If you’re like most Americans, uncertain economic conditions mean you’re taking a closer look at your budget. As you search for ways to cut corners, spend smarter, and stretch your paycheck, one area to prioritize is healthcare. Using pre-tax accounts like a Health Spending Account (HSA) or Flexible Spending Account (FSA) is a money-smart way to plan for and manage your expenses. In fact, for an overview on how FSAs can help you restore lost spending power, join our upcoming webinar.

As open enrollment gets underway, let’s look at FSAs and run through the basics—what they are, how they help you, important things to know, and essential actions to take to make the account work for you. If you remember nothing else from this article, remember:

• You typically need to re-enroll in an FSA each year; and

• If you don’t spend your FSA funds by the end of the year, you might lose them

Keep reading for details on making your FSA work in your favor.

What is an FSA?

A FSA empowers you to pay for certain eligible expenses with pre-tax funds. There are four main types of FSAs:

Healthcare FSA (HCFSA): You can use this type of FSA for eligible medical expenses, including deductibles, copayments, and coinsurance.

Limited-Purpose FSA (LPFSA): An LPFSA is designed to be used in conjunction with an HSA, and allows employees to contribute additional pre-tax dollars specifically for dental and vision expenses.

Post-Deductible FSA: This type of FSA can be used for certain eligible medical expenses once a specified minimum deductible has been met.

Dependent Care FSA (DCFSA) or DCRA: A DCFSA or DCRA can be used for eligible dependent care expenses, including daycare, preschool, elderly care, or other dependent care. This type of FSA can only be used if dependent care is necessary for you or your spouse to work, look for work, or to attend school full-time.

Pro-tip! FSA funds must typically be spent during the plan year, or the funds are forfeited. Keep in mind, plan designs may vary.

How does an FSA save you money on taxes?

An an employee you can contribute pre-tax dollars to your FSA. According to Healthcare.gov, this lowers your taxable income and allows you to “save an amount equal to the taxes you would have paid on the money you set aside.”

Did you know? Through the tax savings on contributions, you can save an average of 30%1 on eligible medical expenses on items like prescription medications and ambulance services to hearing aids and doctor fees.

How much can I contribute to an FSA?

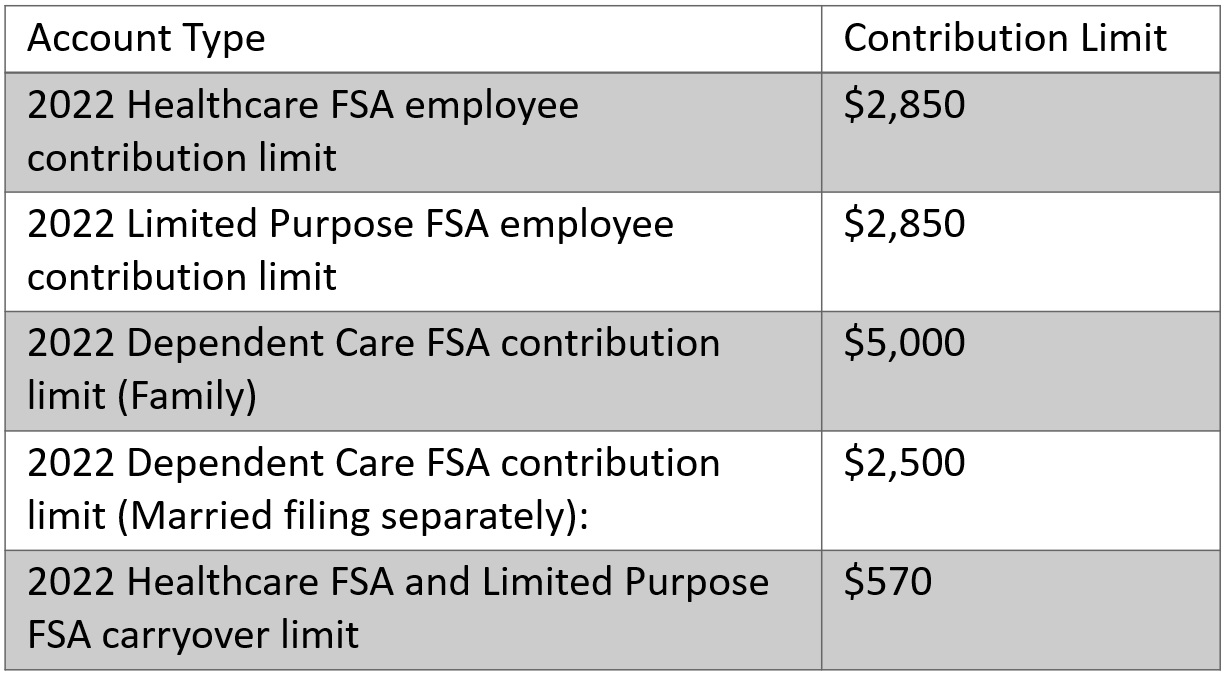

The contribution limit for a healthcare FSA in 2022 is $2,850 per year per employee. If your spouse’s employer also sponsors an FSA, they can contribute up to the same maximum amount in an FSA with their employer as well. See the table below for the limits by account type.

It’s important to note that the Internal Revenue Service (IRS) typically releases updated contribution limits in the fall. Our team will release an update when we have the new information.

Your employer may elect to offer some added flexibility for Healthcare FSAs with a claim runout period, a grace period (extra time to file claims for reimbursement or incur expenses past the health plan year), or a carryover amount, subject to IRS provisions and ultimately determined by the employer’s plan design (see above).

If I leave my employer, can I still keep my FSA funds?

It depends. Your FSA comes as part of your employer’s benefits program so, if you leave your job, you could forfeit some (or perhaps all) of the money you contributed. Some employers do offer some time for you to submit claims, and if your employer offers you the right to continue HCFSA coverage through COBRA, you may be able to extend the amount of time to use your HCFSA. Usually, your last day on the job is also the last day you can incur expenses for an FSA. For this reason, it’s important to check with your benefits team on rules that would apply to you.

1. Carefully estimate your annual expenses

You may question “do I have to spend all the money in my FSA by the end of the year?” In most cases, yes. Typically, the money in your FSA must be spent by the end of the plan year. However, your employer may offer you one of these two options:

• Grace period: Allows for a maximum of up to an extra 2½ months to use money in the FSA for expenses incurred the following plan year.

• Carryover (for HCFSAs only): Allows for up to $570 to be carried over and used in the following year.

Employers can offer one of these options but not both for the same plan. Neither of these options is required. Again, this is a good reason to check with your benefits team to know how your employer structures your FSA.

That’s why, with the use-it-or-lose-it rule, it pays to be strategic. It’s important to make sure you estimate how much you’ll spend on out-of-pocket expenses not covered by your health insurance over the course of the plan year. This step is completed during open enrollment. You can use our calculator. And your benefits team will likely offer enrollment worksheets so you can figure out how much you may spend next year on eligible childcare and medical expenses. During open enrollment you’ll enter the amount you want automatically deducted (taken out) from your paycheck and deposited into your FSA.

2. Spend wisely on eligible expenses before the year ends.

Now that you understand how FSAs work, here are several resources to help you spend wisely. First, look at the interactive list of eligible medical expenses, which includes a wide range of eligible FSA expenses. You can see items covered by your plan, and you’ll likely find several useful items to purchase.

Next, check out the FSA store, an online consumer health and wellness retailer with a wide variety of everyday products eligible for purchase.2

Pro-tip! You only save with your FSA if you spend it all.3

3. Remember to re-enroll in your FSA.

If you currently have an FSA and are looking forward to enjoying the tax savings it offers next year, you have to re-elect during open enrollment in most cases. Our data shows roughly 30% of FSA participants forget to re-enroll in their FSA. Don’t let this be you. In nearly all cases, FSAs require account holders to re-enroll every year. Your current enrollment will only carry over into the next benefit plan year if you select the option again in your benefits enrollment period.

Your flexible spending know-how

Reviewing what we covered, you now hopefully have a better idea of what’s covered by your FSA, how to estimate your expenses, tips on spending your FSA dollars before the plan year ends, and a reminder to re-enroll in your FSA. From tax savings on common FSA-eligible products to having money on hand for medical emergencies when needed, you can go forward with these smart tips to hopefully maximize your spending.

Before you go, be sure to reserve your spot at our upcoming webinar on October 18, Inflation frustration? How FSAs restore your spending power.

1Scenarios, results and calculations are for illustrative purposes only. Individual results may vary.

2HealthEquity and the FSA Store are separate, unaffiliated companies and are not responsible for each other’s policies or services. It is the members’ responsibility to ensure eligibility requirements as well as if they are eligible for the expenses submitted.

3FSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize FSA funds as tax deductible with very few exceptions. Please consult a tax advisor regarding your state’s specific rules.

HealthEquity does not provide legal, tax or financial advice. Always consult a professional when making life-changing decisions.