HealthEquity account. You’ll follow the steps to initiate an Electronic Fund Transfer (EFT) with your linked bank account. If you haven’t linked a bank account yet, you’ll have to do that first. Then, select the amount you’d like to contribute. The money will automatically be drawn from your checking account into your HSA.

How do I report my HSA on my taxes?

Here’s a description of the forms you need and the steps to consider when preparing your 2022 tax return:

-

HealthEquity will report your total 2022 contributions on IRS Form 5498-SA, which will be sent to you.

-

Then, you can report your tax-deductible HSA contributions on Form 8889 (these are the contributions you’ve made with after-tax money via bank transfer—not through payroll deductions).

-

From there, list your total contributions on Form 1040 (this will include your after-tax contributions plus the HSA contributions taken out of your paycheck in 2022).

Here’s a handy checklist when contributing to your HSA

Take advantage of resources to help you with your HSA

As you file, our site has plenty of additional resources to support you. You can reference FAQs at the bottom of our HSA tax center page. And you can always access The Complete HSA Guidebook to help you make informed decisions and take control of your health and wealth.

PS: Don’t wait. Log into your HealthEquity account and make a tax-deductible contribution today.

1HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax-deductible with very few exceptions. Please consult a tax advisor regarding your state’s specific rules.

2Investments are subject to risk, including the possible loss of the principal invested, and are not FDIC or NCUA insured, or guaranteed by HealthEquity, Inc. Investing through the HealthEquity investment platform is subject to the terms and conditions of the Health Savings Account Custodial Agreement and any applicable investment supplement. Investing may not be suitable for everyone and before making any investments, review the fund’s prospectus.

3After age 65, if you withdraw funds for any purpose other than qualified medical expenses, you will be subject to income taxes. Funds withdrawn for qualified medical expenses will remain tax-free.

4The example used is for illustrative purposes only. Your savings will vary based on your combined state and federal effective tax rate and your specific tax situation.

HealthEquity does not provide legal, tax or financial advice. Always consult a professional when making life-changing decisions.